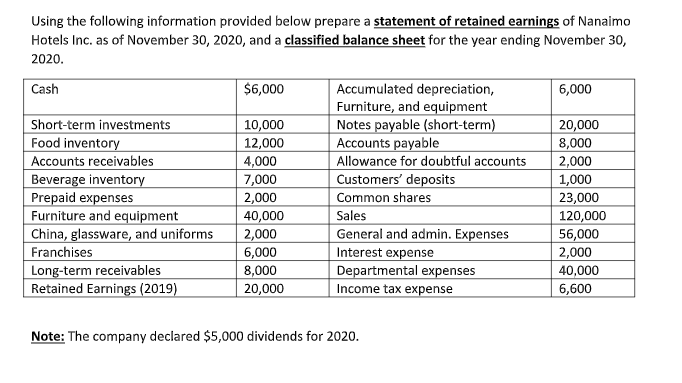

Using the following information provided below prepare a statement of retained earnings of Nanaimo Hotels Inc. as of November 30, 2020, and a classified balance sheet for the year ending November 30, 2020. Cash Accumulated depreciation, Furniture, and equipment Notes payable (short-term) Accounts payable Allowance for doubtful accounts Customers' deposits Common shares Sales General and admin. Expenses Interest expense Departmental expenses Income tax expense $6,000 6,000 Short-term investments Food inventory Accounts receivables Beverage inventory Prepaid expenses Furniture and equipment |China, glassware, and uniforms Franchises Long-term receivables Retained Earnings (2019) 10,000 12,000 4,000 7,000 2,000 40,000 2,000 6,000 8,000 20,000 20,000 8,000 2,000 1,000 23,000 120,000 56,000 2,000 40,000 6,600 Note: The company declared $5,000 dividends for 2020.

Using the following information provided below prepare a statement of retained earnings of Nanaimo Hotels Inc. as of November 30, 2020, and a classified balance sheet for the year ending November 30, 2020. Cash Accumulated depreciation, Furniture, and equipment Notes payable (short-term) Accounts payable Allowance for doubtful accounts Customers' deposits Common shares Sales General and admin. Expenses Interest expense Departmental expenses Income tax expense $6,000 6,000 Short-term investments Food inventory Accounts receivables Beverage inventory Prepaid expenses Furniture and equipment |China, glassware, and uniforms Franchises Long-term receivables Retained Earnings (2019) 10,000 12,000 4,000 7,000 2,000 40,000 2,000 6,000 8,000 20,000 20,000 8,000 2,000 1,000 23,000 120,000 56,000 2,000 40,000 6,600 Note: The company declared $5,000 dividends for 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and...

Related questions

Question

100%

Please help!

Transcribed Image Text:Using the following information provided below prepare a statement of retained earnings of Nanaimo

Hotels Inc. as of November 30, 2020, and a classified balance sheet for the year ending November 30,

2020.

Accumulated depreciation,

Furniture, and equipment

Notes payable (short-term)

Accounts payable

Allowance for doubtful accounts

Customers' deposits

Common shares

Sales

General and admin. Expenses

Interest expense

Departmental expenses

Income tax expense

Cash

$6,000

6,000

Short-term investments

Food inventory

Accounts receivables

Beverage inventory

Prepaid expenses

Furniture and equipment

China, glassware, and uniforms

Franchises

Long-term receivables

Retained Earnings (2019)

10,000

12,000

4,000

7,000

2,000

40,000

2,000

6,000

8,000

20,000

20,000

8,000

2,000

1,000

23,000

120,000

56,000

2,000

40,000

6,600

Note: The company declared $5,000 dividends for 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning