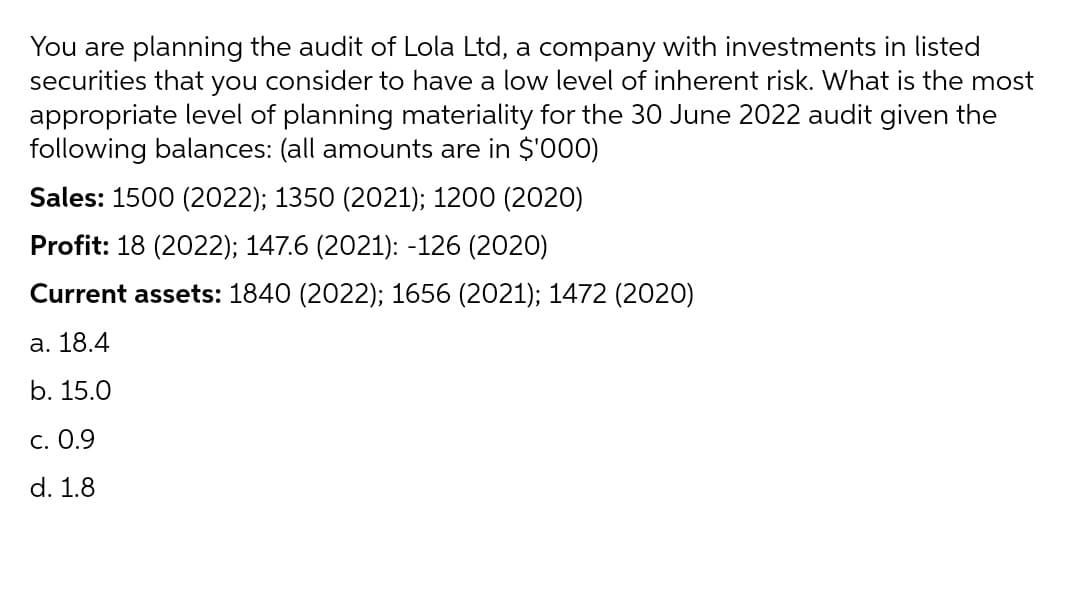

You are planning the audit of Lola Ltd, a company with investments in listed securities that you consider to have a low level of inherent risk. What is the most appropriate level of planning materiality for the 30 June 2022 audit given the following balances: (all amounts are in $'000) Sales: 1500 (2022); 1350 (2021); 1200 (2020) Profit: 18 (2022); 147.6 (2021): -126 (2020) Current assets: 1840 (2022); 1656 (2021); 1472 (2020) а. 18.4 b. 15.0 С. 0.9 d. 1.8

Q: Allen, Beth, and Charlie formed Brick Corporation. Allen and Beth each received one-third of Brick…

A: Preferred stock- Preferred stock, are shares of a corporation's stock with dividends that are…

Q: Defines the meaning of Capital Projects Fund and Debt Service Funds.

A: Capital Project Fund means a fund used to account for financial resources to be used for the…

Q: This year, Rose Company acquired all of the common stock of Hayley Company. At the end of the…

A: Consolidated Sales: Consolidated Revenue means, as of any date of determination, the total revenue…

Q: At the conclusion of each year, each participant made a deposit of 1500.35 into a sinking fund. What…

A: This is used in the case of a future annuity – suppose an equal sum of money is invested in the bank…

Q: 1. Jets Corp. had 200,000 shares of common stock outstanding on January 1, issued 400,000 shares on…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Q1 (a) Imagine a signalling model where there are two types of workers, low productivity workers…

A: Introduction:- The term "equilibrium" refers to a scenario in which market supply and demand are…

Q: Benson's Doll Company produces handmade dolls. The standard amount of time spent on each doll is…

A: Introduction 1. Both planned and actual volume should be based on getting the labor variances…

Q: Dickinsen Company gathered the following data for December: Planned Actual Sales price per unit…

A: Revenue price Variance = (Actual price per unit - Planned price per unit) x Actual number of units…

Q: The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been…

A: The question is related to Cash Flow Statement. Cash Flow Statement is summary of cash receipts and…

Q: Question AS (a) A company manufactures and sells one product. Budgeted sales units for the next…

A: Since you have posted multiple questions , we will do the first question for you. To get the other…

Q: Auga Company Ltd Comparative Balance Sheet December 31, 2021 and 2020 2021…

A: Statement of Cash Flow - Statement of Cash Flow shows the increase and decrease in cash for the…

Q: Zachary Fruit Drink Company planned to make 202,000 containers of apple juice. It expected to use…

A: Actual Price = Actual Price / Quantity purchased. Actual price = $115385/412090 Actual Price = 0.28…

Q: Asset turnover Three major segments of the transportation industry are motor carriers such as…

A: The asset turnover ratio compares the value of a business's assets to its sales or revenues. The…

Q: You are required to calculate the cost per unit of each product A and B based on: a. Traditional…

A: Answer:

Q: Question 4 Rent collected in advance results in deferred tax assets. O True O False

A: Deferred tax assets are those taxes that are already paid but are yet to be recognized in the near…

Q: A xerox machine was purchased 7 years ago costs P50,000. After making 600,000 copies, the salvage…

A: The book value of asset is calculated as difference between cost price and Accumulated depreciation…

Q: A department of Alpha Co. incurred the following costs for the month of September. Variable costs,…

A: Given a limited amount of data, the high-low method in cost accounting attempts to identify fixed…

Q: UPS purchased a six-acre tract of land in Columbia, SC and an existing building for $500,000. The…

A: The property plant and equipment include long-term assets. The land is also a long-term asset. When…

Q: Scenario: The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just…

A: The question is related to Cash Flow Statement. Cash Flow Statement is summary of cash receipts and…

Q: Flounder Company sponsors a defined benefit plan for its 100 employees. On January 1, 2020, the…

A: In this question we will make founder companies income statement.

Q: On October 31, the end of the first month of operations, Maryville Equipment Company pre- pared the…

A: Direct and indirect costs such as direct materials, direct labour, rent, and insurance are accounted…

Q: Flames Corporation has three financial statement elements for which the December 31, 2014 book value…

A: Solution: Future taxable amount means temporary differences which results in higher taxable income…

Q: The adjusted trial balance of Thomas Company as of December 31, 2019 shows the lowing: Debit Credit…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Question 6: FUTA tax is paid solely by the employer. Answer: A. True В. False

A: Answer -6 Futa tax is a payroll tax that is solely paid by the employer . In other words, it is…

Q: Question 5: Which of the following employee taxes is matched by the employer? Answer: A. State…

A: Introduction:- Payroll taxes are the state and federal taxes. As an employer, are responsible to…

Q: On January 1st, XYZ Co. prepays $1,500 for one year of prepaid insurance. What is the amount of…

A: Formula: Monthly insurance expense = Prepaid insurance amount / 12Months

Q: what give rises to the changes in PBO balance?

A: PBO stands for the Projected Benefit Obligation. It shows how much the company would need in its…

Q: P-4***On July 1,2011, SUNSHINE Company issued P2,000,000, 10% bonds, which mature in five years. The…

A: Please see Step 2 for required information.

Q: A project that has a positive net present value discounted at a rate of 15% would have an internal…

A: A project that has a positive net present value discounted at a rate of 15% would have an internal…

Q: Scenario: The 2021 comparative balance sheet and income statement of Auga Company Ltd, have…

A: 1. Statement of Cash Flows - Statement of Cash Flow includes movement of cash during the financial…

Q: Which among the sentences below is incorrect? A. An entity shall measure a current asset or…

A: Fair value A fair value means the actual price of an asset received if it is sold in the market. In…

Q: P-1*** CHRIST Company provided the following information on December 31, 2012: 250,000 2,000,000…

A: Current liabilities are short-term obligations usually required to pay within one accounting year.

Q: Problem 7-4 On January 1, 2019, Martha Company had 6,000,000 authorized ordinary shares of P5 par,…

A: Solution Shareholder equity is the amount which is left after substracting from total assets to…

Q: e amount received compared to the present value was due to the conversion feature. Each $100 bond…

A: Bonds refer to the financial instrument which entitles a promise made by the borrower to the lending…

Q: Vertical Analysis of Income Statement For 20Y2, Tri-Comic Company initiated a sales promotion…

A: Comparative Statement: A comparative statement is a report that contrasts a specific fiscal summary…

Q: Which of the following statements regarding valuation discounts is CORRECT? The blockage interest…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Atlas Furniture Company manufactures designer home furniture. Atlas uses a standard cost system. The…

A: The practice of replacing an anticipated cost for an actual cost in accounting records is known as…

Q: 1. Answer the following questions for the directors: A. True or false, does the statement of cash…

A: The statement of cash flow (CFS) reflects the flow of cash transactions that takes place in the…

Q: Which one of the following is a correct statement about the nontax characteristics of a pooled…

A: B)The principal is distributed to the charitable beneficiary at the end of the noncharitable…

Q: Fully discuss in detail the characteristics that distinguish entrepreneurs from ordinary business…

A: Entrepreneur An entrepreneur is a person who helps in combining the various factors of production…

Q: ISKO Corporation authorized the sale of P4,000,000 of 12%, 8-year debentures on January 1, 2016.…

A: Bond issue The purpose issuing the bond to raise the additional fund which are used for the…

Q: Litton Company invested in a two year project which produced a net present value of P 5,760…

A: Project cost = Present value of cash inflows - net present value where, Present value of cash…

Q: is tool considered as current assets?

A: Assets are the resources owned by the company. They are acquired with an intention to sell or to…

Q: Six Measures of Solvency or Profitability The following data were taken from the financial…

A: a) Ratio to fixed asset long term liabilities =Fixed asset Long term Liability…

Q: Exercise 12-15 (Algo) Calculate selling price of new product with a target CM ratio LO 8, 9 Backus…

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods…

Q: Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue…

A: Statement of Cash Flow - Cash Flow Statement includes movement of cash during the financial year. It…

Q: capital have not yet paid to the corporation Average amount per share that ordinary sha Iready paid…

A: Shareholders also invest money in the company and in return they become the owners in proportion to…

Q: Last month when Holiday Creations, Incorporated, sold 41,000 units, total sales were $164,000, total…

A: Contribution margin ratio = (Contribution margin / Sales) x 100 where, Contribution margin = Sales…

Q: Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue…

A: Statement of Cash Flow - Statement of Cash Flow includes movement of cash for the financial year. It…

Q: Which of the following is an advantage of using cost-based transfer prices? Multiple Choice Such…

A: Solution: Cost based transfer pricing means transfer price that is based on cost or some nominal…

Step by step

Solved in 3 steps

- You are planning the audit of Bluechip Ltd, a company with investments in listed securities that you consider to have a low level of inherent risk. What is the most appropriate level of planning materiality for the 30 June 2021 audit given the following balances: (all amounts are in $'000) Sales: 1200 (2021); 1080 (2020); 960 (2019) Profit: 15.5 (2021); 127.1 (2020): -108.5 (2019) Current assets: 1990 (2021); 1791 (2020); 1592 (2019) a. 1.6 b. 0.8 c. 19.9 d. 12.0You are the senior in charge of the audit of Jewels Manufacturing Limited. The information below has been prepared to assess the going concern of the company at the planning stage of the audit and to identify other issues that may impact on audit risk. Ratio Unaudited 2020 figures 2019 2018 2017 Inventory turnover 1.45 1.83 2.69 3.35 Quick asset ratio 0.97 1.4 1.81 1.8 Accounts Receivable turnover 3.8 5.5 4.1 5.4 Required: Identify issues that affect going concern and/or raise issues and explain the audit steps that you would undertake to minimise audit risk. Complete the table below in the answer box.You are the senior in charge of the audit of Jewels Manufacturing Limited. The information below has been prepared to assess the going concern of the company at the planning stage of the audit and to identify other issues that may impact on audit risk. Ratio Unaudited 2020 figures 2019 2018 2017 Inventory turnover 1.45 1.83 2.69 3.35 Quick asset ratio 0.97 1.4 1.81 1.8 Accounts Receivable turnover 3.8 5.5 4.1 5.4 Required: Identify issues that affect going concern and/or raise issues and explain the audit steps that you would undertake to minimise audit risk. Complete the table.

- You are currently planning the audit of your client, DEF plc. Its year end is 31 December 2019 and the forecast profit before tax is £15.5 million.DEF has a small internal audit (IA) department. During the year, IA started a programme of physically verifying the company’s assets and comparing the results to the non-current assets register, as this type of reconciliation had not occurred for some time. To date only 15% of assets have had their existence confirmed as IA has experienced significant staff shortages and several members of the current IA team are new to DEF plc.Inventory is held in six locations and on 25 and 26 December a full inventory count will be held with adjustments for movements to the year end. This is due to a lack of available staff on 31 December. The number of audit team members are not enough to attend the counts in all the locations. In November, there was a fire in one of the inventory warehouses; inventory of £5 million was damaged and this has been written…FOR THE ANSWER OF THIS QUESTION IN THE AUDIT RISK COLUMN, WITH THE EXPLANATION COULD YOU ALSO WRITE DOWN WEATHER IT IS CONTROL RISK, INHERENT RISK OR DETECTION RISK PART B - QUESTION You are currently planning the audit of your client, DEF plc. Its year end is 31December 2019 and the forecast profit before tax is £15.5 million. DEF has a small internal audit (IA) department. During the year, IA started a programme of physically verifying the company’s assets and comparing the results to the non-current assets register, as this type of reconciliation had not occurred for some time. To date only 15% of assets have had their existence confirmed as IA has experienced significant staff shortages and several members of the current IA team are new to DEF plc. Inventory is held in six locations and on 25 and 26 December a full inventory count will be held with adjustments for movements to the year end. This is due to a lack of available staff on 31 December. The number of audit team…You are in charge of auditing PLM (PopoyLangMalakas) Company's investmentaccounts for the year ended December 31, 2021, which was incorporated last March 3, 2020. During the course of the audit, you have obtained the balances and therelated journal entries of its investment related transactions and have revealed thefollowing information: Question 1: The adjustment to correct the interest income for 2021 includes adebit/(credit) to the interest revenue account amounting to? (Put a negativesign if credit) Question 2: How much is the retroactive adjustment to the beginning balance ofretained earnings for the year 2021, pertaining to the investment in BSP bonds?(Please indicate debit or (credit), use negative sign if credit).Question 3: The correct amount of investment in BSP bonds that should bepresented in the statement of financial position as of December 31, 2021 is?

- You are the manager responsible for the audit of the Kanu Group (the Group), a listed manufacturer of high quality musical instruments, for the year ended 31 March 2018. The draft financial statements of the Group recognize a loss before tax of GH¢2.2 million (2017 – loss of GH¢1.5 million) and total assets of GH¢14.1 million (2017 – GH¢18.3 million). The audit is nearing completion and the audit senior has drafted the auditor’s report which contains the following extract:Key audit matters 1. Valuation of financial instruments The Group enters into structured forward contracts to purchase materials used in its manufacturing process. The valuation of these unquoted instruments involves guesswork and is based on internal models developed by the Group’s finance director, Vincent Addo. Mr. Addo joined the Group in January 2018 and there is significant measurement uncertainty involved in his valuations as a result of his inexperience. As a result, the valuation of these contracts was…You are the audit partner at Smart Auditors Inc. For the month of April 2020, you have received the following technical queries relating to different audit clients. Please note that the matters below are not related. Matter 1: In terms of the basic evidence gathered on the audit of We Fix (Pty ) Ltd, the auditor noted that inventory with a cost of N$500 000 and a net realisable value of N$750 000 has been recorded at the net realisable value amount. The issue has been discussed with management and they have refused to correct the misstatement. Matter 2: On the audit of Grey Fade (Pty) Ltd, based on the audit evidence obtained, the auditor concluded that there are material uncertainty relating to events and conditions which cast significant doubt on the company’s ability to continue as a going concern. However, the audit committee and management had come to the same conclusion and adequate disclosure in the financial statements relating to the material uncertainty had been made. The…Mazars Audit Firm is re-appointed as auditors in Beautiful Jewels for a year ended 31st March 2020. The overall level of acceptable audit risk of the client is considered as 10%. The inherent risk and control risk are assessed at 50% and 80% respectively. (i)Calculate the detection risk, if the audit risk falls down to 5% .

- Mazars Audit Firm is re-appointed as auditors in Beautiful Jewels for a year ended 31st March 2020. The overall level of acceptable audit risk of the client is considered as 10%. The inherent risk and control risk are assessed at 50% and 80% respectively. (i)Calculate the detection risk from the case let using the audit risk modelYou were assigned to audit the financial statements of Swansea Corporation as at and for the year ended December 31, 2021. Your senior asked you to draft a memo on materiality and tolerable error for your client. Swansea Corporation has incurred substantial net losses due to COVID-19 pandemic. Up to 2019, it has been profitable. Which of the following is least likely to be your starting point in computing materiality? Group of answer choices Normalized net income Net loss Total assets Normalized revenueYou are the auditor in charge of the audit of Irene PLC, which has a 30 June year end. The subsequent events review for the year ended 30 June 2022 revealed that, on 1 August 2022, a receiver was appointed at a major customer. At 30 June 2022 that customer owed GHS 150,000 and goods costing GHS 200,000 made to that customer’s specification were held in inventory. Both these amounts are material.RequiredList the matters to which you would direct your attention in respect of the above in relation to the audit for the year ended 30 June 2022, if the audit report on the financial statements has not yet been written.