Section V: Statement of Income Question 5 Identify McDonald's EPS-basic amounts. You can find this value at the bottom of the statement of income. Basic EPS Click here to enter text. Current year, 2019? Preceding year 1? Click here to enter text. Preceding year 2? Click here to enter text. Does it appear that McDonald's EPS-basic improved over the prior years? Click here to enter text.

Section V: Statement of Income Question 5 Identify McDonald's EPS-basic amounts. You can find this value at the bottom of the statement of income. Basic EPS Click here to enter text. Current year, 2019? Preceding year 1? Click here to enter text. Preceding year 2? Click here to enter text. Does it appear that McDonald's EPS-basic improved over the prior years? Click here to enter text.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 48E: Exercise 1-48 Income Statement The following information is available for Wright Auto Supply at...

Related questions

Question

Transcribed Image Text:A 2 A ===

Aäl

Ccl AaBbCc AаBb( AaВЬС АаВЬСс

Heading 1

Heading 2 Heading 3

Heading 4

Heading 7

Paragraph

Styles

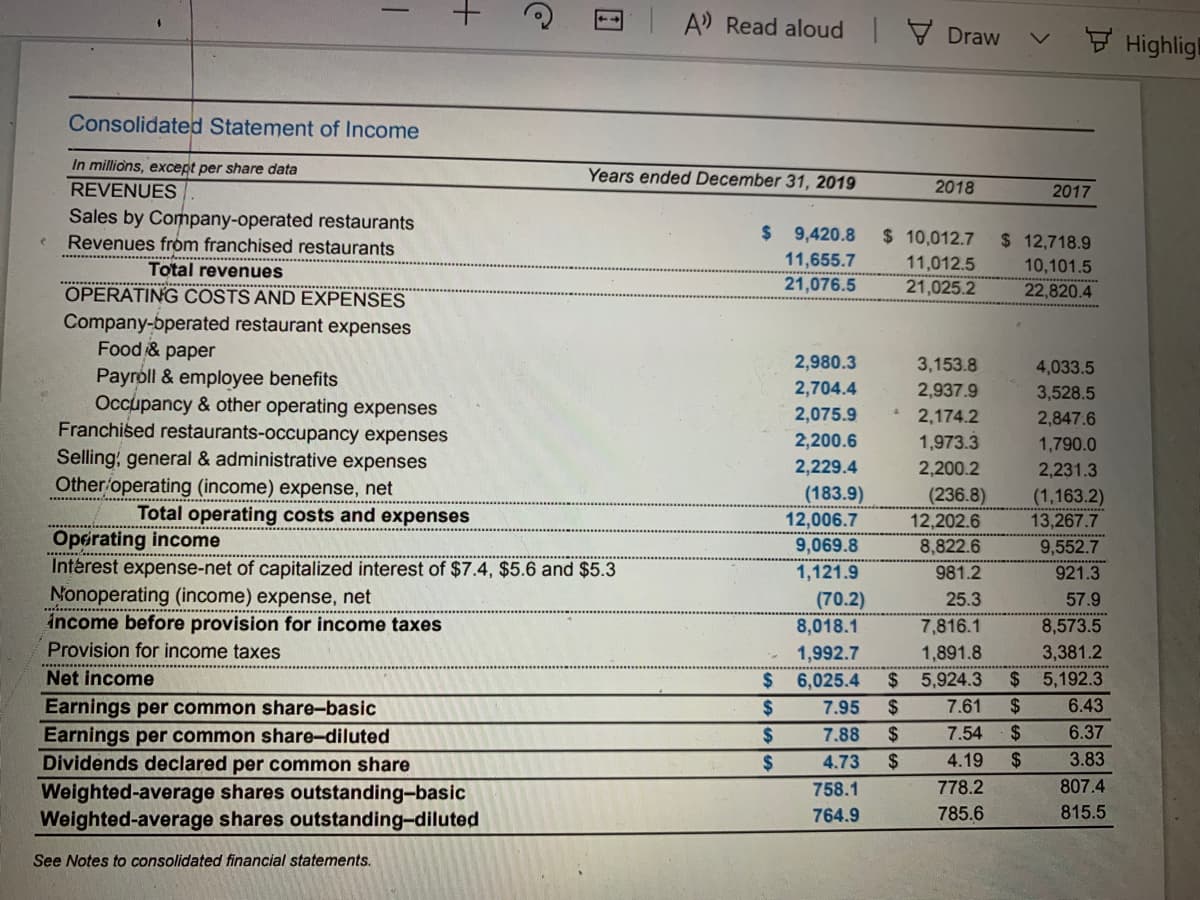

Section V: Statement of Income-Question 5

Identify McDonald's EPS-basic amounts. You can find this value at the bottom of the

statement of income.

Basic EPS

Current year,

2019?

Click here to enter text.

Preceding year 1?

Click here to enter text.

Preceding year 2?

Click here to enter text.

Does it appear that McDonald's EPS-basic improved over the prior years?

Click here to enter text.

McDonald's Consolidated Statement of Cash Flows (SCF)

Alternate company: Statement of Cash Flows found in SEC Form 10-K.

Section V: SCF Question 1

Review the heading of McDonald's SCF. Does its SCF include two or

three years of comparative information?

Click here

to enter

text. Yrs.

Transcribed Image Text:A Read aloud 7 Draw

E Highlig

Consolidated Statement of Income

In millions, except per share data

Years ended December 31, 2019

REVENUES

2018

2017

Sales by Company-operated restaurants

Revenues from franchised restaurants

$ 9,420.8

$ 10,012.7

$ 12,718.9

Total revenues

11,655.7

11,012.5

10,101.5

OPERATING COSTS AND EXPENSES

21,076.5

21,025.2

22,820.4

Company-bperated restaurant expenses

Food & paper

2,980.3

3,153.8

4,033.5

Payroll & employee benefits

Occupancy & other operating expenses

Franchised restaurants-occupancy expenses

2,704.4

2,937.9

3,528.5

2,075.9

* 2,174.2

2,847.6

2,200.6

1,973.3

1,790.0

Selling, general & administrative expenses

Other operating (income) expense, net

2,229.4

2,200.2

2,231.3

(183.9)

(236.8)

Total operating costs and expenses

(1,163.2)

13,267.7

12,006.7

12,202.6

Opeirating income

Intérest expense-net of capitalized interest of $7.4, $5.6 and $5.3

Nonoperating (income) expense, net

9,069.8

8,822.6

9,552.7

.........

1,121.9

981.2

921.3

(70.2)

8,018.1

25.3

57.9

............

income before provision for income taxes

Provision for income taxes

7,816.1

8,573.5

1,992.7

1,891.8

3,381.2

Net income

%24

6,025.4

$ 5,924.3

$ 5,192.3

Earnings per common share-basic

Earnings per common share-diluted

Dividends declared per common share

%24

7.95

24

7.61

$

6.43

%24

7.88

24

7.54

2$

6.37

24

4.73

2$

4.19

$

3.83

758.1

778.2

807.4

Weighted-average shares outstanding-basic

Weighted-average shares outstanding-diluted

764.9

785.6

815.5

See Notes to consolidated financial statements.

国

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning