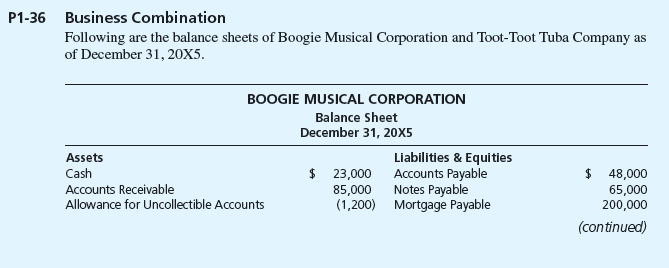

Business Combination

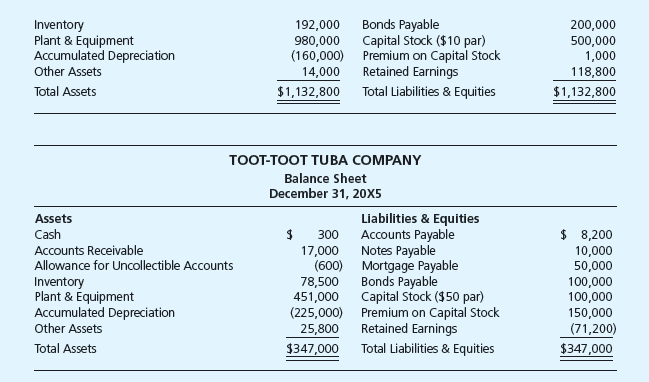

Following are the balance sheets of Boogie Musical Corporation and Toot-Toot Tuba Company as of December 31, 20X5.

In preparation for a possible business combination, a team of experts from Boogie Musical made a thorough examination and audit of Toot-Toot Tuba. They found that Toot-Toot’s assets and liabilities were correctly stated except that they estimated uncollectible accounts at $1.400. The experts also estimated the market value of the inventory at $35.000 and the market value of the plant and equipment at $500.000. The business combination took place on January 1, 20X6, and on that date Boogie Musical acquired all the assets and liabilities of Toot-Toot Tuba. On that date. Boogie’s common stock was selling for $55 per share.

Required

Record the combination on Boogie’s books assuming that Boogie issued 9.000 of its $10 par common shares in exchange for Toot-Toot’s assets and liabilities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

GEN CMB ADV FINCL ACCT; Connect Access Card

- Radcliffe, Sonders, and Towers, who share in income and losses in the ratioof 2:3:5, decided to discontinue operations as of April 20 and liquidate theirpartnership. After the accounts were closed on April 20, the following trialbalance was prepared:Cash 5,900Noncash Assets 109,900Liabilities 26,800Radcliffe, Capital 14,600Sonders, Capital 27,900Towers, Capital 46,500Total115,800 115,800arrow_forwardThe statement of financial position (balance sheet) of Omni-Pave Company reports assets of $7,800,000. Ellen Martin advises you that a major accounting firm has audited the statements and attested that they were prepared in accordance with Generally Accepted Accounting Principles. She tells you that she can buy the total owner's interest in the business for only $5,400,000 and is seriously considering the opportunity. She says that the auditor's unqualified opinion validates the $7,800,000 value of the assets. Ellen believes she would be foolish to pass up the opportunity to purchase the assets at a price of only $5,400,000. What part of the accounting equation is Ellen failing to consider? Comment on Ellen's misconceptions regarding the auditor's role in providing information that is useful in making investment decisions.arrow_forwardThe following balance sheet summary, together with residual profit-sharing ratios, was developed on April 1, 2011, when the Doc, Fae, and Hal partnership began its liquidation: Cash $140,000 Liabilities $ 60,000 Accounts receivable 60,000 Loan from Fae 20,000 Inventories 85,000 Doc capital (20%) 75,000 Plant assets—net 200,000 Fae capital (40%) 200,000 Loan to Doc 25,000 Hal capital (40%) 155,000 $510,000 $510,000 If available cash except for a $5,000 contingency fund is distributed immediately, Doc, Fae, and Hal, respectively, should receive: a. $0, $60,000, and $15,000 b. $11,000, $22,000, and $22,000 c. $0, $70,000, and $5,000 d. $0, $27,500, and $27,500arrow_forward

- Phelps Corporation owns all of the common stock of Stern Company. Each company maintains its own accounting records and prepares separate financial statements. Balance sheets for each company as of December 31, 20Y8, are as follows: Line Item Description PhelpsCorporation SternCompany Assets Cash 30,500 20,500 Accounts Receivable 29,100 20,000 Inventory 80,000 35,250 Investment in Stern Company 85,750 — Other assets 300,000 40,000 Total assets 525,350 115,750 Liabilities and Stockholders’ Equity Accounts Payable 80,000 30,000 Common Stock 300,000 50,000 Retained Earnings 145,350 35,750 Total liabilities and stockholders’ equity 525,350 115,750 Prepare a December 31, 20Y8, consolidated balance for Phelps Corporation and Subsidiary.arrow_forwardOroblanco Company has prepared consolidated financial statements for the current year and is now gathering information in connection with the following five operating segments it has identified. (Figures are in thousands.) Accounts Company Total Books Computers Maps Travel Finance Sales to outside parties $ 1,735 $ 191 $ 752 $ 447 $ 345 $ 0 Intersegment sales 559 43 290 58 168 0 Interest income—external 130 74 0 0 0 56 Interest income—intersegment loans 166 0 0 0 0 166 Assets 3,715 256 1,473 298 353 1,335 Operating expenses 1,560 134 868 297 209 52 Expenses—intersegment sales 264 89 70 40 65 0 Interest expense—external 126 0 0 0 0 126 Interest expense—intersegment loans 223 40 90 57 36 0 Income tax expense (savings) 140 62 (22) 77 81 (58) General corporate expenses 105 - - - - - Unallocated operating costs 130 - - - - - Required: Determine the reportable segments by performing revenue test. Note: Round your percentage answers to 1 decimal place.…arrow_forwardOroblanco Company has prepared consolidated financial statements for the current year and is now gathering information in connection with the following five operating segments it has identified. (Figures are in thousands.) Accounts Company Total Books Computers Maps Travel Finance Sales to outside parties $ 1,735 $ 191 $ 752 $ 447 $ 345 $ 0 Intersegment sales 559 43 290 58 168 0 Interest income—external 130 74 0 0 0 56 Interest income—intersegment loans 166 0 0 0 0 166 Assets 3,715 256 1,473 298 353 1,335 Operating expenses 1,560 134 868 297 209 52 Expenses—intersegment sales 264 89 70 40 65 0 Interest expense—external 126 0 0 0 0 126 Interest expense—intersegment loans 223 40 90 57 36 0 Income tax expense (savings) 140 62 (22) 77 81 (58) General corporate expenses 105 - - - - - Unallocated operating costs 130 - - - - - Determine the reportable segments by performing asset test. Note: Round your percentage answers to 1 decimal place. Enter your…arrow_forward

- ABC Corp and XYZ Technologies (direct competitors) reported the following select data in their annual financial reports: ABC XYZ Total Assets 123,249 11,748 Total Equity 69,019 6,657 Total Revenue 62,751 8,343 Net Income 9,601 933 Despite these two companies having very similar ROE how they achieved their ROE is quite different. How? a) XYZ was less profitable, but relied less on debt. b) ABC was less profitable, but relied less on debt. c) ABC used their assets more effectively; XYZ used leverage more efficiently. d) ABC used their assets more effectively; XYZ was more profitable. e) ABC was more profitable; XYZ used their assets more effectively.arrow_forwardMason Company has prepared consolidated financial statements for the current year and is now gathering information in connection with the following five operating segments it has identified. CompanyTotal Books Computers Maps Travel Finance Sales to outside parties $ 1,547 $ 121 $ 696 $ 416 $ 314 $ 0 Intersegment sales 421 24 240 39 118 0 Interest income—external 97 60 0 0 0 37 Interest income—intersegment loans 147 0 0 0 0 147 Assets 3,398 206 1,378 248 326 1,240 Operating expenses 1,460 115 818 304 190 33 Expenses—intersegment sales 198 70 51 31 46 0 Interest expense—external 107 0 0 0 0 107 Interest expense—intersegment loans 147 21 71 38 17 0 Income tax…arrow_forwardThe financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands): Campbell Newton Revenues $ 2,600 $ 700 Expenses 1,880 400 Net income $ 720 $ 300 Retained earnings, 1/1 $ 2,400 $ 500 Net income 720 300 Dividends (270 ) 0 Retained earning, 12/31 $ 2,850 $ 800 Cash $ 240 $ 230 Receivables and inventory 1,200 360 Buildings (net) 2,700 650 Equipment (net) 2,100 1,300 Total assets $ 6,240 $ 2,540 Liabilities $ 1,500 $ 720 Common stock 1,080 400 Additional paid-in capital 810 620 Retained earnings 2,850 800 Total liabilities & stockholders' equity $ 6,240 $ 2,540 On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35…arrow_forward

- On June 1, Cline Co. paid $800,000 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow:On June 1, Renn’s accounts receivable had a fair value of $140,000. Additionally, Renn’s in-process research and development was estimated to have a fair value of $200,000. All other items were stated at their fair values. On Cline’s June 1 consolidated balance sheet, how much is reported for goodwill? a. $320,000b. $120,000c. $80,000d. $20,000arrow_forwardOn May 1, Donovan Company reported the following account balances: Current assets $ 92,500 Buildings & equipment (net) 240,000 Total assets $ 332,500 Liabilities $ 64,500 Common stock 150,000 Retained earnings 118,000 Total liabilities and equities $ 332,500 On May 1, Beasley paid $425,700 in stock (fair value) for all of the assets and liabilities of Donovan, which will cease to exist as a separate entity. In connection with the merger, Beasley incurred $24,200 in accounts payable for legal and accounting fees. Beasley also agreed to pay $87,300 to the former owners of Donovan contingent on meeting certain revenue goals during the following year. Beasley estimated the present value of its probability adjusted expected payment for the contingency at $29,900. In determining its offer, Beasley noted the following: Donovan holds a building with a fair value $30,300 more than its book value. Donovan has developed unpatented…arrow_forwardOn May 1, Donovan Company reported the following account balances: Current assets $ 96,500 Buildings & equipment (net) 222,000 Total assets $ 318,500 Liabilities $ 33,500 Common stock 150,000 Retained earnings 135,000 Total liabilities and equities $ 318,500 On May 1, Beasley paid $443,900 in stock (fair value) for all of the assets and liabilities of Donovan, which will cease to exist as a separate entity. In connection with the merger, Beasley incurred $23,000 in accounts payable for legal and accounting fees. Beasley also agreed to pay $83,100 to the former owners of Donovan contingent on meeting certain revenue goals during the following year. Beasley estimated the present value of its probability adjusted expected payment for the contingency at $23,200. In determining its offer, Beasley noted the following: Donovan holds a building with a fair value $30,400 more than its book value. Donovan has developed unpatented…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage