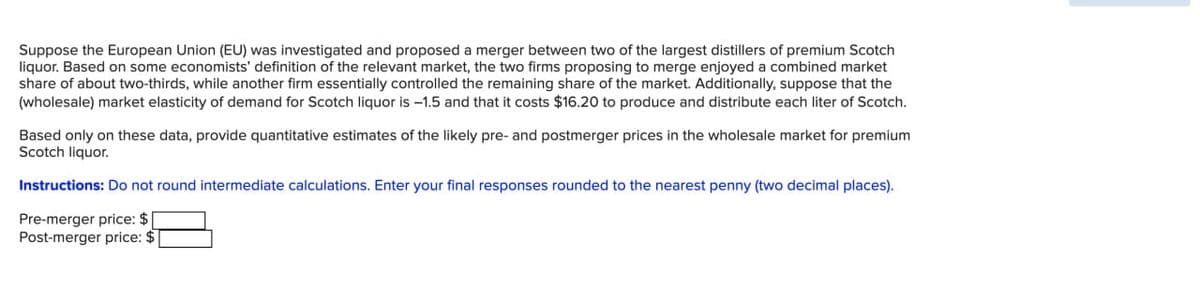

Suppose the European Union (EU) was investigated and proposed a merger between two of the largest distillers of premium Scotch liquor. Based on some economists' definition of the relevant market, the two firms proposing to merge enjoyed a combined market share of about two-thirds, while another firm essentially controlled the remaining share of the market. Additionally, suppose that the (wholesale) market elasticity of demand for Scotch liquor is -1.5 and that it costs $16.20 to produce and distribute each liter of Scotch. Based only on these data, provide quantitative estimates of the likely pre- and postmerger prices in the wholesale market for premium Scotch liquor. Instructions: Do not round intermediate calculations. Enter your final responses rounded to the nearest penny (two decimal places). Pre-merger price: $| Post-merger price: $

Suppose the European Union (EU) was investigated and proposed a merger between two of the largest distillers of premium Scotch liquor. Based on some economists' definition of the relevant market, the two firms proposing to merge enjoyed a combined market share of about two-thirds, while another firm essentially controlled the remaining share of the market. Additionally, suppose that the (wholesale) market elasticity of demand for Scotch liquor is -1.5 and that it costs $16.20 to produce and distribute each liter of Scotch. Based only on these data, provide quantitative estimates of the likely pre- and postmerger prices in the wholesale market for premium Scotch liquor. Instructions: Do not round intermediate calculations. Enter your final responses rounded to the nearest penny (two decimal places). Pre-merger price: $| Post-merger price: $

Survey of Economics (MindTap Course List)

9th Edition

ISBN:9781305260948

Author:Irvin B. Tucker

Publisher:Irvin B. Tucker

Chapter9: Monopolistic Competition And Oligoply

Section: Chapter Questions

Problem 20SQ

Related questions

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

Transcribed Image Text:Suppose the European Union (EU) was investigated and proposed a merger between two of the largest distillers of premium Scotch

liquor. Based on some economists' definition of the relevant market, the two firms proposing to merge enjoyed a combined market

share of about two-thirds, while another firm essentially controlled the remaining share of the market. Additionally, suppose that the

(wholesale) market elasticity of demand for Scotch liquor is -1.5 and that it costs $16.20 to produce and distribute each liter of Scotch.

Based only on these data, provide quantitative estimates of the likely pre- and postmerger prices in the wholesale market for premium

Scotch liquor.

Instructions: Do not round intermediate calculations. Enter your final responses rounded to the nearest penny (two decimal places).

Pre-merger price: $|

Post-merger price: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning