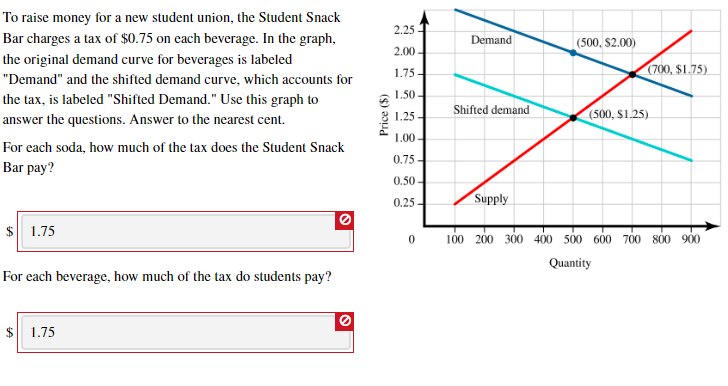

To raise money for a new student union, the Student Snack 2.25 Bar charges a tax of $0.75 on each beverage. In the graph, Demand (500, $2.00) 2.00 the original demand curve for beverages is labeled (700, $1.75) 1.75 "Demand" and the shifted demand curve, which accounts for 1.50 the tax, is labeled "Shifted Demand." Use this graph to Shifted demand (500, S1.25) 1.25 answer the questions. Answer to the nearest cent. 00 For each soda, how much of the tax does the Student Snack 0.75 Bar pay? 0.50- Supply 0.25 1.75 100 200 300 400 500 600 700 800 900 Quantity For each beverage, how much of the tax do students pay? 1.75 ($) aoud

To raise money for a new student union, the Student Snack 2.25 Bar charges a tax of $0.75 on each beverage. In the graph, Demand (500, $2.00) 2.00 the original demand curve for beverages is labeled (700, $1.75) 1.75 "Demand" and the shifted demand curve, which accounts for 1.50 the tax, is labeled "Shifted Demand." Use this graph to Shifted demand (500, S1.25) 1.25 answer the questions. Answer to the nearest cent. 00 For each soda, how much of the tax does the Student Snack 0.75 Bar pay? 0.50- Supply 0.25 1.75 100 200 300 400 500 600 700 800 900 Quantity For each beverage, how much of the tax do students pay? 1.75 ($) aoud

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 10PA

Related questions

Question

Transcribed Image Text:To raise money for a new student union, the Student Snack

2.25

Bar charges a tax of $0.75 on each beverage. In the graph,

Demand

(500, $2.00)

2.00

the original demand curve for beverages is labeled

(700, $1.75)

1.75

"Demand" and the shifted demand curve, which accounts for

1.50

the tax, is labeled "Shifted Demand." Use this graph to

Shifted demand

(500, S1.25)

1.25

answer the questions. Answer to the nearest cent.

00

For each soda, how much of the tax does the Student Snack

0.75

Bar pay?

0.50-

Supply

0.25

1.75

100 200 300 400 500 600 700 800 900

Quantity

For each beverage, how much of the tax do students pay?

1.75

($) aoud

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning