Transfer Pricing, Idle Capacity Mouton & Perrier, Inc., has a number of divisions that produce liquors, bottled water, and glassware. The Glassware Division manufactures a variety of bottles that can be sold externally (to soft-drink and juice bottlers) or internally to Mouton & Perrier's Bottled Water Division. Sales and cost data on a case of 24 basic 12-ounce bottles are as follows: Unit selling price $3.25 Unit variable cost $1.40 Unit product fixed cost* $0.65 Practical capacity in cases 540,000 *$351,000/540,000 During the coming year, the Glassware Division expects to sell 420,000 cases of this bottle. The Bottled Water Division currently plans to buy 108,090 cases on the outside market for $3.25 each. Ellyn Burridge, manager of the Glassware Division, approached Justin Thomas, manager of the Bottled Water Division, and offered to sell the 108,090 cases for $3.17 each. Ellyn explained to Justin that she can avoid selling costs of $0.14 per case by selling internally and that she would split the savings by offering a $0.08 discount on the usual price. Required: 1. What is the minimum transfer price that the Glassware Division would be willing to accept? Round to the nearest cent. 24 per unit What is the maximum transfer price that the Bottled Water Division would be willing to pay? Round to the nearest cent. $ per unit Should an internal transfer take place? Yes v What would be the benefit (or loss) to the firm as a whole if the internal transfer takes place? When required, round your answer to the nearest dollar. Benefit v 2. Suppose Justin knows that the Glassware Division has idle capacity. Do you think that he would agree to the transfer price of $3.17? No v Suppose he counters with an offer to pay $2.72. If you were Ellyn, would you be interested in this price? Yes v 3. Suppose that Mouton & Perrier's policy is that all internal transfers take place at full manufacturing cost. What would the transfer price be? Round to the nearest cent. per unit

Transfer Pricing, Idle Capacity Mouton & Perrier, Inc., has a number of divisions that produce liquors, bottled water, and glassware. The Glassware Division manufactures a variety of bottles that can be sold externally (to soft-drink and juice bottlers) or internally to Mouton & Perrier's Bottled Water Division. Sales and cost data on a case of 24 basic 12-ounce bottles are as follows: Unit selling price $3.25 Unit variable cost $1.40 Unit product fixed cost* $0.65 Practical capacity in cases 540,000 *$351,000/540,000 During the coming year, the Glassware Division expects to sell 420,000 cases of this bottle. The Bottled Water Division currently plans to buy 108,090 cases on the outside market for $3.25 each. Ellyn Burridge, manager of the Glassware Division, approached Justin Thomas, manager of the Bottled Water Division, and offered to sell the 108,090 cases for $3.17 each. Ellyn explained to Justin that she can avoid selling costs of $0.14 per case by selling internally and that she would split the savings by offering a $0.08 discount on the usual price. Required: 1. What is the minimum transfer price that the Glassware Division would be willing to accept? Round to the nearest cent. 24 per unit What is the maximum transfer price that the Bottled Water Division would be willing to pay? Round to the nearest cent. $ per unit Should an internal transfer take place? Yes v What would be the benefit (or loss) to the firm as a whole if the internal transfer takes place? When required, round your answer to the nearest dollar. Benefit v 2. Suppose Justin knows that the Glassware Division has idle capacity. Do you think that he would agree to the transfer price of $3.17? No v Suppose he counters with an offer to pay $2.72. If you were Ellyn, would you be interested in this price? Yes v 3. Suppose that Mouton & Perrier's policy is that all internal transfers take place at full manufacturing cost. What would the transfer price be? Round to the nearest cent. per unit

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 12E

Related questions

Question

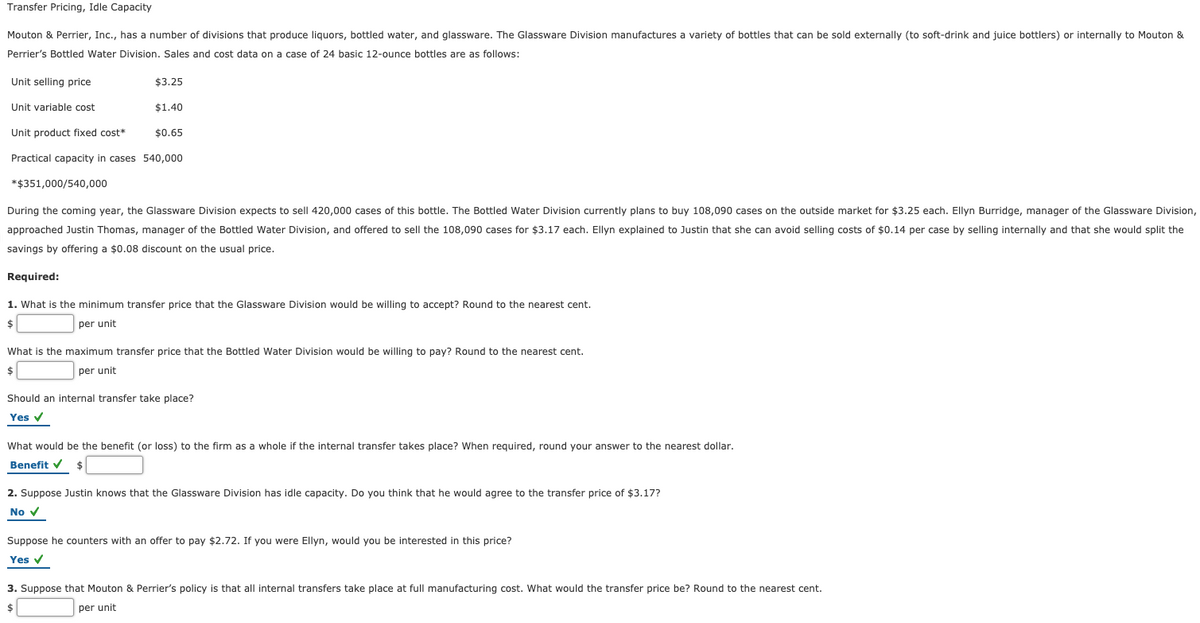

Transcribed Image Text:Transfer Pricing, Idle Capacity

Mouton & Perrier, Inc., has a number of divisions that produce liquors, bottled water, and glassware. The Glassware Division manufactures a variety of bottles that can be sold externally (to soft-drink and juice bottlers) or internally to Mouton &

Perrier's Bottled Water Division. Sales and cost data on a case of 24 basic 12-ounce bottles are as follows:

Unit selling price

$3.25

Unit variable cost

$1.40

Unit product fixed cost*

$0.65

Practical capacity in cases 540,000

*$351,000/540,000

During the coming year, the Glassware Division expects to sell 420,000 cases of this bottle. The Bottled Water Division currently plans to buy 108,090 cases on the outside market for $3.25 each. Ellyn Burridge, manager of the Glassware Division,

approached Justin Thomas, manager of the Bottled Water Division, and offered to sell the 108,090 cases for $3.17 each. Ellyn explained to Justin that she can avoid selling costs of $0.14 per case by selling internally and that she would split the

savings by offering a $0.08 discount on the usual price.

Required:

1. What is the minimum transfer price that the Glassware Division would be willing to accept? Round to the nearest cent.

per unit

What is the maximum transfer price that the Bottled Water Division would be willing to pay? Round to the nearest cent.

per unit

Should an internal transfer take place?

Yes v

What would be the benefit (or loss) to the firm as a whole

the internal transfer takes place? When required, round your answer to the nearest dollar.

Benefit v

2. Suppose Justin knows that the Glassware Division has idle capacity. Do you think that he would agree to the transfer price of $3.17?

No v

Suppose he counters with an offer to pay $2.72. If you were Ellyn, would you be interested in this price?

Yes v

3. Suppose that Mouton & Perrier's policy is that all internal transfers take place at full manufacturing cost. What would the transfer price be? Round to the nearest cent.

per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,