Concept explainers

The assets, liabilities and equity relation, are known as the accounting equation. Assets are the resources of company and that increase as business expand whereas liabilities are the burden on company that has to pay in future. Equity means the owner claim on assets. An accounting equation represent the assets of the company are equal to the liabilities and equity of the company.

In can be represented as follows,

Income Statement:

It includes the information of net income earn or net loss suffered by the company. The expenses deducting from revenue and the resultant is net income or loss to the company. This is informative report that helps the user of financial information to take decision.

Statement of

It is the part of financial statement of the company, that contained information related to retained earnings. Retained earnings are the amount that a company wants to keep aside for internal usage of the company. That will not pay in the form of dividends to the shareholders and kept by the company aside, to pay debts or further investment.

Balance Sheet:

It is a part of the Financial Statement of a company, which shows the financial position of the company as from where the company receive the money (assets) and to whom the company has to pay. (liabilities and shareholders').While purchase a share in the company the investor will firstly see the balance sheet of the respective company than only decide whether he purchase the share or not.

Statement of Cash Flows:

This statement records the inflows and outflows of cash and funds of the Company during the accounting period.

It has following three parts:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

1.

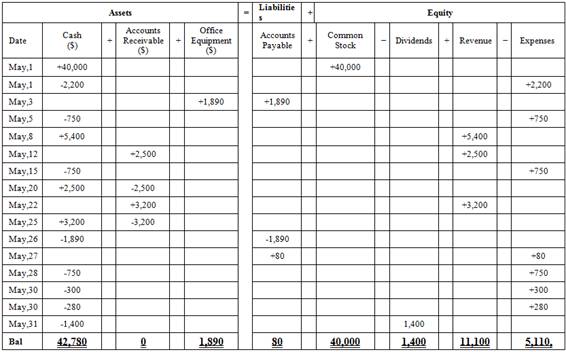

To identify: The effect of given transactions on the accounting equation.

Explanation of Solution

Table (1)

Hence, the cash balance is $42,780, office equipment is $1,890, accounts payable is $80, common stock is $40,000, dividend is $1,400, revenue is $11,100 and expenses is $5,110.

2.

To prepare: The income statement, statement of retained earnings and balance sheet.

2.

Explanation of Solution

Prepare income statement.

| G. Company | ||

| Income Statement | ||

| For the month ended May 31,20XX | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 11,100 | |

| Total Revenue | 11,100 | |

| Expenses: | ||

| Advertising Expenses | 80 | |

| Cleaning Expenses | 750 | |

| Rent Expenses | 2200 | |

| Salary Expenses | 1,500 | |

| Telephone Expenses | 300 | |

| Utilities Expenses | 280 | |

| Total Expense | 5,110 | |

| Net income | 5,990 | |

Table (2)

Hence, net income of .G Company as on May 31, 20XX is $5,990.

Prepare statement of retained earnings.

| G. Company | ||

| Retained Earnings Statement | ||

| For the month ended May 31,20XX | ||

| Particulars | Amount($) | |

| Opening balance | 0 | |

| Net income | 5,990 | |

| Total | 5,990 | |

| Dividends | (1,400) | |

| Retained earnings | 4,590 | |

Table (3)

Hence, the retained earnings of G Company as on May 31, 20XX are $4,590.

Prepare balance sheet.

| G. Company | ||

| Balance Sheet | ||

| As on May 31, 20XX | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 42,780 | |

| Equipment | 1,890 | |

| Total assets | 44,670 | |

| Liabilities and | ||

| Liabilities | ||

| Accounts payable | 80 | |

| Stockholder’s equity | ||

| Common stock | 40,000 | |

| Retained earnings | 4,590 | |

| Total stockholders’ equity | 44,590 | |

| Total Liabilities and Stockholder’s equity | 44,670 | |

Table (4)

Hence, the total of the balance sheet of the G Company as on May 31, 20XX is of $44,670.

3.

To prepare: The statement of cash flows of the M Company.

3.

Explanation of Solution

Prepare the cash flow statement.

| G. Company | ||

| Statement of Cash Flows | ||

| Month Ended May 31, 20XX | ||

| Particulars | Amount($) | Amount($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 11,100 | |

| Payments: | ||

| Cleaning Expenses | (750) | |

| Rent Expenses | (2200) | |

| Salary Expenses | (1,500) | |

| Telephone Expenses | (300) | |

| Utilities | (280) | (5,030) |

| Net cash from operating activities | 6,070 | |

| Cash flow from investing activities | ||

| Purchase of equipment | (1,890) | |

| Net cash from investing activities | (1,890) | |

| Cash flow from financing activities | ||

| Issued common stock | 40,000 | |

| Less: Payment of cash dividends | (1,400) | |

| Net cash from financing activities | 38,600 | |

| Net increase in cash | 42,780 | |

| Cash balance, May 1,20XX | 0 | |

| Cash balance, May 31,20XX | 42,780 | |

Table (5)

Hence, the cash balance of the G Company as on May 31, 20XX is $42,780.

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCT.FUNDAMENTALS <CUSTOM LL>

- Transactions; financial statements 2. Net income: 10,850 On April 1, 20Y8, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April: a. Opened a business bank account with a deposit of 24,000 in exchange for common stock. b. Paid rent on office and equipment for the month, 3,600. c. Paid automobile expenses for month, 1,350, and miscellaneous expenses, 600. d. Purchased supplies on account, 1,200. e. Earned sales commissions, receiving cash, 19,800. f. Paid creditor on account, 750. g. Paid office salaries, 2,500. h. Paid dividends, 3,500. i. Determined that the cost of supplies on hand was 300; therefore, the cost of supplies used was 900. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: 2. Prepare an income statement for April, a statement of stockholders equity for April, and a balance sheet as of April 30.arrow_forwardThe transactions completed by PS Music during June 20Y5 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing 5,000 in PS Musics checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 20Y5. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 20Y5. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.arrow_forwardTransactions; financial statements On August 1, 2018, Brooke Kline established Western Realty. Brooke completed the following transactions during the month of August: A. Opened a business bank account with a deposit of 35,000 in exchange for common stock. B. Purchased supplies on account, 2,750. C. Paid creditor on account, 1,800. D. Earned sales commissions, receiving cash, 52,800. E. Paid rent on office and equipment for the month, 4,500. F. Paid dividends, 3,000. G. Paid automobile expenses for month, 1,100, and miscellaneous expenses, 1,200. H. Paid office salaries, 5,250. I. Determined that the cost of supplies on hand was 1,750; therefore, the cost of supplies used was 1,000. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:arrow_forward

- Comprehensive Problem 1 8 Net income. 31,425 Kelly Pitney began her consulting business. Kelly Consulting, on April 1, 20Y8. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter During May, Kelly Consulting entered into the following transactions: May 3.Received cash from clients as an advance payment for services to be provided and recorded it as unearned tree 4,500 5.Received cash from clients on account 2,450. 9.Paid cash for a newspaper advertisement 225. 13.Raid Office Station Co for part of the debt incurred on April , 640. 15.Recorded services provided on account for the period May 1-15, 9,180. 16 Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17.Recorded cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the Journal 20.Purchased support on account 735. 21.Recorded services provided on account for the period May 1620. 4,820 25.Recorded cash from cash clients for fees earned for the period May 1723, 7,900 27.Received cash from clients on account 9,520. 28.Paid part-time receptionist for two weeks salary. 7S0. 30.Raid telephone bill for May. 260 31.Paid electricity bill for May, 810. 31.Recorded cash from cash clients tor lees earned for the period May 2031. 3,300. 31.Recorded services provided on account for the remainder of May, 2,650. 31.Paid dividends 10,500 Instructions 1.The chart of accounts foe Kelly Consulting is shown us Exhibit 9. and the post-closing trial balance as of April 30, 20Y8, is shown in Exhibit 17. for each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1. 20Y8. and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting cm Page of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 5.Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a)Insurance expired during May is 275. (b)Supplies on hand on May II are 715. (c)Depreciation of office equipment for May is 330. (d)Accrued receptionist salary on May 31 is 325. (e)Rent expired during May is 1600. (f)Unearned fees on May 31 are 3,210 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardThe transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Musk in exchange for common stock by depositing 5,000 in PS Music s checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on lage 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2018. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2018. 31. Received 3,000 for serving as a disc jockey for a party. July 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows: 11 Cash 3,920 41 Fees Earned 6,200 12 Accounts Receivable 1,000 50 Wages Expense 400 14 Supplies 170 51 Office Rent Expense 800 15 Prepaid Insurance 52 Equipment Rent Expense 675 17 Office Equipment 53 Utilities Expense 300 21 Accounts Payable 250 54 Music Expense 1,590 23 Unearned Revenue 55 Advertising Expense 500 31 Common Stock 4,000 56 Supplies Expense 180 33 Dividends 500 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. {Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2018.arrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning