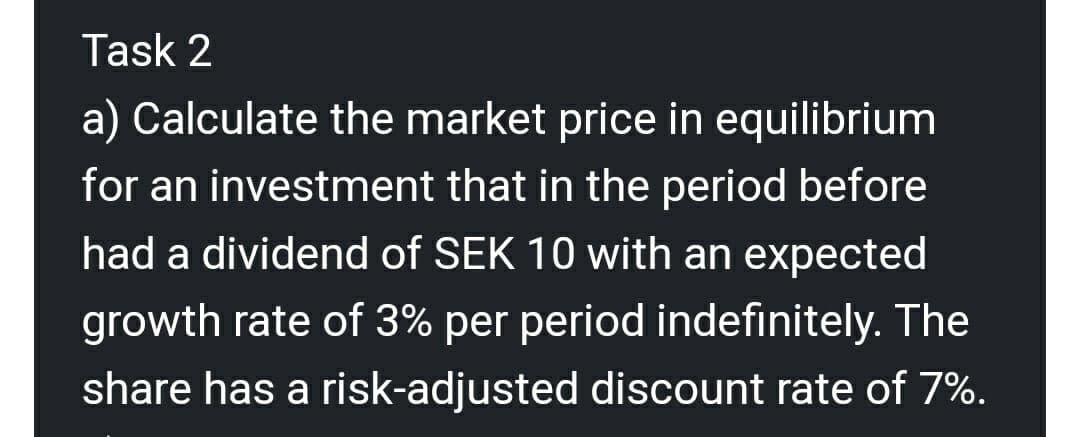

Task 2 a) Calculate the market price in equilibrium for an investment that in the period before had a dividend of SEK 10 with an expected growth rate of 3% per period indefinitely. The share has a risk-adjusted discount rate of 7%.

Q: If the ($/SFr) exchange rate goes from $1.25/SFr to $1.30VSFr this is a $ depreciation. An increase…

A: The correct answer is given in the second step.

Q: On the average, the amount of money that a customer spends in the store is $40 with a standard…

A: Answer; Q21) Option (d) is correct

Q: Define the term “Exchange rate volatility

A: Exchange rate is known as the rate at which the currency of one country is exchanged for the…

Q: Legal reserve requirements: Question 56 options: a) set the minimum amount of reserves a bank…

A: Reserve requirment= Cash reserve ratio reserve requirement/Bank deposit*100

Q: Robinson Crusoe Co. has a technology represented by the production function Y hours of labour.…

A: Given production function y = x1/2 , price P= 10 and cost of labor =w =5

Q: 1.What term denotes a nation's basis for allocating its resources among its citizens A) capital…

A: Since you have posted a multiple question, we will solve first question for you. If you want any…

Q: 1. Consider the figure below, which depicts the matching of jobs and workers. There are two jobs at…

A: Risk averse people will not be willing to take risks.

Q: Consider the Solow growth model. Suppose that F(K, N) = zK^a N^1-a, where a = 0.3. Also, assume that…

A: *Hi there, as the question posted contains multiple sub parts , following our guidelines we can only…

Q: A favorable aggregate supply shock could result from: a.an increase in wages. b.a rapid rise in oil…

A: Aggregate supply shows different combinations of price and real output supplied.

Q: Which good would you expect to have more elastic demand for each of the following pairs of goods,…

A: Elasticity of demand is defined as the measure of change in quantity demanded of the good due to the…

Q: M1 money includes all of the following except Question 45 options: a) savings accounts b)…

A: M1 as a measure of money supply includes currency , demand deposits , travelers checks and all the…

Q: 1.Sadie's Cleaning Services is a perfectly competitive firm that currently cleans 20 offices an…

A: Dear student, you have asked multiple questions in a single post. In such a case, I will be…

Q: Andrea starts her own business, which earns $75,000 in accounting profit in the first year. When…

A: Here we calculate the economic Profit of the Andrea's from this business and choose the correct…

Q: A company has cost estimates associated with operating and maintaining the currently owned filter…

A: The annual worth is the sum of all benefits and expenditures incurred over the course of a year. As…

Q: A market consisting of many sellers who sell similar but not identical products is an example…

A: There are four market structures with different types of goods sold, number of firms, and barriers…

Q: consider the following Normal form game : E R A 5,10 5, 3 5, 3 3,4 N 1,4 |7,2 7,6 M 4,2 | 8,4 3,8 D…

A:

Q: 2. Christiaan can go hiking, or he can stay at home. Hiking would be fun if nothing bad happens, but…

A: A rational economic agent's preferences are such that it assign higher utility to the alternative he…

Q: A world without credit is it possible

A: Meaning of Macroeconomics: The term macroeconomics refers to the situation of economic and…

Q: (ZERO-SUM GAME) Consider the game X [1 al. V What are the values of a that will make: Y a. (X,X) a…

A: Given: Player 1-Row wise, Player 2-Column wise X Y X 1 a Y -1 0

Q: The federal government of Canada is implementing a new excise tax called a carbon tax. Why is the…

A: Carbon tax is the tax levy on production to reduce the emission of carbon in the atmosphere . To…

Q: Under the fixed exchange rate regime, please explain in your own words and draw graphs for the…

A: FIXED EXCHANGE RATE Fixed exchange rate is also known as Pegged exchange rate. It is the rate of…

Q: (game theory)Consider the following game in which player 1 chooses a row and player 2 chooses a…

A: Dominant strategy is the strategy that gives maximum payoff to a player irrespective of what other…

Q: The table above is for a monopolistic competitive firm. What will the firm's profit equal in the…

A: There are many firms in monopolistically competitive market, selling differentiated goods.

Q: Explain the impacts on the Canadian dollar and it’s exchange rate done by the increase in export of…

A: Equilibrium is the point where aggregate expenditure equals income In goods market income must…

Q: Pricing for many service firms (hotels, airlines) O can vary from location to location but not daily…

A: The process of determining a value for a commodity or service is known as pricing in economics and…

Q: Which of the following would NOT be described as “capital” by economists? Question 57 options:…

A: As we know that Capital means that those durable produced goods which helps in further production of…

Q: How are resources allocated in free market enterprise

A: Free market enterprise:- The free market, also known as free enterprise, is a market system in…

Q: The decision to invest in human capital does NOT involve which of the following? Direct expenditures…

A:

Q: The current chairman of the Federal Reserve Bank is Question 49 options: a) Joe Biden b)…

A: Meaning of Financial Assets: The term financial assets refer to the situation, under which these…

Q: Il represents one month). B¥30 D¥80 GY 70 J ¥200 L ¥ 20 C¥40 EY 20 H ¥30 K ¥60 F ¥50 months,…

A: *Answer:

Q: A wholesaler (upstream firm) sells a product to a retailer (downstream firm). Both the wholesaler…

A: In economics, profit maximization is the short run or long run process by which a firm may determine…

Q: The Chain Store Paradox A monopolist (Player A) has branches in 20 different cities. He faces 20…

A: Game theory refers to the concept in economics which deals with the decisions made by two or more…

Q: ne the economy is in short-run macro-equilibrium at E1. If the federal nment engages in expansionary…

A: Fiscal policy is associated with changes in expenditure and taxes so as to alter the AD(aggregate…

Q: /hich of the following regarding "education as a signaling device" is correct? Higher educated…

A: The options as to which is correct regarding " Education as a signalling device" is correct that is…

Q: 8. Which of the following occurs when someone uses confidential information to gain from the…

A: The security that in turn depicts the ownership of only a part of a corporation is being known as…

Q: (Table) Based on the table, the value for C is Competitive Labor Market e MPP P VMP W 0 0 8 0 80 5 5…

A: MPP stands for marginal product of labor. It refers to change in total product from hiring one more…

Q: : Q1/ Choose the correct answers for each of the following 2- If the value of income elasticity of…

A: Income Elasticity of demand is defined as type responsiveness of the quantity demand when income…

Q: 3. Suppose Chelsea has the following utility function over wealth: v (y) = ln y %3D (a) Show that…

A: Utility function : v(y) = ln y Risk aversion refers to that tendency of an investor who prefers…

Q: What can result in firing people, exiting a business, or admitting wrong? O a. reaching breakeven…

A: Employees are fired for a variety of reasons.It includes poor work performance or unethical…

Q: Problem #51. Illustrate and explain using isocosts and isoquants how an organization, which is…

A: Given information Firm is working at the level of least cost or output maximization combination.…

Q: explain the notions of a circular economy and the 6 Rs of sustainability and how these could help…

A: Disruptive changes in the way our society and businesses are organised are required for sustainable…

Q: Trade theory cannot account for the empirical fact of intra-industrial trade (i.e. that countries…

A: According to trade theory, a country's economic well-being is based on the production of commodities…

Q: Table 2. Q TC FC VC MC AFC AVC ATC D SO 1 E $91 V F. M $49 3 G K N P. R $112 Consider the…

A: Answers Q7) As Q= 1, AFC = 91 = TFC/Q TFC = 91*Q = 91 E= 91

Q: All else equal, a higher rate of return on investment in a country will do which of the following?…

A: Exchange rate is determined by the intersection of dd(demand) and ss(supply) of the currency in the…

Q: Quantity of Y 6. 4. 10 Quantity of X Figure 1 Refer to Figure 1. The consumer redirected her…

A:

Q: monopolistic competition. B) It is easier for sellers to enter a market or industry characterized by…

A:

Q: Write down the name of the sections of the report. (a) What questions are answered in each section?…

A: Answer 1. Every report should have the following sections. Title Page Table of Contents Executive…

Q: Suppose that there is a hurricane that leads to the destruction of some of the nation's capital…

A: A Supply Shock is defined as an event which is unexpected and changes the supply of a good, which…

Q: Chobani’s equipment runs for 10 hours and must be idle for four hours while being cleaned. Its…

A: Meaning of Production Function: The term production function refers to the situation under which a…

Step by step

Solved in 2 steps

- A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the uncertainty about the rate of return on the stock by specifying three possible scenarios: Business Condition Scenario, s Probability, p(s) End of Year Price Annual Dividend High growth 1 0.35 $35 $ 4.40 Normal growth 2 0.30 27 4.00 No growth 3 0.35 15 4.00 What are the holding-period returns for a one-year investment in the stock of A-Star Inc. for each of the three scenarios? Calculate the expected HPR and standard deviation of the HPR.A firm is considering purchasing equipment to manufacture a new product. The equipment will cost $3M, and expected net cash inflowsare $0.35M indefinitely. If market demand for theproduct is low, then over the next five years thefirm will have the option of discarding the equipment on a secondary market for $2.2M. Assume thatMARR = 12%, s = 50%, and r = 6%. What isthe value of this investment opportunity for the firm?A global equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the MSCI World Market Portfolio, but she is free to hold stocks from various countries in whatever proportions she finds desirable. Results for a given month are contained in the following table: Country Weight InMSCI Index Manager’sWeight Manager’s Returnin Country Return of Stock Indexfor That Country U.K. 0.29 0.24 22% 15% Japan 0.42 0.2 17 17 U.S. 0.23 0.22 10 13 Germany 0.06 0.34 7 15 Required: a. Calculate the total value added of all the manager’s decisions this period. (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) b. Calculate the value added (or subtracted) by her country allocation decisions. (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount…

- A stock currently sells for 11 TL per share and pays 0.16 TL per year in dividends. What is an investor's valuation of this stock if she expects it to be selling for 14 TL in one year and requires a 10 % return on equity investments? a. 12,89% b. 12,73% c. 12,87% d. 10%You have been asked by the chief financial officer of your company to estimate what thecompany’s share price will be at the end of four years from today. Your company has recentlypaid a dividend of $1.00 which is expected to grow at 5% p.a. over the foreseeable future. Ifthe company’s required rate of return on equity is 10% your price estimate at the end of year 4will be closest to: A. $20.00.B. $21.00.C. $24.30.D. $25.50.Compute the price of a share of stock that pays a $5 peryear dividend and that you expect to be able to sell inone year for $40, assuming you require a 5% return

- 33 TB MC Qu. 12-82 A stock had annual returns of... A stock had annual returns of 5.5 percent, -12 percent, and 15.5 percent for the past thr of returns for this stock? 56.65% 6.94% 1.94%An entrepreneur recently learned about a new hotel business that requires an initial investment of $12M and annual cash flow of $2M in perpetuity. The appropriate discount rate is 20%. Now, consider a pretty similar scenario: an Initial investment $12M. Now, in good state, $6M annual cash flows. In a bad state, -$2M annual cash flows. Furthermore, assume that the entrepreneur wants to own at most, 1 hotel (no option to expand). - But things change when we consider the abandonment option. At date 1, the entrepreneur will know which forecast has come true. If the world is in the good state, he will keep the project alive. If bad state, he will abandon the hotel after period 1. - Now, what is the NPV of the project? - What is the value of the option to abandon?You are financial analyst for the XYZ company. The director has asked you to analyze two proposed capital investments, Project A and Project B. Each project has a cost of RM 10, 000, and the cost of capital for each project is 12 percent. The project s’ cash flows are as follows: Year Expected Net Cash Flows Project A Project B 0 (10,000) (10,000) 1 6500 3500 2 3000 3500 3 3000 3500 4 1000 3500 Calculate each project’s NPV. Which project or projects should be accepted?

- Consider company ABC. Today it is 1st of January 2023 and ABC has just paid a dividend of £3 million. The expected earnings of ABC for the next 30 years are forecast to grow at a rate of 15% per annum. From 1st of January 2053 and onwards the earnings of ABC are expected to grow at a rate of 5%. The required rate of return of ABC is 12% per annum. The current dividend policy of ABC is such that they pay out 50% of its earnings as dividends (assume that they pay their dividends on 1st of January every year). a) Suppose that the dividend payout ratio is expected to stay constant in the future. What is the value of ABC stock? Show and explain your calculations and any assumptions you make. b) Just after the dividend payment on 1st of January 2043, ABC is planning to reduce their dividends and only pay out 40% of its earnings. What is the value of ABC under the new dividend policy? c) Provide a recommendation to the management of ABC as to whether they should increase/cut back on…Carnes Cosmetics Co.'s stock price is $60, and it recently paid a $1.25 dividend. This dividend is expected to grow by 27% for the next 3 years, then grow forever at a constant rate, g; and rs = 14%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.A share of stock in Enbridge Inc. pays an annual dividend of $3.34, and the dividend is expected to grow at 2%, on average, in the foreseeable future. The current market price is $44.58/share. Below are the three individuals based on risk perception by each individual (from low to high). Identify who will likely be a buyer or a seller of this stock. (Each individual currently owns 100 shares.) Individual X has a discount rate of 5% Individual Y has a discount rate of 8% Individual Z has a discount rate of 11%