Principles of Accounting: Chapters 1-13

12th Edition

ISBN: 9781133593102

Author: Belverd E., Jr, Ph.d. Needles, Marian, Ph.D. Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3P

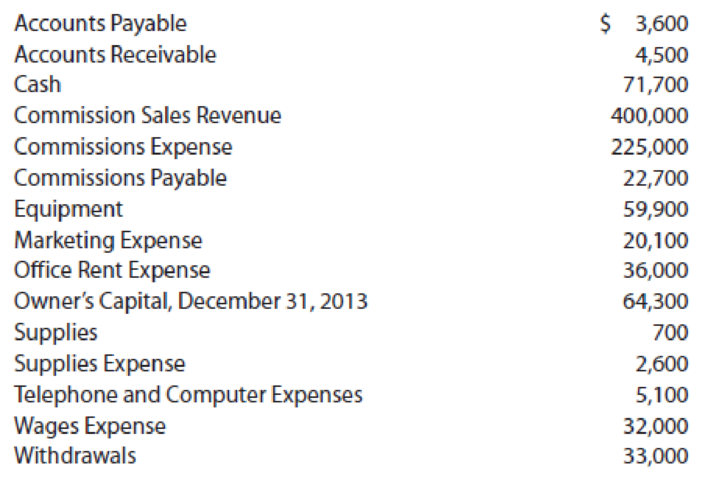

Fuel Designs’ financial accounts follow. The company has just completed its tenth year of operations ended December 31, 2014.

REQUIRED

- 1. Prepare Fuel Designs’ income statement, statement of owner’s equity, and balance sheet. There were no investments by the owner during the year.

- 2. ACCOUNTING CONNECTION ▶ The owner is considering expansion. What other financial statement would be useful to the owner in assessing whether the company’s operations are generating sufficient funds to support the expenses? Why would it be useful?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

During 2022, its first year of operations as a delivery service, Shamrock Corp. entered into the following transactions. 1. 2. 3. 4. 5. 6. 7. 8. 9. Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for changes to revenues or expenses in the right-hand margin. (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) (1) Issued shares of common stock to investors in exchange for $90,000 in cash. Borrowed $40,500 by issuing a note. Purchased delivery trucks for $54,000 cash. Performed services for customers for $14,400 cash. Purchased supplies for $4,230 on account. Paid rent of $4,680. Performed services on account for $9,000. Paid salaries of $25,200. Paid a dividend of $9,900 to shareholders. (2) $ Cash $ Accounts Receivable Assets + $ Supplies $…

Annie Rasmussen is the owner and operator of Go44, a motivational consulting business.At the end of its accounting period, December 31, 2018, Go44 has assets of $720,000 and liabilities of $180,000. Using the accounting equation and considering each case independently,determine the following amounts:a. Annie Rasmussen, capital, as of December 31, 2018.b. Annie Rasmussen, capital, as of December 31, 2019, assuming that assets increased by $96,500 and liabilities increased by $30,000 during 2019.c. Annie Rasmussen, capital, as of December 31, 2019, assuming that assets decreased by $168,000 and liabilities increased by $15,000 during 2019.d. Annie Rasmussen, capital, as of December 31, 2019, assuming that assets increased by $175,000 and liabilities decreased by $18,000 during 2019.e. Net income (or net loss) during 2019, assuming that as of December 31, 2019, assets were $880,000, liabilities were $220,000, and there were no additional investments or withdrawals.

Case Analysis: Analyse the case and find out if Joe Razon was able to compute the totalassets and total owner‟s equity of the business as of the quarter ended December 30, 2018correctly? Show the solutions.

Joe Razon, the sole proprietor of the photocopying business that opened October 1, 2018. Forthe quarter ended December 30, 2018, the business was able to make revenues of ₱50,000(all in cash) and it was able to incur expenses of ₱35,000 (all in cash). As the end of thequarter, total liabilities amounted to₱50,000. Joe Razon wants to know the business total assets and total owner‟s equity. Withthe help of his friend who is an accountant, he arrived at ₱75,000 total assets and ₱25,000total owner‟s equity. Moreover, Joe Razon had a Cash investment of ₱45,000 cash andEquipment amounting to ₱30,000.

Chapter 1 Solutions

Principles of Accounting: Chapters 1-13

Ch. 1 - What makes accounting a valuable discipline?Ch. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - How are expenses and withdrawals similar, and how...Ch. 1 - How do generally accepted accounting principles...Ch. 1 - Why do managers in governmental and not-for-profit...Ch. 1 - Prob. 1SECh. 1 - Match the descriptions that follow with the...Ch. 1 - Determine the amount missing from each accounting...Ch. 1 - Use the accounting equation to answer each...

Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Prob. 6SECh. 1 - Use the following accounts and balances to prepare...Ch. 1 - Randall Company engaged in activities during the...Ch. 1 - Prob. 9SECh. 1 - Prob. 10SECh. 1 - Prob. 1EACh. 1 - Financial accounting uses money measures to gauge...Ch. 1 - You have been asked to compare the sales and...Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Daiichi Companys total assets and liabilities at...Ch. 1 - 1. Indicate whether each of the following accounts...Ch. 1 - Listed in random order are some of Oxford Services...Ch. 1 - Dukakis Company had the following accounts and...Ch. 1 - Prob. 9EACh. 1 - Prob. 10EACh. 1 - Complete the financial statements that follow by...Ch. 1 - Prob. 12EACh. 1 - Match the terms that follow with the appropriate...Ch. 1 - Prob. 14EACh. 1 - Prob. 15EACh. 1 - Prob. 1PCh. 1 - The following three independent sets of financial...Ch. 1 - Fuel Designs financial accounts follow. The...Ch. 1 - The accounts of Frequent Ad, an agency that...Ch. 1 - Athena Riding Clubs financial statements follow.Ch. 1 - A list of financial statement items follows....Ch. 1 - Three independent sets of financial statements...Ch. 1 - Prob. 8APCh. 1 - Prob. 9APCh. 1 - Aqua Swimming Clubs financial statements follow....Ch. 1 - Costco Wholesale Corporation is Americas largest...Ch. 1 - Prob. 2CCh. 1 - Prob. 3CCh. 1 - Prob. 4CCh. 1 - Refer to the CVS annual report and the financial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the income statement for Sentinel Travel Service shown in Practice Exercise 1-4B, prepare a statement of owners equity for the year ended August 31, 2016. Barb Schroeder, the owner, invested an additional 36,000 in the business during the year and withdrew cash of 18,000 for personal use. Barb Schroeder, capital as of September 1, 2015, was 380,000.arrow_forwardUsing the income statement for Ousel Travel Service shown in Practice Exercise 1-4A, prepare a statement of owners equity for the year ended November 30, 2016. Shane Ousel, the owner, invested an additional 50,000 in the business during the year and withdrew cash of 30,000 for personal use. Shane Ousel, capital as of December 1, 2015, was 666,000.arrow_forwardUsing the income statement for Adventure Travel Service shown in Practice Exercise 1-4A, prepare a statement of owners equity for the year ended April 30, 2019. Jerome Foley, the owner, invested an additional 60,000 in the business during the year and withdrew cash of 40,000 for personal use. Jerome Foley, capital as of May 1, 2018, was 1,020,000.arrow_forward

- Reading and Interpreting Chipotles Financial Statements Refer to the financial statements for Chipotle reproduced in the chapter and answer the following questions. What was the companys net income for 2014? State Chipotles financial position on December 31, 2014, in terms of the accounting equation. By what amount did Leasehold improvements, property and equipment, net, increase during 2014? Explain what would cause an increase in this item.arrow_forwardAccounting concepts Match each of the following statements with the appropriate accounting concept. Sonic concepts may he used more than once, while others may not be used at all. Use the notat ions shown to indicate the appropriate accounting concept. Statements 1. Assume that a business will continue forever. 2. Material litigation involving the corporation is described in a note. 3. Monthly utilities costs are reported as expenses along with the monthly revenues. 4. Personal transactions of owners are kept separate from the business. 5. This concept supports relying on an independent actuary (statistician), rather than the chief operating officer of the coq)ration, to estimate a pension liability. 6. Changes in the use of accounting methods from one period to the next are described in the notes to the financial statements. 7. Land worth $800,000 is reported at its original purchase price of $220,000. 8. This concept justifies recording only transactions that are expressed in dollars. 9. If this concept was ignored, the confidence of users in the financial statements could not be maintained. 10. The changes in financial condition are reported at the end of the month.arrow_forwardThe following information is taken from the records of Baklava Bakery for the year 2019. A. Calculate net income or net loss for January. B. Calculate net income or net loss for February. C. Calculate net income or net loss for March. D. For each situation, comment on how a stakeholder might view the firms performance. (Hint: Think about the source of the income or loss.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License