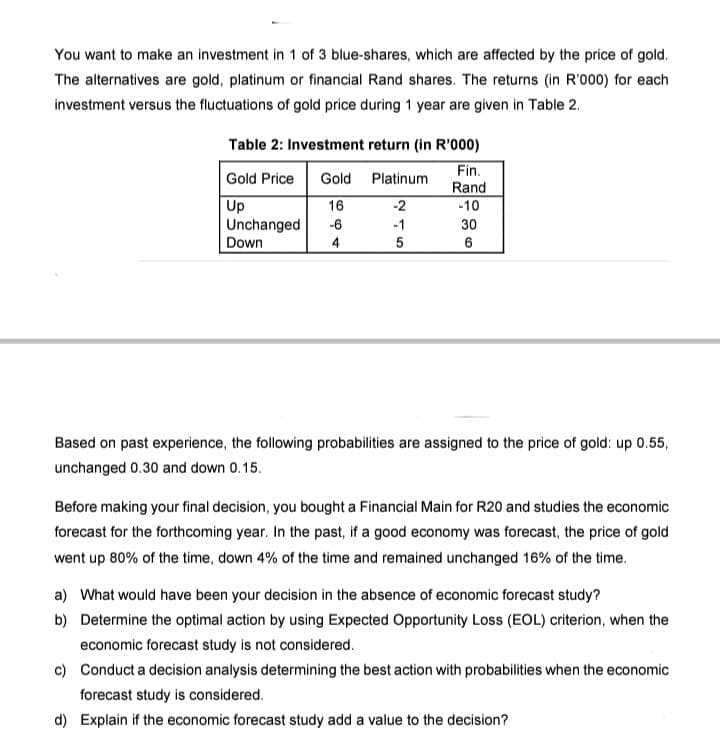

You want to make an investment in 1 of 3 blue-shares, which are affected by the price of gold. The alternatives are gold, platinum or financial Rand shares. The returns (in R'000) for each investment versus the fluctuations of gold price during 1 year are given in Table 2. Table 2: Investment return (in R'000) Fin. Rand -10 Gold Price Gold Up 16 Unchanged -6 Down 4 Platinum -2 -1 5 30 6 Based on past experience, the following probabilities are assigned to the price of gold: up 0.55, unchanged 0.30 and down 0.15. Before making your final decision, you bought a Financial Main for R20 and studies the economic forecast for the forthcoming year. In the past, if a good economy was forecast, the price of gold went up 80% of the time, down 4% of the time and remained unchanged 16% of the time. a) What would have been your decision in the absence of economic forecast study? b) Determine the optimal action by using Expected Opportunity Loss (EOL) criterion, when the economic forecast study is not considered. c) Conduct a decision analysis determining the best action with probabilities when the economic forecast study is considered. d) Explain if the economic forecast study add a value to the decision?

You want to make an investment in 1 of 3 blue-shares, which are affected by the price of gold. The alternatives are gold, platinum or financial Rand shares. The returns (in R'000) for each investment versus the fluctuations of gold price during 1 year are given in Table 2. Table 2: Investment return (in R'000) Fin. Rand -10 Gold Price Gold Up 16 Unchanged -6 Down 4 Platinum -2 -1 5 30 6 Based on past experience, the following probabilities are assigned to the price of gold: up 0.55, unchanged 0.30 and down 0.15. Before making your final decision, you bought a Financial Main for R20 and studies the economic forecast for the forthcoming year. In the past, if a good economy was forecast, the price of gold went up 80% of the time, down 4% of the time and remained unchanged 16% of the time. a) What would have been your decision in the absence of economic forecast study? b) Determine the optimal action by using Expected Opportunity Loss (EOL) criterion, when the economic forecast study is not considered. c) Conduct a decision analysis determining the best action with probabilities when the economic forecast study is considered. d) Explain if the economic forecast study add a value to the decision?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section: Chapter Questions

Problem 60P: You are considering a 10-year investment project. At present, the expected cash flow each year is...

Related questions

Question

Transcribed Image Text:You want to make an investment in 1 of 3 blue-shares, which are affected by the price of gold.

The alternatives are gold, platinum or financial Rand shares. The returns (in R'000) for each

investment versus the fluctuations of gold price during 1 year are given in Table 2.

Table 2: Investment return (in R'000)

Fin.

Rand

Gold Price Gold

Up

16

Unchanged -6

Down

4

Platinum

-2

-1

5

-10

30

6

Based on past experience, the following probabilities are assigned to the price of gold: up 0.55,

unchanged 0.30 and down 0.15.

Before making your final decision, you bought a Financial Main for R20 and studies the economic

forecast for the forthcoming year. In the past, if a good economy was forecast, the price of gold

went up 80% of the time, down 4% of the time and remained unchanged 16% of the time.

a) What would have been your decision in the absence of economic forecast study?

b) Determine the optimal action by using Expected Opportunity Loss (EOL) criterion, when the

economic forecast study is not considered.

c) Conduct a decision analysis determining the best action with probabilities when the economic

forecast study is considered.

d) Explain if the economic forecast study add a value to the decision?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 6 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,