WoolCorp WoolCorp buys sheep’s wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You’ve just been hired as a production manager at WoolCorp. Currently WoolCorp makes two products: (1) raw, clean wool to be used as stuffing or insulation and (2) wool yarn for use in the textile industry. The company would like you to evaluate its costing methods for its raw wool and wool yarn. Single Plantwide Rate WoolCorp is currently using the single plantwide factory overhead rate method, which uses a predetermined overhead rate based on an estimated allocation base such as direct labor hours or machine hours. The rate is computed as follows: Single Plantwide Factory Overhead Rate = (Total Budgeted Factory Overhead) ÷ (Total Budgeted Plantwide Allocation Base) WoolCorp has been using combing machine hours as its allocation base. The company would like to consider activity-based costing. In order to understand their current system better, you evaluate WoolCorp’s current method of costing for raw wool and wool yarn. The production staff has compiled the following information for you on the production of 500 pounds of either raw wool or wool yarn: Factory Overhead Type Budgeted Factory Overhead Sorting $25,600 Cleaning 38,400 Combing 1,400 Raw Wool Wool Yarn Hours of combing machine use required 70 30 In the following table, use combing machine hours as the allocation base for assigning overhead costs to each product. When required, round your answers to the nearest dollar. Single Plantwide Factory Overhead Rate: $ fill in the blank 62729300f04cfa8_1 per combing hour Raw Wool Wool Yarn Allocated factory overhead cost $ fill in the blank 62729300f04cfa8_2 $ fill in the blank 62729300f04cfa8_3 Feedback Activity-Based Costing In order to compare WoolCorp’s current method with activity-based costing, you interview the production staff and compile the following information, which relates to the costs for raw wool and wool yarn. Type of Cost Activity Base Total Cost Sorting Hours of sorting $25,600 Cleaning Units of cleaning machine power 38,400 Combing Hours of combing machine use 1,400 Raw Wool Wool Yarn Hours of sorting required 1,000 4,000 Units of cleaning machine power required 1,920 4,480 Hours of combing machine use required 70 30 In the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to the nearest cent. Activity Activity Rate Sorting $ fill in the blank 2136cff1507cfb8_1 per sorting hour Cleaning $fill in the blank 2136cff1507cfb8_2 per unit of cleaning machine power Combing $ fill in the blank 2136cff1507cfb8_3 per hour of combing machine use In the following table, allocate the costs of sorting, cleaning, and combing based on the rates of activity consumed by each product’s process. When required, round your answers to the nearest dollar. Raw Wool Wool Yarn Sorting cost $ fill in the blank 2136cff1507cfb8_4 $ fill in the blank 2136cff1507cfb8_5 Cleaning cost fill in the blank 2136cff1507cfb8_6 fill in the blank 2136cff1507cfb8_7 Combing cost fill in the blank 2136cff1507cfb8_8 fill in the blank 2136cff1507cfb8_9 Total cost $ fill in the blank 2136cff1507cfb8_10 $ fill in the blank 2136cff1507cfb8_11

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

WoolCorp

WoolCorp buys sheep’s wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning

Currently WoolCorp makes two products: (1) raw, clean wool to be used as stuffing or insulation and (2) wool yarn for use in the textile industry.

The company would like you to evaluate its costing methods for its raw wool and wool yarn.

Single Plantwide Rate

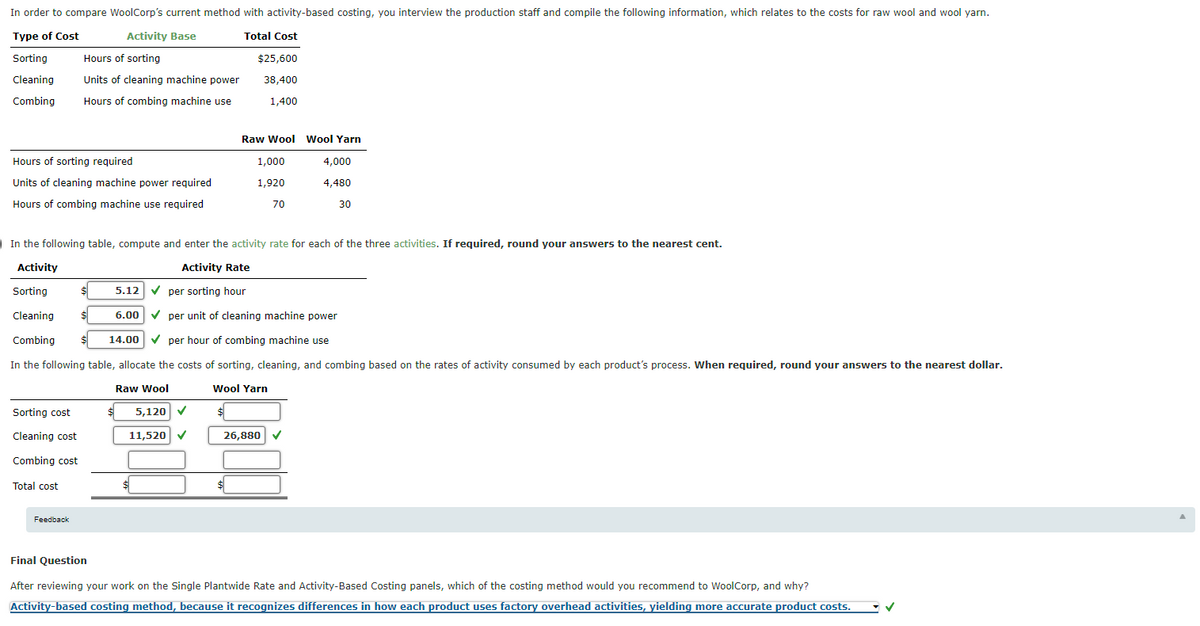

WoolCorp is currently using the single plantwide factory overhead rate method, which uses a predetermined overhead rate based on an estimated allocation base such as direct labor hours or machine hours. The rate is computed as follows:

Single Plantwide Factory Overhead Rate = (Total Budgeted Factory Overhead) ÷ (Total Budgeted Plantwide Allocation Base)

WoolCorp has been using combing machine hours as its allocation base.

The company would like to consider activity-based costing. In order to understand their current system better, you evaluate WoolCorp’s current method of costing for raw wool and wool yarn. The production staff has compiled the following information for you on the production of 500 pounds of either raw wool or wool yarn:

Factory Overhead Type |

Budgeted Factory Overhead |

| Sorting | $25,600 |

| Cleaning | 38,400 |

| Combing | 1,400 |

| Raw Wool | Wool Yarn | |

| Hours of combing machine use required | 70 | 30 |

In the following table, use combing machine hours as the allocation base for assigning overhead costs to each product. When required, round your answers to the nearest dollar.

Single Plantwide Factory Overhead Rate: $ fill in the blank 62729300f04cfa8_1 per combing hour

| Raw Wool | Wool Yarn | |

| Allocated |

$ fill in the blank 62729300f04cfa8_2 | $ fill in the blank 62729300f04cfa8_3 |

Activity-Based Costing

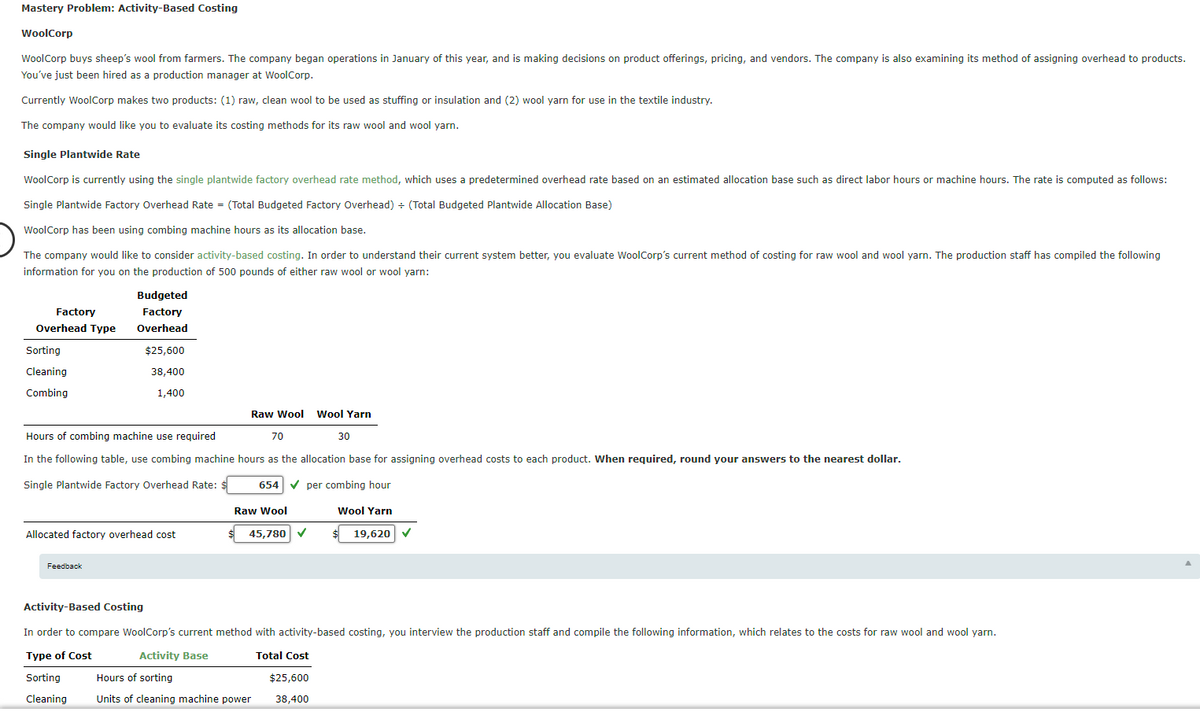

In order to compare WoolCorp’s current method with activity-based costing, you interview the production staff and compile the following information, which relates to the costs for raw wool and wool yarn.

| Type of Cost | Activity Base | Total Cost |

| Sorting | Hours of sorting | $25,600 |

| Cleaning | Units of cleaning machine power | 38,400 |

| Combing | Hours of combing machine use | 1,400 |

| Raw Wool | Wool Yarn | |

| Hours of sorting required | 1,000 | 4,000 |

| Units of cleaning machine power required | 1,920 | 4,480 |

| Hours of combing machine use required | 70 | 30 |

In the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to the nearest cent.

| Activity | Activity Rate | |

| Sorting | $ fill in the blank 2136cff1507cfb8_1 | per sorting hour |

| Cleaning | $fill in the blank 2136cff1507cfb8_2 | per unit of cleaning machine power |

| Combing | $ fill in the blank 2136cff1507cfb8_3 | per hour of combing machine use |

In the following table, allocate the costs of sorting, cleaning, and combing based on the rates of activity consumed by each product’s process. When required, round your answers to the nearest dollar.

| Raw Wool | Wool Yarn | |

| Sorting cost | $ fill in the blank 2136cff1507cfb8_4 | $ fill in the blank 2136cff1507cfb8_5 |

| Cleaning cost | fill in the blank 2136cff1507cfb8_6 | fill in the blank 2136cff1507cfb8_7 |

| Combing cost | fill in the blank 2136cff1507cfb8_8 | fill in the blank 2136cff1507cfb8_9 |

| Total cost | $ fill in the blank 2136cff1507cfb8_10 | $ fill in the blank 2136cff1507cfb8_11 |

Activity based costing is a form of costing system under which all type of indirect costs and overheads are being allocated on the basis of activities and their cost drivers.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images