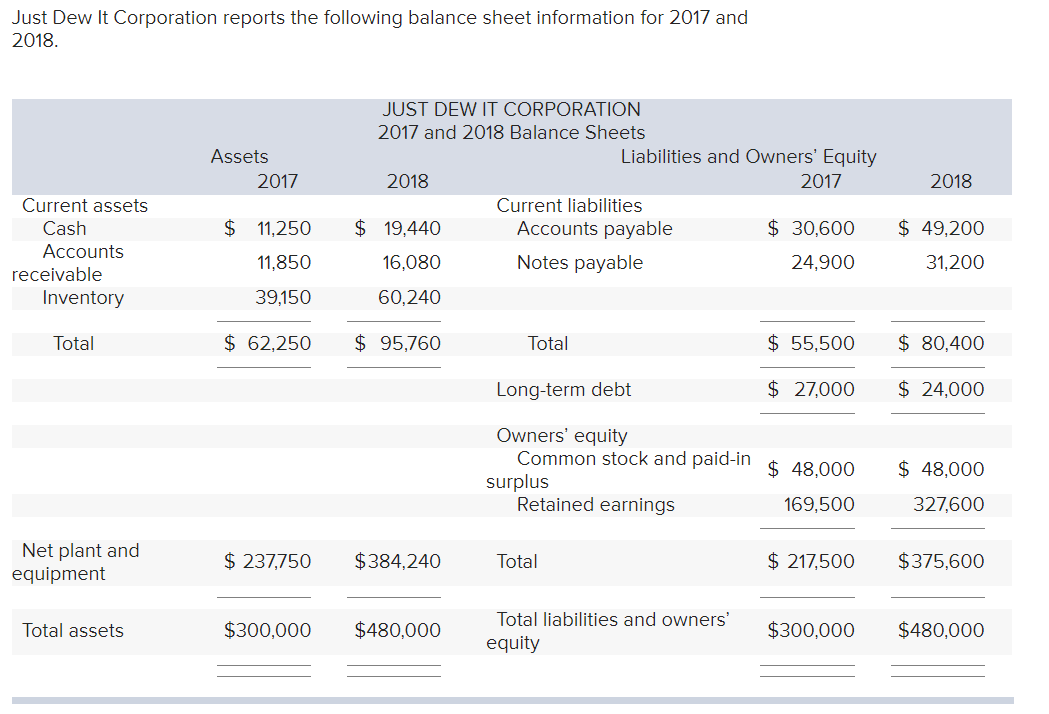

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Assets Liabilities and Owners' Equity 2017 2018 2017 2018 Current assets Current liabilities Cash $ 11,250 $ 19,440 Accounts payable $ 30,600 $ 49,200 Accounts 11,850 16,080 Notes payable 24,900 31,200 receivable Inventory 39,150 60,240 Total $ 62,250 $ 95,760 Total $ 55,500 $ 80,400 Long-term debt $ 27,000 $ 24,000 Owners' equity Common stock and paid-in surplus Retained earnings $ 48,000 $ 48,000 169,500 327,600 Net plant and equipment $ 237,750 $384,240 Total $ 217,500 $375,600 Total liabilities and owners' Total assets $300,000 $480,000 $300,000 $480,000 equity

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Assets Liabilities and Owners' Equity 2017 2018 2017 2018 Current assets Current liabilities Cash $ 11,250 $ 19,440 Accounts payable $ 30,600 $ 49,200 Accounts 11,850 16,080 Notes payable 24,900 31,200 receivable Inventory 39,150 60,240 Total $ 62,250 $ 95,760 Total $ 55,500 $ 80,400 Long-term debt $ 27,000 $ 24,000 Owners' equity Common stock and paid-in surplus Retained earnings $ 48,000 $ 48,000 169,500 327,600 Net plant and equipment $ 237,750 $384,240 Total $ 217,500 $375,600 Total liabilities and owners' Total assets $300,000 $480,000 $300,000 $480,000 equity

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 17PA: Using the following Company W information, prepare a Retained Earnings Statement. Retained earnings...

Related questions

Question

Please Make Sure to do the rounding.

Transcribed Image Text:Just Dew It Corporation reports the following balance sheet information for 2017 and

2018.

JUST DEW IT CORPORATION

2017 and 2018 Balance Sheets

Assets

Liabilities and Owners' Equity

2017

2018

2017

2018

Current assets

Current liabilities

Cash

$ 11,250

$ 19,440

Accounts payable

$ 30,600

$ 49,200

Accounts

11,850

16,080

Notes payable

24,900

31,200

receivable

Inventory

39,150

60,240

Total

$ 62,250

$ 95,760

Total

$ 55,500

$ 80,400

Long-term debt

$ 27,000

$ 24,000

Owners' equity

Common stock and paid-in

surplus

Retained earnings

$ 48,000

$ 48,000

169,500

327,600

Net plant and

equipment

$ 237,750

$384,240

Total

$ 217,500

$375,600

Total liabilities and owners'

Total assets

$300,000

$480,000

$300,000

$480,000

equity

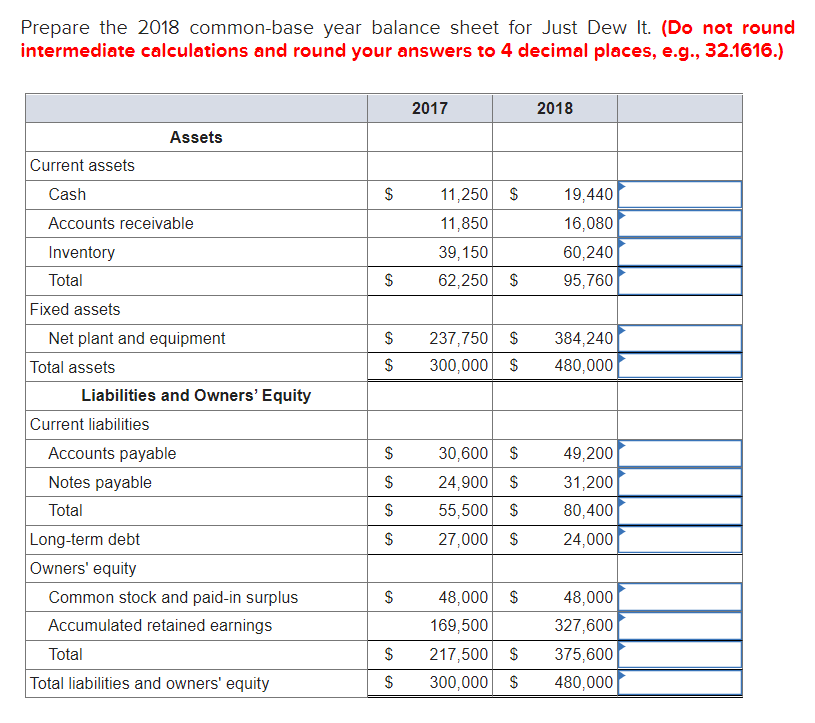

Transcribed Image Text:Prepare the 2018 common-base year balance sheet for Just Dew It. (Do not round

intermediate calculations and round your answers to 4 decimal places, e.g., 32.1616.)

2017

2018

Assets

Current assets

Cash

$

11,250 $

19,440

Accounts receivable

11,850

16,080

Inventory

39,150

60,240

Total

$

62,250 S

95,760

Fixed assets

237,750 $

300,000 $

Net plant and equipment

384,240

Total assets

$

480,000

Liabilities and Owners' Equity

Current liabilities

30,600 S

24,900 S

55,500 S

27,000 $

Accounts payable

$

49,200

Notes payable

31,200

Total

$

80,400

Long-term debt

Owners' equity

24,000

Common stock and paid-in surplus

$

48,000 S

48,000

Accumulated retained earnings

169,500

327,600

217,500 $

300,000 $

Total

375,600

Total liabilities and owners' equity

480,000

%24

%24

24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT