Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Solve Y=C+1o+Go, C= a+b(Y-T), T= d+tY using matrix inversion, and again by using Cramer's Rule

Transcribed Image Text:CISE 5.6

0

ave seen from t

tion for any linear-equation

for testing the existence of a unique

ise available. In addition, it should be noted th

iable method, which affords no means of analytical

tion, the matrix-inversion method and Cramer's rule do provide the

expressions x* = A'd and x = 14,\/\4). Such analytical expressions of

operations on the solution as written, if called for.

useful not only because they are in themselves a summary statement of the

procedure, but also because they make possible the performance of furth

Under certain circumstances, matrix methods can even claim a comp

tage, such as when the task is to solve at the same time several equation

an identical coefficient matrix A but different constant-term vectors. In

elimination-of-variable method would require that the computational

peated each time a new equation system is considered. With the matrix-

however, we are required to find the common inverse matrix A¹ only or

inverse can be used to premultiply all the constant-term vectors pertain

equation systems involved, in order to obtain their respective solutic

computational advantage will take on great practical significance wh

solution of the Leontief input-output models in Sec. 5.7.

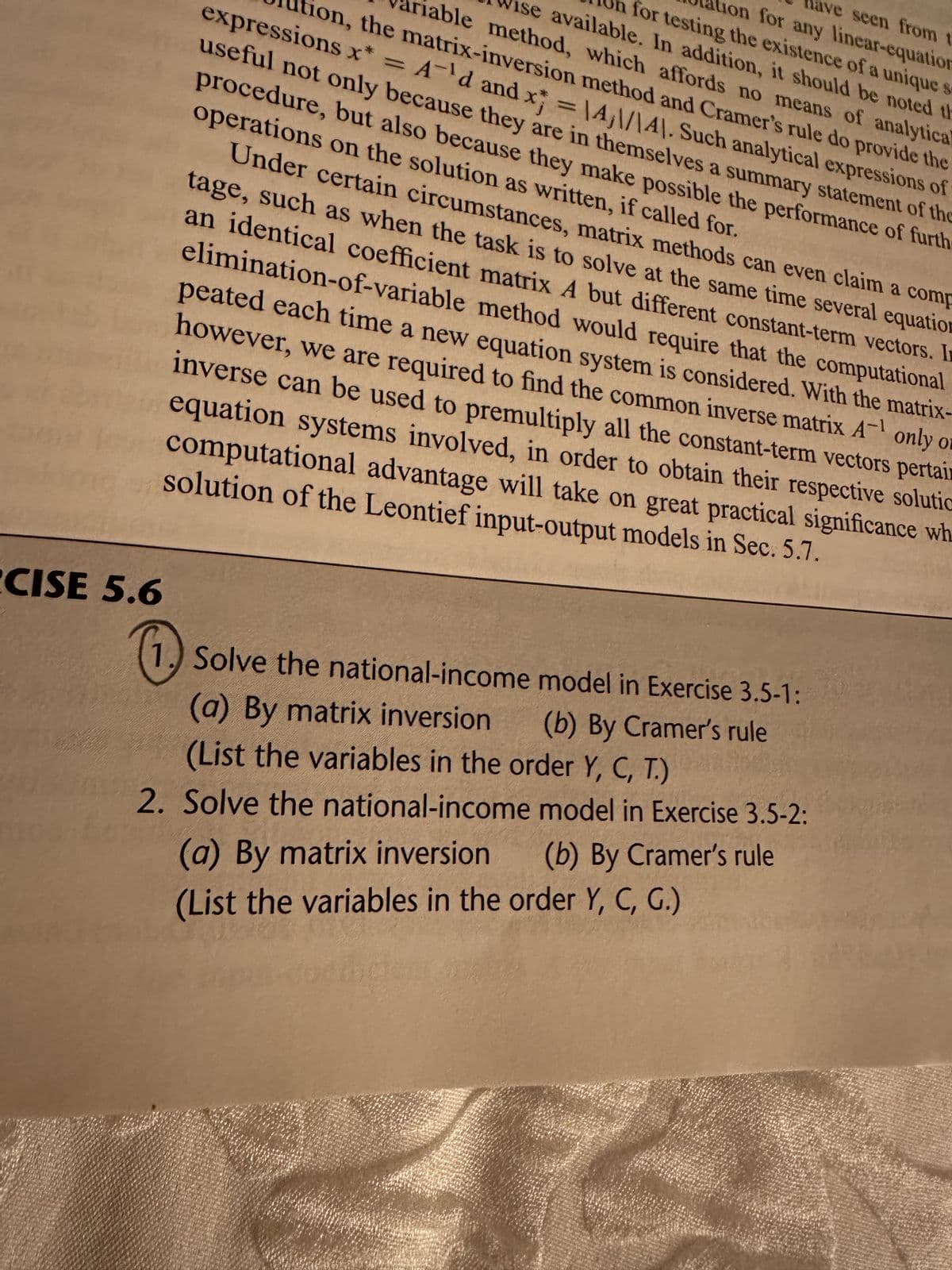

Solve the national-income model in Exercise 3.5-1:

(a) By matrix inversion (b) By Cramer's rule

(List the variables in the order Y, C, T.)

2. Solve the national-income model in Exercise 3.5-2:

(a) By matrix inversion (b) By Cramer's rule

(List the variables in the order Y, C, G.)

fo

![E 3.5

As a check on our calculation, we can add the C* expression in (3.25) to (To+Go) and

verify that the sum is equal to the Y* expression in (3.24).

This model is obviously one of extreme simplicity and crudity, but other models of

national-income determination, in varying degrees of complexity and sophistication, can

be constructed as well. In each case, however, the principles involved in the construction

and analysis of the model are identical with those already discussed. For this reason, we

shall not go into further illustrations here. A more comprehensive national-income model.

involving the simultaneous equilibrium of the money market and the goods market, will be

discussed in Sec. 8.6.

C

1 Given the following model:

Y = C + lo + Go

C = a + b(Y - T)

T=d+tY

(a>0,

(d>0,

Chapter 3 Equilibrium Analysis in Economics 47

0<b<1) [T: taxes]

0<t<1) [t: income tax rate)

(a) How many endogenous variables are there?

(b) Find Y*, T*, and C*.

income model be:](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F18def6ce-9aea-4bab-b8da-98b00690cf31%2Ff2d677a6-2972-4cea-8d1e-8228267c2976%2F5g65n2yn_processed.jpeg&w=3840&q=75)

Transcribed Image Text:E 3.5

As a check on our calculation, we can add the C* expression in (3.25) to (To+Go) and

verify that the sum is equal to the Y* expression in (3.24).

This model is obviously one of extreme simplicity and crudity, but other models of

national-income determination, in varying degrees of complexity and sophistication, can

be constructed as well. In each case, however, the principles involved in the construction

and analysis of the model are identical with those already discussed. For this reason, we

shall not go into further illustrations here. A more comprehensive national-income model.

involving the simultaneous equilibrium of the money market and the goods market, will be

discussed in Sec. 8.6.

C

1 Given the following model:

Y = C + lo + Go

C = a + b(Y - T)

T=d+tY

(a>0,

(d>0,

Chapter 3 Equilibrium Analysis in Economics 47

0<b<1) [T: taxes]

0<t<1) [t: income tax rate)

(a) How many endogenous variables are there?

(b) Find Y*, T*, and C*.

income model be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 20 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education