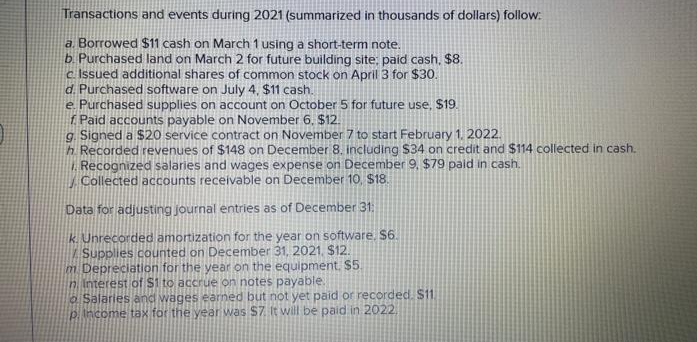

Transactions and events during 2021 (summarized in thousands of dollars) follow: a. Borrowed $11 cash on March 1 using a short-term note. b. Purchased land on March 2 for future building site: paid cash. $8. c. Issued additional shares of common stock on April 3 for $30. d. Purchased software on July 4, $11 cash. e. Purchased supplies on account on October 5 for future use, $19. f. Paid accounts payable on November 6, $12. g. Signed a $20 service contract on November 7 to start February 1, 2022. h. Recorded revenues of $148 on December 8, including $34 on credit and $114 collected in cash. 1. Recognized salaries and wages expense on December 9, $79 paid in cash. Collected accounts receivable on December 10, $18. Data for adjusting journal entries as of December 31: k. Unrecorded amortization for the year on software. $6. Supplies counted on December 31, 2021, $12. m Depreciation for the year on the equipment. $5. n Interest of $1 to accrue on notes payable. Salaries and wages earned but not yet paid or recorded. $11 p. Income tax for the year was $7. It will be paid in 2022

Transactions and events during 2021 (summarized in thousands of dollars) follow: a. Borrowed $11 cash on March 1 using a short-term note. b. Purchased land on March 2 for future building site: paid cash. $8. c. Issued additional shares of common stock on April 3 for $30. d. Purchased software on July 4, $11 cash. e. Purchased supplies on account on October 5 for future use, $19. f. Paid accounts payable on November 6, $12. g. Signed a $20 service contract on November 7 to start February 1, 2022. h. Recorded revenues of $148 on December 8, including $34 on credit and $114 collected in cash. 1. Recognized salaries and wages expense on December 9, $79 paid in cash. Collected accounts receivable on December 10, $18. Data for adjusting journal entries as of December 31: k. Unrecorded amortization for the year on software. $6. Supplies counted on December 31, 2021, $12. m Depreciation for the year on the equipment. $5. n Interest of $1 to accrue on notes payable. Salaries and wages earned but not yet paid or recorded. $11 p. Income tax for the year was $7. It will be paid in 2022

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1AP

Related questions

Question

Record entry to close revenue and expense accounts to

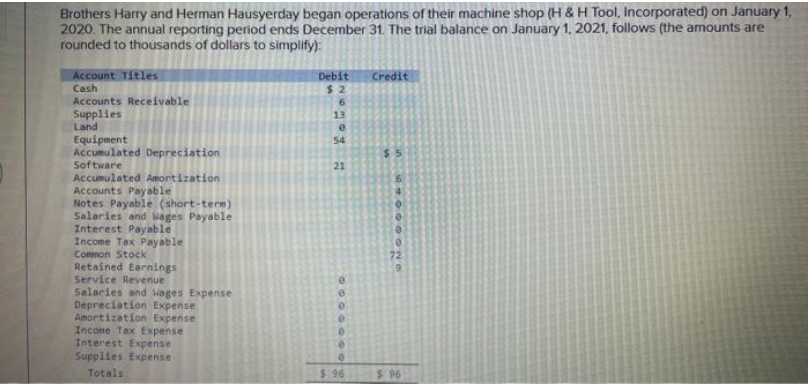

Transcribed Image Text:Brothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool, Incorporated) on January 1,

2020. The annual reporting period ends December 31. The trial balance on January 1, 2021, follows (the amounts are

rounded to thousands of dollars to simplify):

Account Titles

Cash

Accounts Receivable

Supplies

Land

Equipment

Accumulated Depreciation

Software

Accumulated Amortization

Accounts Payable

Notes Payable (short-term)

Salaries and Wages Payable

Interest Payable

Income Tax Payable

Common Stock

Retained Earnings

Service Revenue

Salaries and wages Expense

Depreciation Expense

Amortization Expense

Income Tax Expense

Interest Expense

Supplies Expense

Totals.

Debit

$2

H Lowong

e

54

21

&0000000

$.96

Credit

56400DONG

$5

72

5.96

Transcribed Image Text:Transactions and events during 2021 (summarized in thousands of dollars) follow:

a. Borrowed $11 cash on March 1 using a short-term note.

b. Purchased land on March 2 for future building site: paid cash. $8.

c. Issued additional shares of common stock on April 3 for $30.

d. Purchased software on July 4, $11 cash.

e. Purchased supplies on account on October 5 for future use, $19.

f. Paid accounts payable on November 6, $12.

g. Signed a $20 service contract on November 7 to start February 1, 2022.

h. Recorded revenues of $148 on December 8, including $34 on credit and $114 collected in cash.

1. Recognized salaries and wages expense on December 9, $79 paid in cash.

Collected accounts receivable on December 10, $18.

Data for adjusting journal entries as of December 31:

k. Unrecorded amortization for the year on software. $6.

Supplies counted on December 31, 2021, $12.

m Depreciation for the year on the equipment. $5.

n Interest of $1 to accrue on notes payable.

Salaries and wages earned but not yet paid or recorded. $11

p. Income tax for the year was $7. It will be paid in 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning