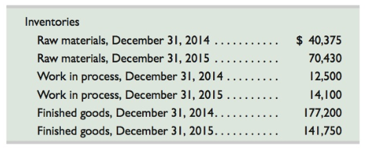

Using the information from Problem 1-2B and the inventory information for the Best Bikes below, complete the requirements below. Assume income tax expense in $136,700 for the year.

Required

- Prepare the company’s 2015 schedule of cost of goods manufactured.

- Prepare the company’s 2015 income statement that reports separate categories for (a) selling expenses and (b) general administrative expenses.

Analysis Component

- Compute the (a) inventory turnover, defined as cost of goods sold divided by average inventory, and (b) days' sales in inventory, defined as 365 times ending inventory divided by cost of goods sold, for both its raw materials inventory and its finished goods inventory. (To compute turnover and days' sales in inventory for raw materials, use raw materials used rather than cost of goods sold.) Discuss some possible reasons for differences ratios for the two of inventories. Round answers to one decimal place.

Concept introduction:

Cost of goods manufactured:

Cost of goods manufactured, also known as cost of goods completed calculates the total value of inventory that was produced during the period and is ready for sale. It is the total amount of expenses incurred to turn work in process into finished goods. It includes total manufacturing costs including all direct materials, direct labor, factory overheads to the beginning work in process inventory and subtracting ending work in process inventory which can be seen below:

Requirement 1:

To calculate:

Schedule of Cost of goods manufactured for 2015.

Answer to Problem 3PSB

Cost of goods manufactured = $18, 16, 995

Explanation of Solution

To calculate cost of goods manufactured, following formula would be used:

To calculate Direct materials used, following formula would be used:

Beginning raw material = $40, 375

Raw material purchases = $8, 94, 375

Ending raw material = $70, 430

Direct labor is given as $5, 62, 500 in the given problem. Factory overheads would include the following:

Depreciation charged on factory equipment = $35, 400

Cost of factory supervision = $1, 21, 500

Utilization of factory utilities = $6, 060

Expenses for utilities of factory = $37, 500

Indirect labor = $59, 000

Miscellaneous cost of production = $8, 440

Expense pertaining to rent on factory building = $93, 500

Expense pertaining to maintenance of factory = $30, 375

Also, beginning work in process inventory is given as $12, 500 and Ending work in process inventory as $14, 100 in the given problem. Therefore, schedule of cost of goods manufactured as asked in the given problem is given below:

Schedule of cost of goods manufactured of company (Amount in $):

| Particulars | (Amount in $) | (Amount in $) |

| Direct materials used | 8, 64, 320 | |

| Add: Direct labor | 5, 62, 500 | |

| Add: Factory overheads | 3, 91, 775 | |

| Total manufacturing costs | 18, 18, 595 | |

| Add: Beginning work in process inventory | 12, 500 | |

| Less: Ending work in process inventory | (14, 100) | |

| Cost of goods manufactured | 18, 16, 995 |

Thus, cost of goods manufactured is coming out to be $18, 16, 995.

Concept introduction:

Income statement:

Income statement, also known as Statement of revenue and expense measures company’s financial performance over an accounting period (say for a year, a quarter). In this statement, total expenses are deducted from total revenues to arrive at net income or loss for the period.

Selling expenses:

These are the expenses incurred for making sales. These include direct and indirect cost associated with selling a product.

General and administrative expenses:

These are basically the overheads of the company. These are the costs a company incurs to keep its business operational.

Requirement 2:

Income statement reporting separate categories for (a) selling expenses and (b) general and administrative expenses.

Answer to Problem 3PSB

Net income after income tax = $24, 97, 865

Explanation of Solution

To prepare the income statement categorizing selling or general and administrative expenses, firstly cost of goods sold would be calculated using the below- mentioned formula:

We have already computed cost of goods manufactured as $18, 16, 995 in the previous requirement. Beginning finished goods inventory as $1, 77, 200 and ending finished goods inventory as $1, 41, 750. Thus,

Further, Sales are given as $49, 42, 625. Gross profit would be calculated as follows:

Following would be covered under selling expenses:

Expenses for advertising = $20, 250

Expenses for depreciation = $10, 125

Expenses for rent = $27, 000

Expenses for sales salaries = $2, 95, 300

General and administrative expenses would include the following:

Expenses for depreciation = $8, 440

Expenses for sales salaries = $70, 875

Expenses for rent = $23, 625

Also, expense for income tax is given as $1, 36, 700 in the given problem. Net income after income tax would be calculates as under:

Schedule of Income statement as asked in the given problem for 2015 is shown below:

Income statement of company (Amount in $):

| Particulars | Amount | Amount |

| Sales | 49, 42, 625 | |

| Less: Cost of goods sold | ||

| Cost of goods manufactured | 18, 16, 995 | |

| Add: Beginning finished goods inventory | 1, 77, 200 | |

| Goods available for sale | 19, 94, 195 | |

| Less: Ending finished goods inventory | (1, 41, 750) | |

| Cost of goods sold | (18, 52, 445) | |

| Gross profit | 30, 90, 180 | |

| Less: Selling expenses | ||

| Expenses for advertising | 20.250 | |

| Expenses for depreciation | 10, 125 | |

| Expenses for rent | 27, 000 | |

| Expenses for sales salaries | 2, 95, 300 | |

| Total selling expenses | (3, 52, 675) | |

| Less: General and administrative expenses | ||

| Expenses for depreciation | 8, 440 | |

| Expenses for sales salaries | 70, 875 | |

| Expenses for rent | 23, 625 | |

| Total general and administrative expenses | (1, 02, 940) | |

| Net income before income tax expense | 26, 34, 565 | |

| Less: Income tax expense | (1, 36, 700) | |

| Net income after income tax | 24, 97, 865 |

Thus, Net income after income tax is coming out to be $24, 97, 865.

Concept introduction:

Inventory turnover:

Inventory turnover, also known as merchandise turnover calculates the number of times a company sells or replaces its stock of goods during a period.

Raw material turnover is calculated by dividing the raw materials used with average raw materials used, i.e.

This is an efficiency ratio that shows how effectively inventory is managed by comparing cost of goods sold with average inventory for a period. It is calculated by dividing the cost of goods sold with average inventory.

Day’s sales in inventory measure the liquidity of inventory. For raw materials, it is calculated in the following manner:

Day’s sales for finished goods inventory would be calculated as follows:

Requirement 3:

To calculate:

- Inventory turnover defined as cost of goods sold divided by average inventory

- Day’s sales in inventory defined as 365 times ending inventory divided by cost of goods sold for both raw materials inventory and finished goods inventory

- Reasons for differences between these ratios for the two types of inventories

Answer to Problem 3PSB

- Inventory turnover defined as cost of goods sold divided by average inventory For raw materials inventory = 15.6 times

- Days sales in inventory defined as 365 times ending inventory divided by cost of goods sold for both raw materials inventory and finished goods inventory

- Reasons for differences between these ratios for the two types of inventories

For finished goods inventory = 11.6 times

For raw materials inventory = 29.7 days For finished goods inventory = 27.9 days

The company is having higher raw material inventory ratio which may be due to unexpected increased sales or it may be due to the negligence of company for procurement of its raw materials and in administering them.

Further, the lower inventory ratio of finished goods may be due to the reason that company is holding large quantity of inventory to support operations than it may need.

Explanation of Solution

- Inventory turnover defined as cost of goods sold divided by average inventory

- Raw material turnover is calculated by dividing the raw materials used with average raw materials used, i.e.

Average inventory can be computed using the following formula:

In the given problem, Beginning raw materials inventory as $ 40, 375 and ending raw materials inventory as $70, 430. Thus,

Further, Direct materials used have been calculated as $8, 64.320. Therefore, inventory turnover would be calculated as follows:

Hence, inventory turnover is coming out to be 15.6 times.

- Inventory turnover is calculated by dividing the cost of goods sold with average inventory, i.e.

Average inventory can be computed using the following formula:

In the given problem, Beginning finished goods inventory as $1, 77, 200 and ending finished goods inventory as $1, 41, 750. Thus,

Further, Cost of goods has been calculated as $18, 52, 445. Therefore, Inventory turnover would be:

Hence, inventory turnover = 11.6 times.

(b) Day’s sales in inventory defined as 365 times ending inventory divided by cost of goods sold for both raw materials inventory and finished goods inventory:

- Day’s sales for raw material inventory would be calculated as follows:

Ending raw materials inventory is given as $70, 430 and Direct materials used has been calculated as $8.64.320. Thus,

Hence, Day’s sale for raw material inventory is coming out to be 29.7 days.

- Day’s sales in inventory measures liquidity of inventory and is calculated in the following manner:

In the given problem, Ending finished goods inventory as $1, 41, 750 and Cost of goods has been calculated as $18, 52, 445. Thus,

Hence, Day’s sale in finished goods inventory is coming to be 27.9 days.

(c) Reasons for differences between these ratios for the two types of inventories:

The turnover ratios as well as Day’s sales in inventory for both raw materials and finished goods has been shown below in the tabular form:

| Particulars | Raw materials | Finished goods |

| Inventory Turnover ratios | 15.6 | 11.6 |

| Day’s sales in inventory | 29.7 | 27.9 |

From the above table, it can be seen that turnover ratio of finished goods is lesser that that of raw materials inventory ratio. The company is having higher raw material inventory ratio which may be due to unexpected increased sales or it may be due to the negligence of company for procurement of its raw materials and in administering them.

Further, the lower inventory ratio of finished goods may be due to the reason that company is holding large quantity of inventory to support operations than it may need.

Also, the raw materials supply is carried for 29.7 days whereas that of finished goods inventory for 27.9 days by the company.

Want to see more full solutions like this?

Chapter 1 Solutions

MANAGERIAL ACCOUNTING ACCT 2302 >IC<

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Managerial Accounting: Tools for Business Decision Making

Auditing and Assurance Services (16th Edition)

Auditing And Assurance Services

Financial Accounting, Student Value Edition (4th Edition)

Principles Of Taxation For Business And Investment Planning 2020 Edition

- Calculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forwardCalculate the cost of goods sold dollar value for A67 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forwardUse the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forward

- The beginning inventory for Funky Party Supplies and data on purchases and sales for a three-month period are shown in Problem 7-1A. Instructions 1. Determine the inventory on March 31, 2016, and the cost of goods sold for the three-month period, using the first-in, first-out method and the periodic inventory system. 2. Determine the inventory on March 31, 2016, and the cost of goods sold for the three-month period, using the last-in, first-out method and the periodic inventory system. 3. Determine the inventory on March 31, 2016, and the cost of goods sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent. 4. Compare the gross profit and the March 31, 2016, inventories, using the following column headings:arrow_forwardHabicht Company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows: Required: 1. Determine the gross profit for each year under each of the following periodic inventory methods: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places.) 2. Next Level Explain whether the companys return on assets (net income divided by average total assets) would be higher under FIFO or LIFO.arrow_forwardUse the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forward

- Use the following information to compute cost of goods sold under the FIFO and LIFO inventory methods. The firm sold 200 units.arrow_forwardUse the weighted-average (AVG) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardUse the last-in, first-out method (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forward

- The following inventory data relate to Edwards, Inc.: Calculate the following for the year: a. Direct materials purchased. b. Direct labor costs incurred. c. Cost of goods sold. d. Gross profit.arrow_forwardAssume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000. How will this affect your net income in the current year? How will it affect next years net income?arrow_forwardTrini Company had the following transactions for the month. Calculate the cost of goods sold dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning