Concept explainers

Production-Based Costing versus Activity-Based Costing, Assigning Costs to Activities, Resource Drivers

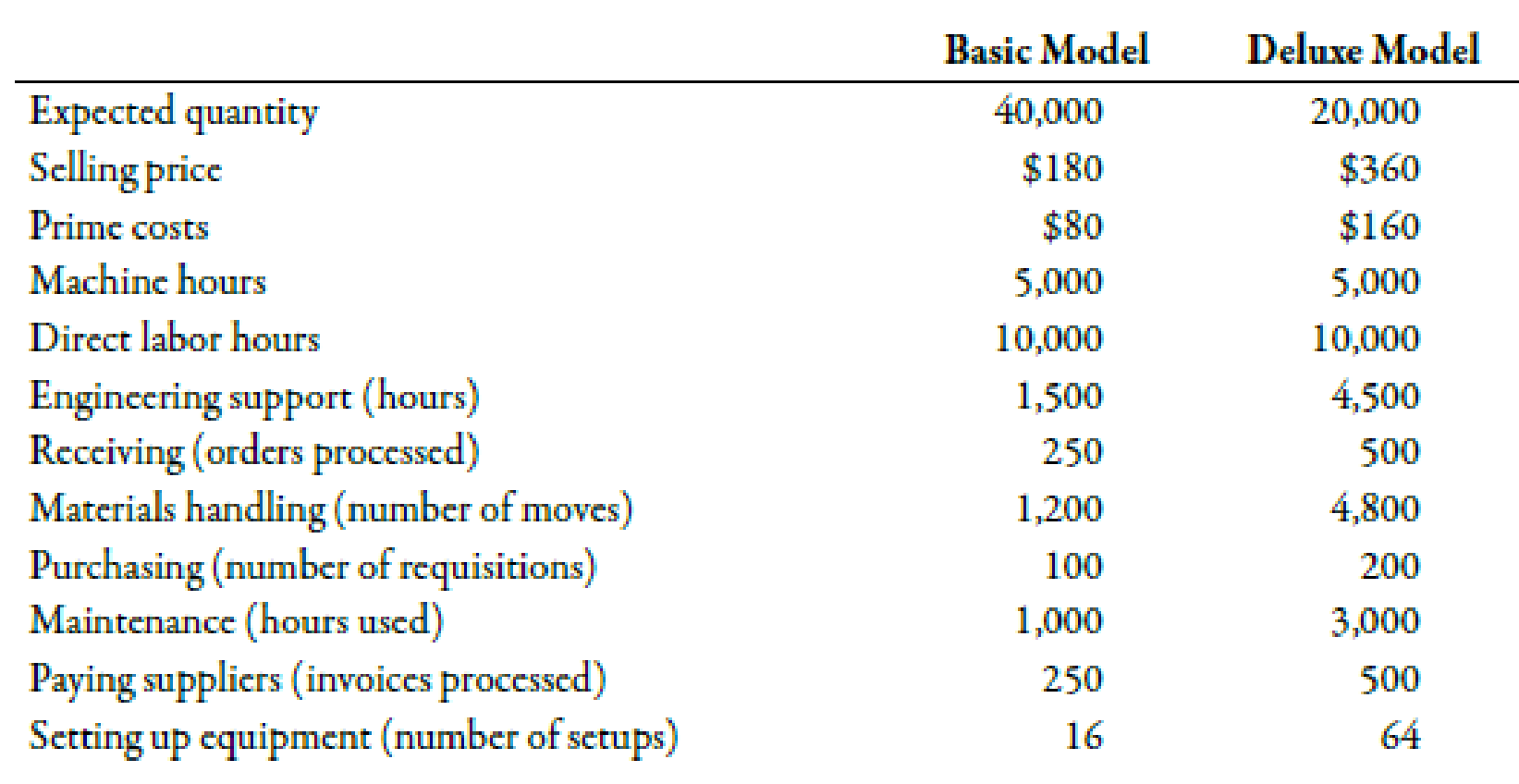

Willow Company produces lawnmowers. One of its plants produces two versions of mowers: a basic model and a deluxe model. The deluxe model has a sturdier frame, a higher horsepower engine, a wider blade, and mulching capability. At the beginning of the year, the following data were prepared for this plant:

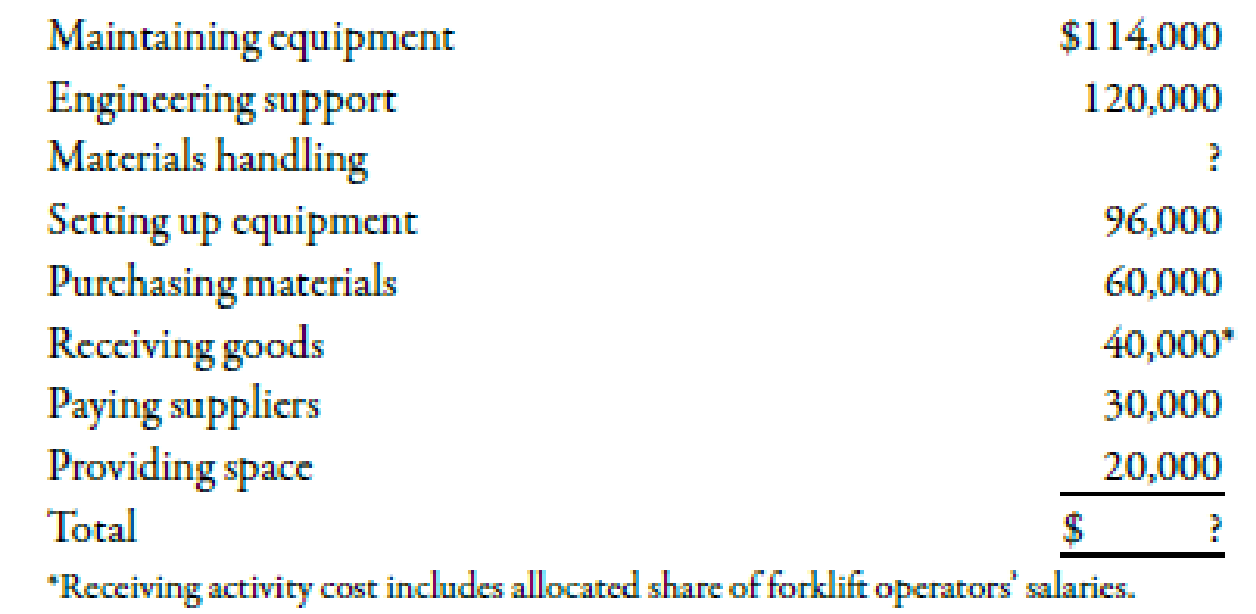

Additionally, the following overhead activity costs are reported:

Facility-level costs are allocated in proportion to machine hours (provides a measure of time the facility is used by each product). Receiving and materials handling use three inputs: two forklifts, gasoline to operate the forklift, and three operators. The three operators are paid a salary of $40,000 each. The operators spend 25% of their time on the receiving activity and 75% on moving goods (materials handling). Gasoline costs $3 per move.

Required:

(Note: Round answers to two decimal places.)

- 1. Calculate the cost of the materials handling activity. Label the cost assignments as driver tracing or direct tracing. Identify the resource drivers.

- 2. Calculate the cost per unit for each product by using direct labor hours to assign all overhead costs.

- 3. Calculate activity rates, and assign costs to each product. Calculate a unit cost for each product, and compare these costs with those calculated in Requirement 2.

- 4. Calculate consumption ratios for each activity.

- 5. CONCEPTUAL CONNECTION Explain how the consumption ratios calculated in Requirement 4 can be used to reduce the number of rates. Calculate the rates that would apply under this approach.

1.

Compute the costs of the material handling activity and label the activities into driver tracing or direct tracing. Also, identify the resource drivers of the various activities.

Explanation of Solution

Activity Based Costing (ABC):

Activity based costing is an apportionment of costs that first considers the activity drivers that helps in the allocation of costs to various activities and then allocates costs to different cost objects by using the drivers.

| Particulars |

Rate (R) ($) |

Quantity (Q) |

Amount ($) |

| Labor | 120,000 | 0.75 | 90,000 |

| Gasoline | 3 | 6,000 | 18,000 |

| Depreciation | 16,000 | 0.75 | 12,000 |

| Total Cost | 120,000 |

Table (1)

Labor and Gasoline are driver tracing.

Identification of resource driver:

| Activity | Resource driver |

| Labor | Time |

| Gasoline | Number of moves |

| Depreciation | Time |

Table (2)

2.

Compute the costs per unit for each product with the help of direct labor hours.

Explanation of Solution

Computation of costs per account by customer category:

| Particulars |

Basic ($) |

Deluxe ($) |

| Prime costs | 80 | 160 |

| Overhead costs | 7.501 | 152 |

| Total costs | 87.50 | 175 |

Table (3)

Working Note:

1. Calculation of overhead costs:

First, the amount of plant wide rate is computed so as to calculate the overhead costs of basic:

2. Calculation of overhead costs of deluxe:

3.

Compute the activity rates and assign this cost to each product. Compute unit cost for each product and compare the costs.

Explanation of Solution

Computation of costs per account by customer category:

| Activity | Rate(R) | Quantity (Q) |

Basic |

Deluxe ($) |

| (A)Prime costs | 80 | 40,000 | 3,200,000 | |

| 160 | 20,000 | 3,200,000 | ||

| (B)Maintenance | 28.501 | 1,000 | 28,500 | |

| 28.501 | 3,000 | 85,500 | ||

| (C)Engineering | 20.002 | 1,500 | 30,000 | |

| 20.002 | 4,500 | 90,000 | ||

| (D)Materials handling | 20.003 | 1,200 | 24,000 | |

| 20.003 | 4,800 | 96,000 | ||

| (E)Setting up | 1,2004 | 16 | 19,200 | |

| 1,2004 | 64 | 76,800 | ||

| (F)Purchasing | 2005 | 100 | 20,000 | |

| 2005 | 200 | 40,000 | ||

| (G)Receiving | 53.336 | 250 | 13,333 | |

| 53.336 | 500 | 26,665 | ||

| (H)Paying Suppliers | 407 | 250 | 10,000 | |

| 407 | 250 | 20,000 | ||

| (I)Paying Space | 28 | 5,000 | 10,000 | |

| 28 | 5,000 | 10,000 | ||

|

Total Cost | 3,355,033 | 3,644,965 | ||

| Units produced | 40,000 | 20,000 | ||

|

Units costs (ABC) | 83.88 | 182.25 | ||

| Units Costs(Traditional) | 87.50 | 175.00 |

Table (4)

The ABC approach is more accurate in assigning the cost to each product as compared to the traditional approach. The traditional approach shows that the basic model was overstated and deluxe model was understated because traditional model used the plant wide overhead rate.

Working Note:

1. Calculation of maintenance rates:

2. Calculation of engineering rate:

3. Calculation of material handling rate:

4. Calculation of setting up rate:

5. Calculation of purchasing rate:

6. Calculation of receiving rate:

7. Calculation of paying suppliers rate:

8. Calculation of providing space rate:

4.

Compute the consumption ratios for each activity.

Explanation of Solution

Use the following formula to calculate consumption ratio of basic model:

| Consumption Ratio | |||

| Overhead Activity | Amount of Activity Driver Per Product | Total Driver Quantity | Basic |

| (A) | (B) | (A/B) | |

| Maintenance | 1,000 | 4,000 | 0.25 |

| Engineering | 1,500 | 6,000 | 0.25 |

| Material handling | 1,200 | 6,000 | 0.20 |

| Setups | 16 | 80 | 0.20 |

| Purchasing | 100 | 300 | 0.33 |

| Receiving | 250 | 750 | 0.33 |

| Paying suppliers | 250 | 750 | 0.33 |

| Providing space | 5,000 | 10,000 | 0.50 |

Table (5)

Use the following formula to calculate consumption ratio of deluxe model:

| Consumption Ratio | |||

| Overhead Activity | Amount of Activity Driver Per Product | Total Driver Quantity | Deluxe |

| (A) | (B) | (A/B) | |

| Maintenance | 3,000 | 4,000 | 0.75 |

| Engineering | 4,500 | 6,000 | 0.75 |

| Material handling | 4,800 | 6,000 | 0.80 |

| Setups | 64 | 80 | 0.80 |

| Purchasing | 200 | 300 | 0.67 |

| Receiving | 500 | 750 | 0.67 |

| Paying suppliers | 500 | 750 | 0.67 |

| Providing space | 5,000 | 10,000 | 0.50 |

Table (6)

Working Note:

Total driver quantity hours are computed by adding total hours of basic hours and deluxe hours. Total hours are 4,000

5.

Discuss the impact of consumption ratio on reducing the taxes. Also, compute the rate of taxes that would apply under this approach.

Explanation of Solution

The activities with the same proportions are combined into one pool, if the products are consumed in same proportion. The pooled activity costs will be apportioning in the similar proportion according to the individual activity costs. Therefore, the rate of pool is reduced from 8 to 4 with the help of consumption ratio. The calculation of pool is explained below:

Calculation of pool rate by grouping together maintenance activity and engineering activity:

| Particulars |

Amount ($) |

| Maintenance | 114,000 |

| Engineering | 120,000 |

| Total | 234,000 |

| Maintenance hours | 4,000 |

|

Pool rate | 58.50 |

Table (7)

Therefore, the pool rate of same consumption ratio activities is $58.50.

Calculation of pool rate by grouping together material handling activity and setups activity:

| Particulars |

Amount ($) |

| Material handling | 120,000 |

| Setups | 96,000 |

| Total | 216,000 |

| Number of moves | 6,000 |

|

Pool rate | 36 |

Table (8)

Therefore, the pool rate of same consumption ratio activities is $36.00.

Calculation of pool rate by grouping together purchasing, receiving and paying suppliers activity:

| Particulars |

Amount ($) |

| Purchasing | 60,000 |

| Receiving | 40,000 |

| Paying suppliers | 30,000 |

| Total | 130,000 |

| Orders processed | 750 |

|

Pool rate | 173.33 |

Table (9)

Therefore, the pool rate of same consumption ratio activities is $173.33.

Calculation of pool rate of providing space:

| Particulars |

Amount ($) |

| Providing space | 20,000 |

| Machine hours | 10,000 |

|

Pool rate | 2 |

Table (10)

Therefore, the pool rate of providing space is $2.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Functional-Based versus Activity-Based Costing For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped. Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the companys market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line. Upon investigation, they were informed that the only real change in product-costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products: The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number. During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior years output for that product. Required: (Note: Round rates and unit cost to the nearest cent.) 1. CONCEPTUAL CONNECTION Compute the amount of accounting cost assigned to a backpack before the duffel-bag line was added by using a plantwide rate approach based on units produced. Is this assignment accurate? Explain. 2. Suppose that the company decided to assign the accounting costs directly to the product lines by using the number of transactions as the activity driver. What is the accounting cost per unit of backpacks? Per unit of duffel bags? 3. Compute the amount of accounting cost assigned to each backpack and duffel bag by using departmental rates based on direct labor hours. 4. CONCEPTUAL CONNECTION Which way of assigning overhead does the best jobthe functional-based approach by using departmental rates or the activity-based approach by using transactions processed for each product? Explain. Discuss the value of ABC before the duffel-bag line was added.arrow_forwardAssigning Costs to a Cost Object, Direct and Indirect Costs Hummer Company uses manufacturing cells to produce its products (a cell is a manufacturing unit dedicated to the production of subassemblies or products). One manufacturing cell produces small motors for lawn mowers. Suppose that the motor manufacturing cell is the cost object. Assume that all or a portion of the following costs must be assigned to the cell. a. Salary of cell supervisor b. Power to heat and cool the plant in which the cell is located c. Materials used to produce the motors d. Maintenance for the cells equipment (provided by the maintenance department) e. Labor used to produce motors f. Cafeteria that services the plants employees g. Depreciation on the plant h. Depreciation on equipment used to produce the motors i. Ordering costs for materials used in production j. Engineering support (provided by the engineering department) k. Cost of maintaining the plant and grounds l. Cost of the plants personnel office m. Property tax on the plant and land Required: Classify each of the costs as a direct cost or an indirect cost to the motor manufacturing cell.arrow_forwardActivity cost pools, activity rates, and product costs using activity-based costing Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: The estimated activity-base usage and unit information for two product lines was determined as follows: A. Determine the activity rate for each activity cost pool. B. Determine the activity-based cost per unit of each product.arrow_forward

- Lampierre makes brass and gold frames. The company computed this information to decide whether to switch from the traditional allocation method to ABC: The estimated overhead for the material cost pool is estimated as $12,500, and the estimate for the machine setup pool is $35,000. Calculate the allocation rate per unit of brass and per unit of gold using: A. The traditional allocation method B. The activity-based costing methodarrow_forwardStep Costs, Relevant Range Bellati Inc. produces large industrial machinery. Bellati has a machining department and a group of direct laborers called machinists. Each machinist can machine up to 500 units per year. Bellati also hires supervisors to develop machine specification plans and oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee, at most, three machinists. Bellatis accounting and production history shows the following relationships between number of units produced and the annual costs of supervision and materials handling (by machinists): Required: 1. Prepare a graph that illustrates the relationship between direct labor cost and number of units produced in the machining department. (Let cost of direct labor be the vertical axis and number of units be the horizontal axis.) Would you classify this cost as a strictly variable cost, a fixed cost, or a step cost? 2. Prepare a graph that illustrates the relationship between the cost of supervision and the number of units produced. (Let cost of supervision be the vertical axis and number of units be the horizontal axis.) Would you classify this cost as a strictly variable cost, a fixed cost, or a step cost? 3. Suppose that the normal range of production is between 1,400 and 1,500 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 500 units. What is the increase in the cost of direct labor? Cost of supervision?arrow_forwardActivity-based product costing Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 0.5 machine hour per unit. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forward

- Activity-based costing and product cost distortion The management of Four Finger Appliance Company in Exercise 14 has asked you to use activity-based costing instead of direct labor hours to allocate factory overhead costs to the two products. You have determined that 81,000 of factory overhead from each of the production departments can be associated with setup activity (162,000 in total). Company records indicate that blenders required 135 setups, while the toaster ovens required only 45 setups. Each product has a production volume of 7,500 units. Determine the three activity rates (assembly, test and pack, and setup). Determine the total factory overhead and factory overhead per unit allocated to each product using the activity rates in (A).arrow_forwardFisico Company produces exercise bikes. One of its plants produces two versions: a standard model and a deluxe model. The deluxe model has a wider and sturdier base and a variety of electronic gadgets to help the exerciser monitor heartbeat, calories burned, distance traveled, etc. At the beginning of the year, the following data were prepared for this plant: Additionally, the following overhead activity costs are reported: Required: 1. Calculate the cost per unit for each product using direct labor hours to assign all overhead costs. 2. Calculate activity rates and determine the overhead cost per unit. Compare these costs with those calculated using the unit-based method. Which cost is the most accurate? Explain.arrow_forwardActivity-based product costing Mello Manufacturing Company is a diversified manufacturer that manufactures three products (Alpha, Beta, and Omega) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 40 minutes per unit of machine time. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forward

- Friedman Company uses JIT manufacturing. There are several manufacturing cells set up within one of its factories. One of the cells makes stands for flat-screen televisions. The cost of production for the month of April is given below. During May, 30,000 stands were produced and sold. Required: 1. Explain why process costing can be used for computing the cost of production for the stands. 2. Calculate the cost per unit for a stand. 3. Explain how activity-based costing can be used to determine the overhead assigned to the cell.arrow_forwardUse the following information for Brief Exercises 4-34 and 4-35: Sanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay: Brief Exercises 4-34 (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Refer to the information for Sanjay Company above. Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratiosone for Assembly and the other for Painting.) 2. Allocate the support department costs to the producing departments by using the direct method.arrow_forwardYoung Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College