MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the correct way to write out the non-linear program for part a?

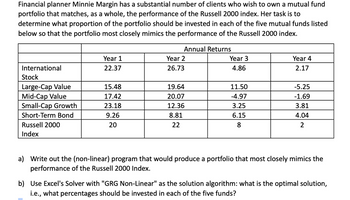

Transcribed Image Text:Financial planner Minnie Margin has a substantial number of clients who wish to own a mutual fund

portfolio that matches, as a whole, the performance of the Russell 2000 index. Her task is to

determine what proportion of the portfolio should be invested in each of the five mutual funds listed

below so that the portfolio most closely mimics the performance of the Russell 2000 index.

Annual Returns

International

Stock

Large-Cap Value

Mid-Cap Value

Small-Cap Growth

Short-Term Bond

Russell 2000

Index

Year 1

22.37

15.48

17.42

23.18

9.26

20

Year 2

26.73

19.64

20.07

12.36

8.81

22

Year 3

4.86

11.50

-4.97

3.25

6.15

8

Year 4

2.17

-5.25

-1.69

3.81

4.04

2

a) Write out the (non-linear) program that would produce a portfolio that most closely mimics the

performance of the Russell 2000 Index.

b) Use Excel's Solver with "GRG Non-Linear" as the solution algorithm: what is the optimal solution,

i.e., what percentages should be invested in each of the five funds?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- An investigative idea during World War II developed into the modeling procedure known as linear programming. Teachers often present linear programming as a really, cool application of systems of inequalities, but don’t give students the opportunities to understand the kinds of questions this process can answer. Let's talk briefly about the origin of this method - how and when was it first used? How is the technique applied now? Discuss the mathematical aspects of this procedure. What does it entail? What key mathematical concept(s) does it depend on?arrow_forwardThe question is in the screenshot and the answers are listed below: A. 700 small copiers and 1,050 large copiers. B. 1,025 small copiers and 825 large copiers. C. 975 small copiers and 875 large copiers. D. 900 small copiers and 925 large copiers.arrow_forwardPlease can you help me with this linear programming question, I've tried seek an anser/guidance from chatgpt but it seems to get it wrong.arrow_forward

- A linear programming computer package is needed. Epsilon Airlines services predominately the eastern and southeastern United States. A vast majority of Epsilon's customers make reservations through Epsilon's website, but a small percentage of customers make reservations via phone. Epsilon employs call-center personnel to handle these reservations along with any problems with the website reservation system and for the rebooking of flights for customers if their plans change or their travel is disrupted. Staffing the call center appropriately is a challenge for Epsilon's management team. Having too many employees on hand is a waste of money, but having too few results in very poor customer service and the potential loss of customers. Epsilon analysts have estimated the minimum number of call-center employees needed by day of week for the upcoming vacation season (June, July, and the first two weeks of August). These estimates are given in the following table. Day Minimum Number of…arrow_forwardQuestion 7 Classify the nature of this linear program. Assume all the variables are non-negative. Min-2X + Y subject to 3X-Y 22 -X+ 2Y ≤ 10 Y ≤5arrow_forwardLinear Programming: I got started on it, please follow up with my solution or give a better onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman