What is National Co.'s amount of total investor-supplied (Net current asset investment and net fixed asset investment) operating capital for 2022? *

What is National Co.'s amount of total investor-supplied (Net current asset investment and net fixed asset investment) operating capital for 2022? *

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 36BE: Analyzing Fixed Assets Pitt reported the following information for 2018 and 2019: Required: Compute...

Related questions

Question

18

Transcribed Image Text:What is National Co.'s amount of total investor-supplied (Net current asset investment and net

fixed asset investment) operating capital for 2022? *

Sample format: 1,111,111,111

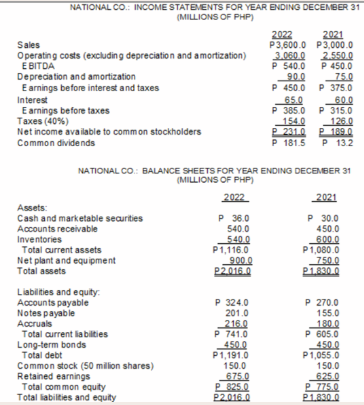

Transcribed Image Text:NATIONAL CO.: INCOME STATEMENTS FOR YEAR ENDING DECEMBER 31

(MILLIONS OF PHP)

2021

P3,600.0 P3,000.0

2.550.0

2022

Sales

Operating costs (excluding depreciation and amortization)

E BITDA

Depreciation and amortization

Earnings before interest and taxes

3.060.0

P 540.0

P 450.0

75.0

P 450.0 P 375.0

65.0

90.0

60.0

P 385.0 P 315.0

154.0

Interest

E arnings before taxes

Taxes (40%)

Net income available to common stockholders

126.0

P 231.0 P 189.0

P 181.5

Common dividends

P 13.2

NATIONAL CO.: BALANCE SHEETS FOR YEAR ENDING DECEMBER 31

(MILLIONS OF PHP)

2022

2021

Assets:

Cash and marketable securities

Accounts receivable

P 36.0

540.0

P 30.0

450.0

540.0

P1,116.0

900.0

P2.016.0

Inventories

Total current assets

600.0

P1,080.0

750.0

P1.830.0

Net plant and equipment

Total assets

Liabilities and equity:

Accounts payable

Notes payable

Accruals

Total current liabilties

Long-term bonds

Total debt

Common stock (50 million shares)

Retained earnings

Total com mon equity

Total labilties and equity

P 324.0

201.0

216.0

P 741.0

450.0

P1,191.0

P 270.0

155.0

180.0

P 605.0

450.0

P1,055.0

150.0

150.0

675.0

P 825.0

P2.016.0

625.0

P 775.0

P1.830.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning