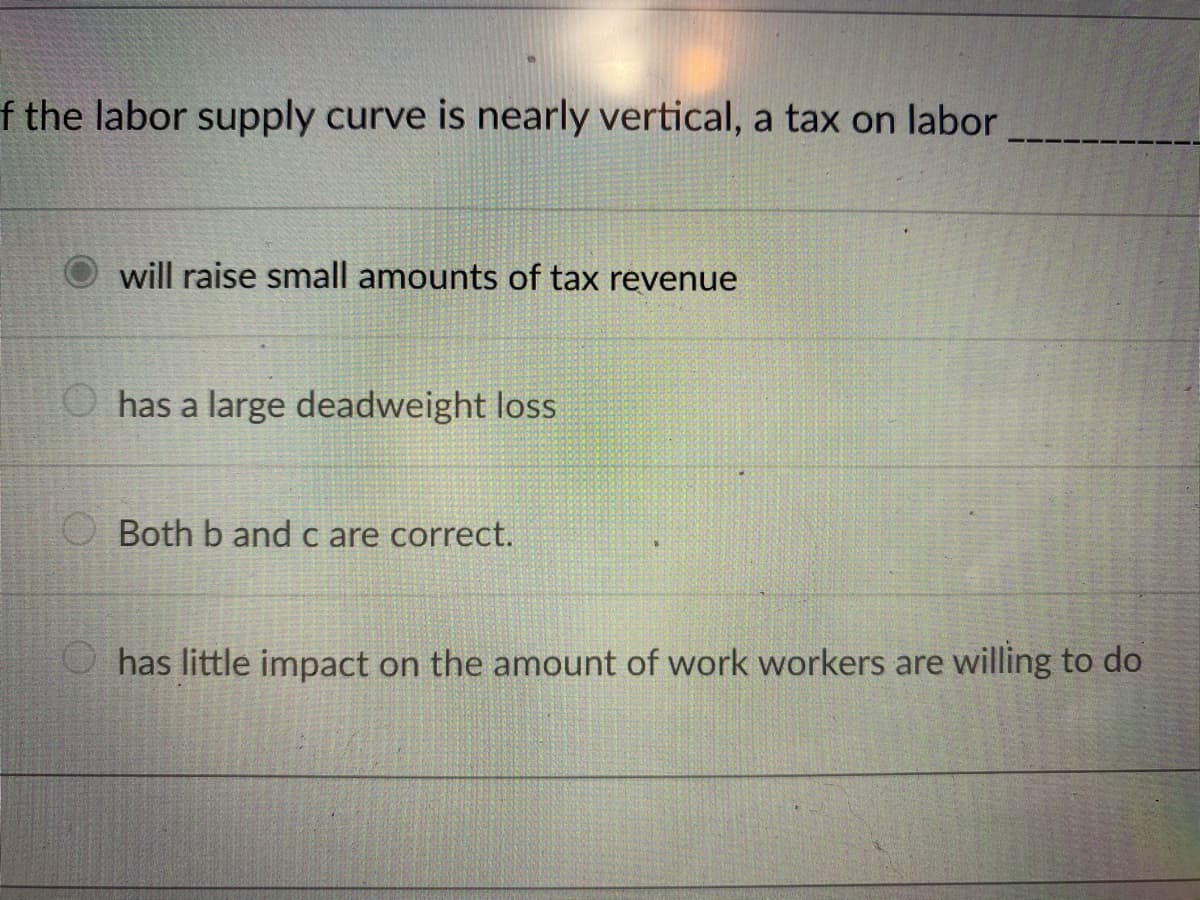

that mean it would raise a small amount of tax revenue? Or would that mean that tax revenue would be larger-because deadweight loss is smaller?

that mean it would raise a small amount of tax revenue? Or would that mean that tax revenue would be larger-because deadweight loss is smaller?

Principles of Economics, 7th Edition (MindTap Course List)

7th Edition

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Application: The Cost Of Taxation

Section: Chapter Questions

Problem 4PA

Related questions

Question

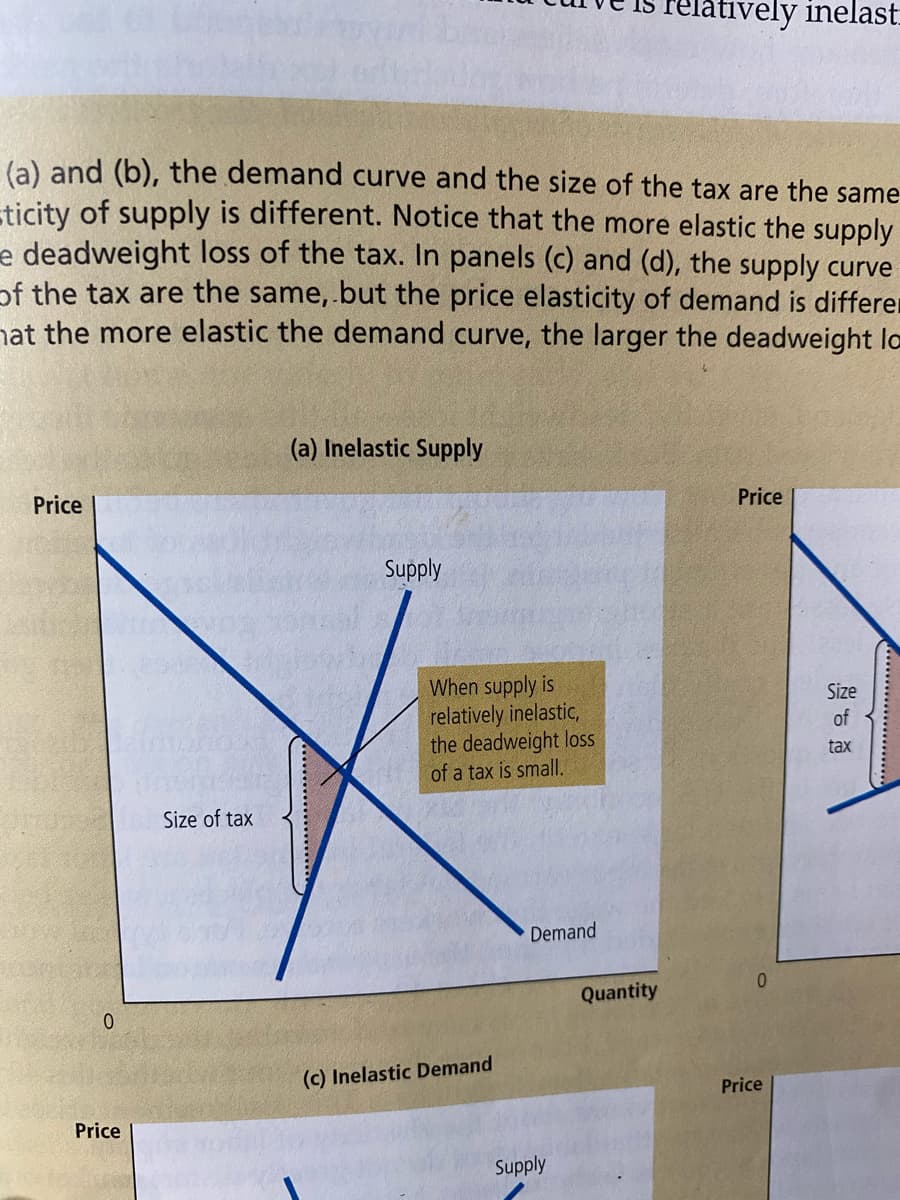

I have a picture of the question added as well as a photo from my Econ book. The photo in my book shows how the supply curve, when vertical, the deadweight loss from a tax is small.  this is why I chose option a. Because wouldn’t that mean it would raise a small amount of tax revenue? Or would that mean that tax revenue would be larger-because deadweight loss is smaller?

Transcribed Image Text:Tatively inelast

(a) and (b), the demand curve and the size of the tax are the same

ticity of supply is different. Notice that the more elastic the supply

e deadweight loss of the tax. In panels (c) and (d), the supply curve

of the tax are the same, but the price elasticity of demand is differer

nat the more elastic the demand curve, the larger the deadweight lo

(a) Inelastic Supply

Price

Price

Supply

When supply is

relatively inelastic,

the deadweight loss

of a tax is small.

Size

of

tax

Size of tax

Demand

Quantity

(c) Inelastic Demand

Price

Price

Supply

.........

......................

Transcribed Image Text:f the labor supply curve is nearly vertical, a tax on labor

will raise small amounts of tax revenue

O has a large deadweight loss

Both b and c are correct.

O has little impact on the amount of work workers are willing to do

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning