Cengagenow For Financial Accounting

14th Edition

ISBN: 9781305500143

Author: WARREN

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3PB

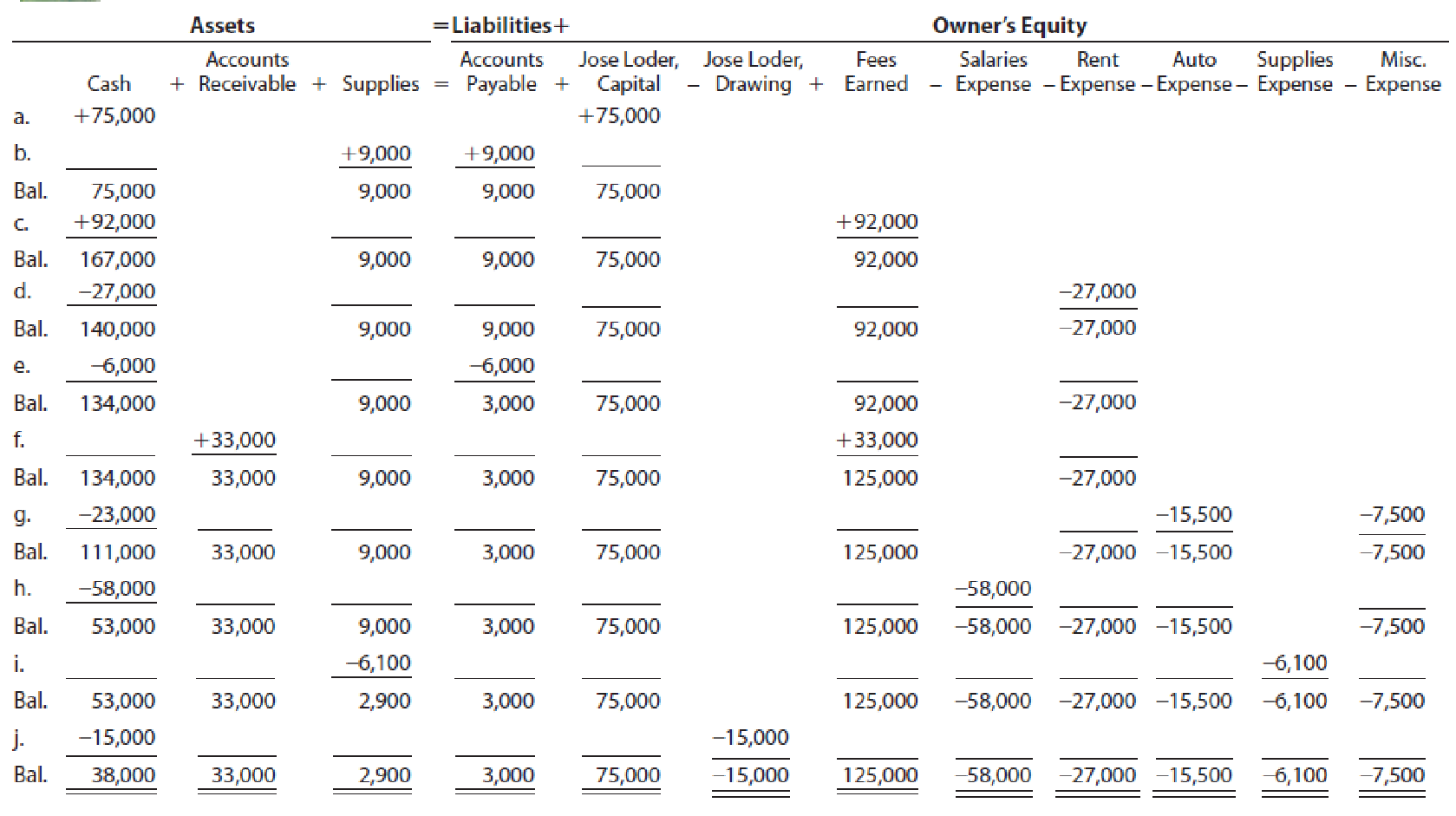

Jose Loder established Bronco Consulting on August 1, 2016. The effect of each transaction and the balances after each transaction for August follow:

Instructions

- 1. Prepare an income statement for the month ended August 31, 2016.

- 2. Prepare a statement of owner’s equity for the month ended August 31, 2016.

- 3. Prepare a

balance sheet as of August 31, 2016. - 4. (Optional) Prepare a statement of cash flows for the month ending August 31, 2016.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Life, Inc., experienced the following events in 2018, its first year of operation:Performed counseling services for $23,600 cash.On February 1, 2018, paid $16,200 cash to rent office space for the coming year.Adjusted the accounts to reflect the amount of rent used during the year.RequiredBased on this information alone:1)Record the events under an accounting equation.2)Prepare an income statement, balance sheet, and statement of cash flows for the 2018 accounting period.3)Ignoring all other future events, what is the amount of rent expense that would be recognized in 2019?Under required please if you could show me how to do 1,2, &3.

The accounting records of Tama Co. show the following assets and liabilities as of December 31, 2018 and 2019. 1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equity on the balance sheet and remember that total equity equals the difference between assets and liabilities. 2. Compute net income for 2019 by comparing total equity amounts for these two years and using thefollowing information: During 2019, the owner invested $5,000 additional cash in the business and withdrew $3,000 cash for personal use. 3. Compute the December 31, 2019, debt ratio (in percent and rounded to one decimal).

Mijka Company was started on January 1, 2018. During 2018, the company experienced the following three accounting events: (1) earned cash revenues of $32,200, (2) paid cash expenses of $14,400, and (3) paid a $2,700 cash dividend to its stockholders. These were the only events that affected the company during 2018.

given the following information prepare a balance sheet according to the date of dec 31, 2018

Chapter 1 Solutions

Cengagenow For Financial Accounting

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Josh Reilly is the owner of Dispatch Delivery...Ch. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - A business had revenues of 640,000 and operating...Ch. 1 - The financial statements are interrelated. (a)...

Ch. 1 - On February 22, Kountry Repair Service extended an...Ch. 1 - On March 31, Higgins Repair Service extended an...Ch. 1 - Brock Hahn is the owner and operator of Dream-It...Ch. 1 - Fritz Evans is the owner and operator of...Ch. 1 - Arrowhead Delivery Service is owned and operated...Ch. 1 - Interstate Delivery Service is owned and operated...Ch. 1 - Prob. 4PEACh. 1 - The revenues and expenses of Sentinel Travel...Ch. 1 - Using the income statement for Ousel Travel...Ch. 1 - Using the income statement for Sentinel Travel...Ch. 1 - Using the following data for Ousel Travel Service...Ch. 1 - Using the following data for Sentinel Travel...Ch. 1 - A summary of cash flows for Ousel Travel Service...Ch. 1 - A summary of cash flows for Sentinel Travel...Ch. 1 - Prob. 8PEACh. 1 - Prob. 8PEBCh. 1 - The following is a list of well-known companies:...Ch. 1 - Prob. 2ECh. 1 - Ozark Sports sells hunting and fishing equipment...Ch. 1 - Prob. 4ECh. 1 - Prob. 5ECh. 1 - Prob. 6ECh. 1 - Annie Rasmussen is the owner and operator of Go44,...Ch. 1 - Indicate whether each of the following is...Ch. 1 - Describe how the following business transactions...Ch. 1 - Prob. 10ECh. 1 - Indicate whether each of the following types of...Ch. 1 - The following selected transactions were completed...Ch. 1 - Teri West operates her own catering service....Ch. 1 - The income statement of a proprietorship for the...Ch. 1 - Four different proprietorships, Jupiter, Mars,...Ch. 1 - From the following list of selected items taken...Ch. 1 - Based on the data presented in Exercise 1-16,...Ch. 1 - Financial information related to Udder Products...Ch. 1 - Dairy Services was organized on August 1, 2016. A...Ch. 1 - One item is omitted in each of the following...Ch. 1 - Prob. 21ECh. 1 - Prob. 22ECh. 1 - Indicate whether each of the following activities...Ch. 1 - A summary of cash flows for Ethos Consulting Group...Ch. 1 - Prob. 25ECh. 1 - Prob. 26ECh. 1 - Lowes Companies Inc., a major competitor of The...Ch. 1 - On April 1 of the current year, Andrea Byrd...Ch. 1 - The amounts of the assets and liabilities of...Ch. 1 - Seth Feye established Reliance Financial Services...Ch. 1 - On July 1, 2016, Pat Glenn established Half Moon...Ch. 1 - DLite Dry Cleaners is owned and operated by Joel...Ch. 1 - The financial statements at the end of Wolverine...Ch. 1 - Amy Austin established an insurance agency on...Ch. 1 - The amounts of the assets and liabilities of...Ch. 1 - Jose Loder established Bronco Consulting on August...Ch. 1 - On April 1, 2016, Maria Adams established Custom...Ch. 1 - Bevs Dry Cleaners is owned and operated by Beverly...Ch. 1 - The financial statements at the end of Atlas...Ch. 1 - Prob. 1COPCh. 1 - Colleen Fernandez, president of Rhino Enterprises,...Ch. 1 - Prob. 2CPCh. 1 - Prob. 3CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Seth Feye established Reliance Financial Services on July 1, 2016. Reliance Financial Services offers financial planning advice to its clients. The effect of each transaction and the balances after each transaction for July follow: Instructions 1. Prepare an income statement for the month ended July 31, 2016. 2. Prepare a statement of owners equity for the month ended July 31, 2016. 3. Prepare a balance sheet as of July 31, 2016. 4. (Optional) Prepare a statement of cash flows for the month ending July 31, 2016.arrow_forwardJose Loder established Bronco Consulting on August 1, 2019. The effect of each transaction and the balances after each transaction for August follow: Instructions 1. Prepare an income statement for the month ended August 31, 2019. 2. Prepare a statement of owners equity for the month ended August 31, 2019. 3. Prepare a balance sheet as of August 31, 2019. 4. (Optional) Prepare a statement of cash flows for the month ending August 31, 2019.arrow_forwardA summary of cash flows for Sentinel Travel Service for the year ended August 31, 2016, follows: The cash balance as of September 1, 2015, was 89,000. Prepare a statement of cash flows for Sentinel Travel Service for the year ended August 31, 2016.arrow_forward

- A summary of cash flows for Ousel Travel Service for the year ended November 30, 2016, follows: The cash balance as of December 1, 2015, was 203,000. Prepare a statement of cash flows for Ousel Travel Service for the year ended November 30, 2016.arrow_forwardNature of transactions Cheryl Alder operates her own catering service. Summary financial data for March are presented in the following equation form. Each line, designated by a number, indicates the effect of a transaction on the balance sheet. Each increase and decrease in retained earnings, except transaction (4), affects net income. a. Describe each transaction. h. What is the net decrease in cash during the month? c. What is the net increase in retained earnings during the month? d. What is the net income for the month? e. How much of the net income for the month was retained in the business? f. What are the net cash flows from operating activities? g. ‘1iat arc the net cash flows fn)m investing activities? h. What are the net cash flows from financing activities?arrow_forwardFinancial statements Seth Feye established Reliance Financial Services on July 1, 20Y2. Reliance Financial Services offers financial planning advice to its clients. The effect of each transaction and the balances after each transaction for July follow: Instructions 1. Prepare an income statement for the month ended July 31, 20Y2. 2. Prepare a statement of stockholders equity for the month ended July 31, 20Y2. 3. Prepare a balance sheet as of July 31, 20Y2. 4. (Optional) Prepare a statement of cash flows for the month ending July 31, 20Y2.arrow_forward

- Jose Loder established Bronco Consulting on August 1, 20Y1. The effect of each transaction and $10,900 the balances after each transaction for August follow: Instructions1. Prepare an income statement for the month ended August 31, 20Y1.2. Prepare a statement of stockholders' equity for the month ended August 31, 20Y1.3. Prepare a balance sheet as of August 31, 20Y1.4. {Optional) Prepare a statement of cash flows for the month ending August 31, 20Y1.arrow_forwardConsider the following set of transactions occurring during the month of May for Bison Consulting Company. For each transaction, indicate the impact on (1) the balance of cash, (2) cash-basis net income, and (3) accrual-basis net income for May. The first answer is provided as an example.arrow_forwardAnalyze the business transactions using the tabular flow (A=L+C), Find the new balances after each transaction, Foot rule all transactions at the end of the period Prepare financial statements: Income Statement, Capital Statement, Balance Sheet and Statement of Cash Flows for Vivian Harris company for the period January 31, 2018 On December 1, 2018, Vivian Harris started a business which performs a consulting services for clients. She invested on December 1, $30,000 cash in the business and deposited the cash in a bank account. December 2, Vivian Harris purchase supplies for $2,500 cash to effectively run her consulting firm recently established. December 3, Vivian Harris purchased equipment for $26,000 cash to set up her new firm. December 4, Vivian Harris purchased on account additional supplies of 7,100 for her consulting firm. December 5, Vivian Harris provided her first consulting service to a client and collected $4,200 cash. December 6, Vivian Harris paid rent for $1,000 and…arrow_forward

- lJose Loder established Bronco Consulting on August 1, 20Y1. The effect of each transaction and $10,900 the balances after each transaction for August follow: Instructions1. Prepare an income statement for the month ended August 31, 20Y1.2. Prepare a statement of stockholders' equity for the month ended August 31, 20Y1.3. Prepare a balance sheet as of August 31, 20Y1.4. {Optional) Prepare a statement of cash flows for the month ending August 31, 20Y1.arrow_forwardA financial statements Seth Feye established Reliance Financial Services on july 1, 2012. Reliance Financial Services offers financial planning advice to its clients. The effect of each transaction and the balance after each transaction for july follow: Instructions 1.Prepare an income statement for lire month ended july 31, 2012 2. Prepare a statement of Stockholder's equity for the month ended july 31, 2012 3. Prepare a balance sheet as july 31, 2012 4. (optional) Prepare a statement of cash flows for the month ending july 31, 2012arrow_forwardWest End Inc., an auto mechanic shop, has the following account balances, given nocertain order, for the quarter ended March 31, 2019. Based on the information provided, prepare West End’s annual financial statements (i.e. Company’s Income Statement, Statement of Retained Earnings and Balance Sheet– omit the Statement of Cash Flows).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License