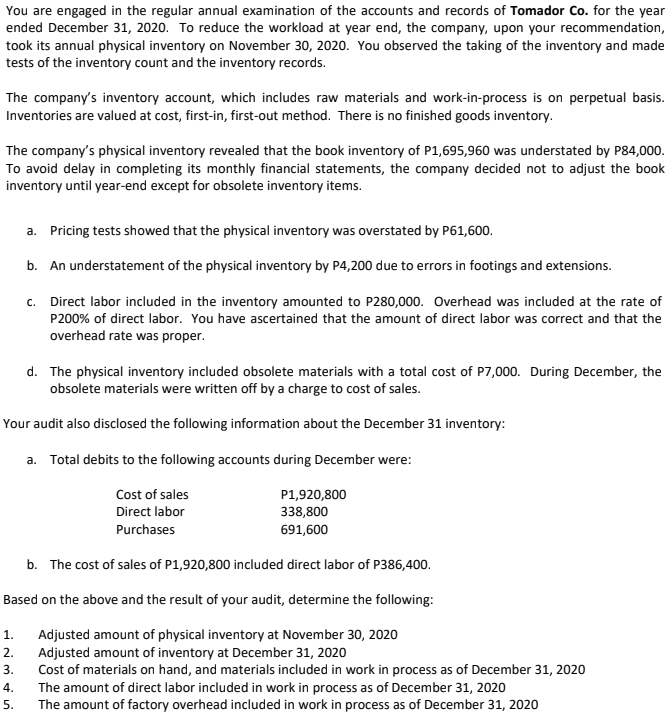

You are engaged in the regular annual examination of the accounts and records of Tomador Co. for the year ended December 31, 2020. To reduce the workload at year end, the company, upon your recommendation, took its annual physical inventory on November 30, 2020. You observed the taking of the inventory and made tests of the inventory count and the inventory records. The company's inventory account, which includes raw materials and work-in-process is on perpetual basis. Inventories are valued at cost, first-in, first-out method. There is no finished goods inventory. The company's physical inventory revealed that the book inventory of P1,695,960 was understated by P84,000. To avoid delay in completing its monthly financial statements, the company decided not to adjust the book inventory until year-end except for obsolete inventory items. a. Pricing tests showed that the physical inventory was overstated by P61,600. b. An understatement of the physical inventory by P4,200 due to errors in footings and extensions. c. Direct labor included in the inventory amounted to P280,000. Overhead was included at the rate of P200% of direct labor. You have ascertained that the amount of direct labor was correct and that the overhead rate was proper. d. The physical inventory included obsolete materials with a total cost of P7,000. During December, the obsolete materials were written off by a charge to cost of sales. Your audit also disclosed the following information about the December 31 inventory: a. Total debits to the following accounts during December were: Cost of sales P1,920,800 Direct labor 338,800 Purchases 691,600 b. The cost of sales of P1,920,800 included direct labor of P386,400. Based on the above and the result of your audit, determine the following: 1. Adjusted amount of physical inventory at November 30, 2020 Adjusted amount of inventory at December 31, 2020 Cost of materials on hand, and materials included in work in process as of December 31, 2020 2. 3. The amount of direct labor included in work in process as of December 31, 2020 5. 4. The amount of factory overhead included in work in process as of December 31, 2020

You are engaged in the regular annual examination of the accounts and records of Tomador Co. for the year ended December 31, 2020. To reduce the workload at year end, the company, upon your recommendation, took its annual physical inventory on November 30, 2020. You observed the taking of the inventory and made tests of the inventory count and the inventory records. The company's inventory account, which includes raw materials and work-in-process is on perpetual basis. Inventories are valued at cost, first-in, first-out method. There is no finished goods inventory. The company's physical inventory revealed that the book inventory of P1,695,960 was understated by P84,000. To avoid delay in completing its monthly financial statements, the company decided not to adjust the book inventory until year-end except for obsolete inventory items. a. Pricing tests showed that the physical inventory was overstated by P61,600. b. An understatement of the physical inventory by P4,200 due to errors in footings and extensions. c. Direct labor included in the inventory amounted to P280,000. Overhead was included at the rate of P200% of direct labor. You have ascertained that the amount of direct labor was correct and that the overhead rate was proper. d. The physical inventory included obsolete materials with a total cost of P7,000. During December, the obsolete materials were written off by a charge to cost of sales. Your audit also disclosed the following information about the December 31 inventory: a. Total debits to the following accounts during December were: Cost of sales P1,920,800 Direct labor 338,800 Purchases 691,600 b. The cost of sales of P1,920,800 included direct labor of P386,400. Based on the above and the result of your audit, determine the following: 1. Adjusted amount of physical inventory at November 30, 2020 Adjusted amount of inventory at December 31, 2020 Cost of materials on hand, and materials included in work in process as of December 31, 2020 2. 3. The amount of direct labor included in work in process as of December 31, 2020 5. 4. The amount of factory overhead included in work in process as of December 31, 2020

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PA: On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as...

Related questions

Question

Transcribed Image Text:You are engaged in the regular annual examination of the accounts and records of Tomador Co. for the year

ended December 31, 2020. To reduce the workload at year end, the company, upon your recommendation,

took its annual physical inventory on November 30, 2020. You observed the taking of the inventory and made

tests of the inventory count and the inventory records.

The company's inventory account, which includes raw materials and work-in-process is on perpetual basis.

Inventories are valued at cost, first-in, first-out method. There is no finished goods inventory.

The company's physical inventory revealed that the book inventory of P1,695,960 was understated by P84,000.

To avoid delay in completing its monthly financial statements, the company decided not to adjust the book

inventory until year-end except for obsolete inventory items.

a. Pricing tests showed that the physical inventory was overstated by P61,600.

b. An understatement of the physical inventory by P4,200 due to errors in footings and extensions.

c. Direct labor included in the inventory amounted to P280,000. Overhead was included at the rate of

P200% of direct labor. You have ascertained that the amount of direct labor was correct and that the

overhead rate was proper.

d. The physical inventory included obsolete materials with a total cost of P7,000. During December, the

obsolete materials were written off by a charge to cost of sales.

Your audit also disclosed the following information about the December 31 inventory:

a. Total debits to the following accounts during December were:

Cost of sales

P1,920,800

Direct labor

338,800

691,600

Purchases

b. The cost of sales of P1,920,800 included direct labor of P386,400.

Based on the above and the result of your audit, determine the following:

Adjusted amount of physical inventory at November 30, 2020

Adjusted amount of inventory at December 31, 2020

Cost of materials on hand, and materials included in work in process as of December 31, 2020

The amount of direct labor included in work in process as of December 31, 2020

The amount of factory overhead included in work in process as of December 31, 2020

1.

2.

3.

4.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning