Concept explainers

Income Statement and

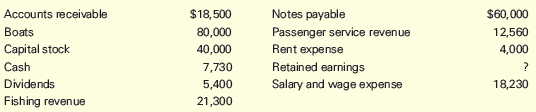

Green Bay Corporation began business in July 2016 as a commercial fishing operation and a passenger service between islands. Shares of stock were issued to the owners in exchange for cash. Boats were purchased by making a down payment in cash and signing a note payable for the balance. Fish are sold to local restaurants on open account, and customers are given 15 days to pay their account. Cash fares are collected for all passenger traffic. Rent for the dock facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Green Bay Corporation at the end of its first month of operations:

Required

- Prepare an income statement for the month ended July 31, 2016.

- Prepare a balance sheet at July 31, 2016.

- What information would you need about Notes Payable to fully assess Green Bay’s long-term viability? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

EBK FINANCIAL ACCOUNTING: THE IMPACT ON

- Income Statement and Balance Sheet Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended January 31, 2016. Prepare a balance sheet at January 31, 2016. What information would you need about Notes Payable to fully assess Fort Worths longterm viability? Explain your answer.arrow_forwardQuestion: During March 2020, ABC engaged in the following transactions: a. ABC received cash of $50,000 from David R. and issued common stock to David. b. The business paid $20,000 cash to acquire a truck. c. The business purchased supplies costing $1,800 on account. d. The business painted a house for a client and received $3,000 cash. e. The business painted a house for a client for $4,000. The client agreed to pay next week. f. The business paid $900 cash toward the supplies purchased in transaction c. g. The business paid employee salaries of $1,000 in cash. h. The business paid cash dividends of $1,500. i. The business collected $2,600 from the client in transaction e. j. David paid $200 cash for personal groceries. Required Record transaction in journal formarrow_forwardTransaction Analysis Galle Inc. entered into the following transactions during January. Borrowed $50,000 from First Street Bank by signing a note payable. Purchased $25,000 of equipment for cash. Paid $500 to landlord for rent for January. Performed services for customers on account, $10,000. Collected $3,000 from customers for services performed in Transaction d. Paid salaries of $2,500 for the current month. Required: Show the effect of each transaction using the following model. If an amount box does not require an entry, leave the cells blank or enter zero ("0"). Enter decreases in account values as negative numbers. If the effect of a transaction is to increase AND decrease the same item, enter "0" since the net effect on the item is zero. Assets = Liabilities + Stockholders' Equity ContributedCapital + RetainedEarningsarrow_forward

- Miller Delivery Service completed the following transactions during December 2016: Dec. 1 Miller Delivery Service began operations by receiving $10,000 cash and a truck with a fair value of $20,000 from Robert Miller. The business issued Miller shares of common stock in exchange for this contribution. 1 Paid $1,000 cash for a four-month insurance policy. The policy begins December 1. 4 Paid $500 cash for office supplies. 12 Performed delivery services for a customer and received $2,000 cash. 15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. 18 Paid employee salary, $1,000. 20 Received $15,000 cash for performing delivery services. 22 Collected $800 in advance for delivery service to be performed later. 25 Collected $2,500 cash from customer on account. 27 Purchased fuel for the truck, paying $300 on account. (Credit Accounts Payable) 28 Performed delivery services on account, $700. 29 Paid office rent, $1,600,…arrow_forwardMiller Delivery Service completed the following transactions during December 2016: Dec. 1 Miller Delivery Service began operations by receiving $10,000 cash and a truck with a fair value of $20,000 from Robert Miller. The business issued Miller shares of common stock in exchange for this contribution. 1 Paid $1,000 cash for a four-month insurance policy. The policy begins December 1. 4 Paid $500 cash for office supplies. 12 Performed delivery services for a customer and received $2,000 cash. 15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. 18 Paid employee salary, $1,000. 20 Received $15,000 cash for performing delivery services. 22 Collected $800 in advance for delivery service to be performed later. 25 Collected $2,500 cash from customer on account. 27 Purchased fuel for the truck, paying $300 on account. (Credit Accounts Payable) 28 Performed delivery services on account, $700. 29 Paid office rent, $1,600,…arrow_forwardAnalyzing Transactions Luis Madero, after working for several years with a large public accounting firm, decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Madero's balance sheet at July 31, 2013. The following events occurred during August 2013. Issued common stock to Ms. Garriz in exchange for $15,000 cash. Paid $850 for first month's rent on office space. Purchased supplies of $2,250 on credit. Borrowed $8,000 from the bank. Paid $1,080 on account for supplies purchased earlier on credit. Paid secretary's salary for August of $2,150. Performed accounting services for clients who paid cash upon completion of the service in the total amount of $4,700. Used $3,180 of the supplies on hand. Performed accounting services for clients on credit in the total amount of $1,920. Purchased $500 in supplies for cash. Collected $1,290 cash from clients for whom services were…arrow_forward

- Write a statement of financial postition (balance sheet) using this data: Layla introduced £50,000 of capital, which was paid into a bank account opened in the name of the business. Premises were rented from 1 January 2021 at an annual rental of £20,000. During the year, rent of £25,000 was paid to the owner of the premises. Rates (a tax on business premises) were paid during the year as follows; For the period 1 January 2021 to 31 March 2021 £ 500 For the period 1 April 2021 to 31 March 2022 £1,200 A delivery van was bought on 1January 2021 for £12,000. This is expected to be used in the business for four years and then to be sold for £2,000. Wages totalling £33,500 were paid during the year. At the end of the year, the business owed £630 of wages for the last week of the year. Electricity bills for the first three quarters of the year were paid totalling £1,650. After 31 December 2021, but before the financial statements had been finalised for the year, the…arrow_forwardon april 1, 2021, nels ferrer organized a business called friendly trucking. during april, the company entered into the following transactions. apr 1 nels ferrer deposited php500,000 cash in a bank account in the name of the business. apr 1 purchased for php250,000 a transportation equipment to be use in the business. nels paid 50% as down payment while the balance will be paid on may 15, 2016 apr 1 paid rental for the month of april, php 5,000 apr 5 earned and collected trucking income from ryan, php8,000 earned trucking income from jesper, php 30,000 on account. jesper will pay on may 8, 2016 apr 8 apr 10 paid salaries of drivers, php10,000 rented the vehicle to joshua for php35,000, joshua paid php20,000 on that date and the balance on april 20 apr 15 apr 18 paid electric bills for the month, php2,000 apr 20 collected from joshua the balance of his april 15 account apr 25 purchased office supplies, php2,300 apr 29 earned and collected trucking income from jay, php 18,000…arrow_forwardThe Naseeb Company began operations on August 1, 2018. The following transactions occur during the month of August. Aug-1 Owners invest $50,000 cash in the corporation in exchange for 5,000 shares of common stock. Aug-1 On the first day of August, $6,000 rent on a building is paid for the months of August and September. Aug-1 $30,000 is borrowed from a local bank, and a note payable is signed. Aug-3 Equipment is purchased for $20,000 cash. Aug-5 Naseeb Inc purchases, for $35,000 on account, an estimated 6-month supplies from Hero Supply. Aug-16 $20,000 cash is loaned to another company, evidenced by a note receivable. Aug-20 Company Receives $30,000 in cash and bills Kinley company $15,000 for services of $45,000 performed in month of August. Aug-25 $8,000 is collected on account from customers. Aug-26 $20,000 is paid on account to Hero supply. Aug-31 Salaries of $7,000 are paid to employees for August.…arrow_forward

- Analyze the effect of transactions on assets, liabilities, and equity.Hayes Computer Timeshare Company entered into the following transactions during May 2017.1 . Purchased office equipment for $10,000 from Office Outfitters on account.2 . Paid $3,000 cash for May rent on storage space.3 . Received $12,000 cash from customers for contracts billed in April. InstructionsIndicate with the appropriate letter whether each of the transactions above results in:(a) An increase in assets and a decrease in assets.(b) An increase in assets and an increase in equity.(c) An increase in assets and an increase in liabilities.(d) A decrease in assets and a decrease in equity.(c) A decrease in assets and a decrease in liabilities.(f) An increase in liabilities and a decrease in equity.arrow_forwardTransactions; Financial Statements Bev’s Dry Cleaners is owned and operated by Beverly Zahn. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and the liabilities of the business on November 1, 2019, are as follows: Cash, $18,480; Accounts Receivable, $37,840; Supplies, $3,520; Land, $44,000; Accounts payable, $15,840. Business transactions during November are summarized as follows: Beverly Zahn invested additional cash in the business with a deposit of $33,000 in the business bank account. Purchased land adjacent to land currently owned by Bev’s Dry Cleaners to use in the future as a parking lot, paying cash of $16,600. Paid rent for the month, $12,140. Charged customers for dry cleaning revenue on account, $34,410. Paid creditors on account, $14,170. Purchased supplies on account, $6,070. Received cash from cash customers for dry cleaning revenue, $32,380.…arrow_forwardIn addition to the above accounts, VGC’s chart of accounts includes the following: Service Revenue, Salaries and Wages Expense, Advertising Expense, and Utilities Expense. The January transactions are shown below: Received $50,000 cash from customers on 1/1 for subscriptions that had already been earned in 2017. Purchased 10 new computer servers for $33,500 on 1/2; paid $10,000 cash and signed a three-year note for the remainder owed. Paid $10,000 for an Internet advertisement run on 1/3. On January 4, purchased and received $3,000 of supplies on account. Received $170,000 cash on 1/5 from customers for service revenue earned in January. Paid $3,000 cash to a supplier on January 6. On January 7, sold 15,000 subscriptions at $15 each for services provided during January. Half was collected in cash and half was sold on account. Paid $378,000 in wages to employees on 1/30 for work done in January. On January 31, received an electric and gas utility bill for $5,350 for January utility…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning