FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

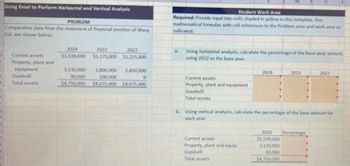

Transcribed Image Text:Using Excel to Perform Horizontal and Vertical Analysis

PROBLEM

Comparative data from the statement of financial position of Wavy

Ltd. are shown below.

Curent assets

Property, plant and

equipment

Goodwill

Total assets

2024

$1,530,000

3,130,000

90,000

2022

2023

51.175,000 $1,225,000

2.800,000

100,000

$4,750,000 $4,075,000 $4,075,000

2,850,000

O

Student Work Area

Required: Provide input into cells shaded in yellow in this template. Use

mathematical formulas with cell references to the Problem area and work area an

indicated

a

Using horizontal analysis, calculate the percentage of the base-year amount,

using 2022 as the base year.

Current assets

Property, plant and equipment

Goodwill

Total assets

2024

Current assets

Property, plant and equip.

Goodwill

Total assets

2023

b. Using vertical analysis, calculate the percentage of the base amount for

each year.

2024

$1,530,000

3.130,000

90,000

$4,750,000

2022

Percentage

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Suppose in its 2027 annual report that McDonald's Corporation reports beginning total assets of $20.80 billion, ending total assets of $19.20 billion, net sales of $21.80 billion, and net income of $4.10 billion. (a) Compute McDonald's return on assets. (Round return on assets to one decimal place, e.g. 5.1%.) McDonald's return on assets % (b) Compute McDonald's asset turnover. (Round asset turnover to 2 decimal places, e.g. 5.12.) McDonald's asset turnover timesarrow_forwardThe following are financial data taken from the annual report of Foundotos Company: Year 2 $134,448 51,981 37,154 57,504 Net sales Gross property, plant and equipment Accumulated depreciation Intangible assets (net) A. Calculate the following ratios for Year 1 and Year 2: 1. Fixed asset turnover 2. Accumulated depreciation divided-by-gross fixed assets B. What do the trends in these ratios reveal about Foundotos? Year 1 $130,060 47,744 34,180 36,276arrow_forwardfarrow_forward

- please answer do not image formatarrow_forwardConsider the following excerpt of Butterfly Corporation's balance sheet and income statement Use the excerpt of Corporation's balance sheet and its income statement to compute 's profit margin and return on assets for 2022 and 2023. Comment on Butterfly's profitability and changes in profitability from 2022 to 2023 . Butterfly's total assets at the end of were $169,000 million. (in millions) 2023 2022 Sales $67,000 $66,000 Cost of Goods Sold 34,000 33,700 Gross Profit 33,000 32,300 Selling, General, and Administrative Expenses 15,000 15,100 Research and Development Expense 7,500 7,700 Interest Expense 190 185 Earnings before Taxes 10,310 9,315 Income Tax Expense 3,100 3,000 Net Income $7,210 $6,315 Assets (dollars in millions) 2023 2022 Current Assets Cash and Cash Equivalents $20,000 $28,000 Marketable Securities 7,900 2,900 Accounts Receivable…arrow_forwardwhat is the return in assets for each year?arrow_forward

- Please solve the question sub-division b alone.arrow_forwardThe comparative balance sheets for Carla Vista Corporation appear below: CARLA VISTA CORPORATION Comparative Balance Sheet at December 31st 2027 2026 Assets Cash $ 17,160 $ 12,840 Accounts receivable 25,440 28,080 Land 24,000 31,200 Building 84,000 84,000 Accumulated depreciation—equipment (18,000) (12,000) Total assets $ 132,600 $ 144,120 Liabilities and Shareholders' Equity Accounts payable $ 14,840 $ 37,320 Common shares 90,000 82,800 Retained earnings 27,760 24,000 Total liabilities and shareholders' equity $ 132,600 $ 144,120 Additional information: 1. Profit for the year ending December 31, 2027 was $27,160. 2. Land was sold for cash of $5,880, resulting in a loss of $1,320 on sale of the land. 3. Cash dividends were declared and paid during the year, $23,400. REQUIRED: Prepare a Statement of Cash Flows, using the indirect method, for the year ended December 31, 2027 in proper format.arrow_forwardForecast an Income Statement Following is the income statement for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $27,807 Costs and expenses Cost of products sold 8,331 Research and development expense 2,330 Selling, general, and administrative expense 9,480 Amortization of intangible assets 1,605 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 5,439 Other nonoperating income, net (373) Interest expense 1,314 Income before income taxes 4,498 Income tax provision 547 Net income 3,951 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $3,932 Use the following assumptions to prepare a forecast of the company’s income statement for FY2020. Note: Complete the entire question in Excel using the following template: Excel Template. Format each answer to two decimal…arrow_forward

- Please helparrow_forwardVertical Analysis of Balance Sheets Consolidated balance sheets for Winged Manufacturing follow. Winged ManufacturingConsolidated Balance Sheets(dollars in thousands) December 31 ASSETS 2023 2023 Current assets: Cash and cash equivalents $1,203,488 $676,413 Short-term investments 54,368 215,890 Accounts receivable, net of allowance for doubtful accountsof $90,992 ($83,776 in 2022) 1,581,347 1,381,946 Inventories 1,088,434 1,506,638 Deferred tax assets 293,048 268,085 Other current assets 255,767 289,383 Total current assets $4,476,452 $4,338,355 Property, plant, and equipment: Land and buildings $484,592 $404,688 Machinery and equipment 572,728 578,272 Office furniture and equipment 158,160 167,905 Leasehold improvements 236,708 261,792 $1,452,188 $1,412,657 Accumulated depreciation and amortization (785,088) (753,111) Net property, plant, and equipment $667,100 $659,546 Other assets…arrow_forwardReturn on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financlal data (in millions) In its annual report: 2018 2019 Net Income $9,050 $7.500 Net Sales 52,350 37,200 Total Assets 58,734 68,128 If the company's total assets are $55,676 in 2017, calculate the company's: (a) return on assets (round answers to one decimal place - ex: 10.79%6) (b) asset turnover for 2018 and 2019 (round answers to two decimal places) 2018 2019 a. Return on Assets Ratio 96 96 b. Asset Turnover Ratio Check O Prevlous Save Answersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education