Concept explainers

(a)

Liabilities

Liabilities are an obligation of the business to pay to the creditors in future for the goods and services purchased on account or any for other financial benefit received. It can be current liabilities or a non-current liabilities depending upon the time period in which it is paid.

Current liability

Current liability is an obligation that the companies need to pay from the remaining current assets or creation of other current liabilities within a fiscal year or the operating cycle whichever is higher.

Notes payable

Notes Payable is a written promise to pay a certain amount on a future date, with certain percentage of interest. Companies use to issue notes payable to meet short-term financing needs.

To Prepare: The

(a)

Explanation of Solution

Prepare the journal entry to record the issuance of 6% notes payable to purchase of an inventory on September 1, 2017 as shown below:

| Date | Account title and Description | Debit | Credit |

| Sept. 1, 2017 | Inventory | $12,000 | |

| 6% Notes payable | $12,000 | ||

| (To record the 6% notes payable for purchases of an inventory of Corporation E) |

Table (1)

Description:

- Inventory is a current asset, and increased. Therefore, debit inventory account for $12,000.

- 6% Notes payable is a current liability and increased. Therefore, credit 6% notes payable account for $12,000.

To Prepare: The journal entry to record the accrued interest expense of 6% notes payable on September 30, 2017.

Explanation of Solution

Prepare the journal entry to record the accrued interest expense of 6% notes payable on September 30, 2017 as shown below:

| Date | Account title and Description | Debit | Credit |

| Sept. 30, 2017 | Interest expense (1) | $60 | |

| Interest payable | $60 | ||

| (To record the accrued interest expense of 6% notes payable for Corporation E) |

Table (2)

Working note:

Calculate interest expense on 30th September 2017 of Corporation E as shown below:

Description:

- Interest expense is a component of

stockholders’ equity , and decreased it. Therefore, debit inventory account for $60. - Interest payable is a current liability and decreased. Therefore, credit interest payable account for $60.

To Prepare: The journal entry to record the issuance of 8% notes payable to purchase equipment on October 1, 2017.

Explanation of Solution

Prepare journal entry to record the issuance of 8% notes payable to purchases equipment on October 1, 2017as shown below:

| Date | Account title and Description | Debit | Credit |

| Oct. 1, 2017 | Equipment | $16,500 | |

| 8% Notes payable | $16,500 | ||

| (To record the 8% notes payable to purchase of an equipment for Corporation E) |

Table (3)

Description:

- Equipment is a fixed asset, and increased. Therefore, debit equipment account for $16,500.

- 8% Notes payable is a current liability and increased. Therefore, credit 8% notes payable account for $16,500.

To Prepare: The journal entry to record the accrued interest expense of 6% notes payable and 8% notes payable on October 31, 2017.

Explanation of Solution

Prepare the journal entry to record the accrued interest expense of 6% notes payable and 8% notes payable on October 31, 2017 as shown below:

| Date | Account title and Description | Debit | Credit |

| Oct. 31, 2017 | Interest expense (3) | $170 | |

| Interest payable | $170 | ||

| (To record the accrued interest expense of 6% notes payable for Corporation E) |

Table (4)

Working note:

Calculate interest expense on 31st October 2017 of Corporation E as shown below:

Calculate interest expense on 31st October 2017 of Corporation E as shown below:

Calculate total interest expenses as on 31st October 2017 of Corporation E as shown below:

Description:

- Interest expense is a component of stockholders’ equity, and decreased it. Therefore, debit inventory account for $170.

- Interest payable is a current liability and decreased. Therefore, credit interest payable account for $170.

To Prepare: The journal entry to record the issuance of 6% notes payable to purchases Vehicle on November 1, 2017.

Explanation of Solution

Prepare journal entry to record the issuance of 8% notes payable to purchase vehicle on November 1, 2017as shown below:

| Date | Account title and Description | Debit | Credit |

| Nov. 1, 2017 | Vehicle | $34,000 | |

| 6% Notes payable | $26,000 | ||

| Cash | $8,000 | ||

| (To record the 8% notes payable to purchase of an equipment for Corporation E) |

Table (5)

Description:

- Vehicle is a fixed asset, and increased. Therefore, debit Vehicle account for $34,000.

- 6% Notes payable is a current liability and increased. Therefore, credit 6% notes payable account for $26,000.

- Cash is a current asset and decreased. Therefore, credit cash account for $8,000.

To Prepare: The journal entry to record the accrued interest expense of 6% notes payable on November 31, 2017.

Explanation of Solution

Prepare the journal entry to record the accrued interest expense of 6% notes payable on November 31, 2017 as shown below:

| Date | Account title and Description | Debit | Credit |

| Nov. 31, 2017 | Interest expense (5) | $300 | |

| Interest payable | $300 | ||

| (To record the accrued interest expense for Corporation E) |

Table (6)

Working note:

Calculate interest expense on 31st October 2017 of Corporation E as shown below:

Calculate total interest expenses as on 31st November 2017 using working note (3) and (4) of Corporation E as shown below:

Description:

- Interest expense is a component of stockholders’ equity, and decreased it. Therefore, debit inventory account for $300.

- Interest payable is a current liability and decreased. Therefore, credit interest payable account for $300.

To Prepare: The journal entry to record the payment of principal and interest on December 1, 2017.

Explanation of Solution

Prepare journal entry to record the payment of principal and interest on December 1, 2017as shown below:

| Date | Account title and Description | Debit | Credit |

| Dec. 1, 2017 | 6% Notes payable | $12,000 | |

| Interest payable (6) | $180 | ||

| Cash | $12,180 | ||

| (To record the 6% notes payable to purchase of an equipment for Corporation E) |

Table (7)

Working note:

Calculate interest payable for Corporation E as shown below:

Description:

- 6% notes payable is a current liability, and decreased. Therefore, debit notes payable account for $12,000.

- Interest payable is a current liability and decreased. Therefore, debit interest payable account for $180.

- Cash is a current asset and decreased. Therefore, credit cash account for $12,180.

To Prepare: The journal entry to record the payment of principal and interest on December 31, 2017.

Explanation of Solution

Prepare journal entry to record the payment of principal and interest on December 31, 2017as shown below:

| Date | Account title and Description | Debit | Credit |

| Dec. 31, 2017 | Interest expense (7) | $240 | |

| Interest payable | $240 | ||

| (To record the accrued interest expenses for Corporation E) |

Table (8)

Working note:

Calculate interest expenses for Corporation E on 31st December 2017 using working note (2) and (4) as shown below:

(b)

To Compute: The T-Accounts of Notes payable, Interest payable and Interest expense of Corporation E.

(b)

Explanation of Solution

Calculate the T-Accounts of Notes payable, Interest payable and Interest expense of Corporation E as shown below:

| Notes Payable | |||||

| 12/1 | $12,000 | 9/1 | $12,000 | ||

| 10/1 | $16,500 | ||||

| 11/1 | $26,000 | ||||

| 12/31 | Bal. | $42,500 | |||

Table (1)

| Interest Payable | |||||

| 12/1 | $180 | 9/30 | $60 | ||

| 10/31 | $170 | ||||

| 11/30 | $300 | ||||

| 12/31 | $240 | ||||

| 12/31 | Bal. | $590 | |||

Table (2)

| Interest Expense | |||||

| 9/30 | $60 | ||||

| 10/31 | $170 | ||||

| 11/30 | $300 | ||||

| 12/31 | $240 | ||||

| 12/31 | Bal. | $770 | |||

Table (3)

Description:

Normal balance of assets account, expenses, and losses account are debit balance. Hence, a debit increases these accounts and credit decreases these accounts.

Normal balance of liabilities account, capital account, revenue account and gains are credit balance. Hence, a debit decreases these accounts and credit increases these accounts.

(c)

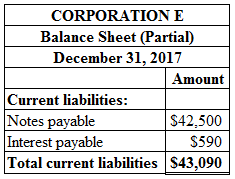

To Compute: The balance sheet presentation of notes payable and interest payable of Corporation E on December 31, 2017.

(c)

Explanation of Solution

Calculate the balance sheet presentation of notes payable and interest payable of Corporation E on December 31, 2017 as shown below:

Figure (1)

(d)

To Identify: The total interest expense of Corporation E using T-Accounts.

(d)

Explanation of Solution

Calculate total interest expense of Corporation E using T-Accounts as shown below:

| Interest Expense | |||||

| 9/30 | $60 | ||||

| 10/31 | $170 | ||||

| 11/30 | $300 | ||||

| 12/31 | $240 | ||||

| 12/31 | Bal. | $770 | |||

Table (3)

Therefore, total interest expense of Corporation E is $770.

Want to see more full solutions like this?

Chapter 10 Solutions

FINANCIAL ACCT.:TOOLS...(LL)-W/ACCESS

- Serene Company purchases fountains for its inventory from Kirkland Inc. The following transactions take place during the current year. A. On July 3, the company purchases thirty fountains for $1,200 per fountain, on credit. Terms of the purchase are 2/10, n/30, invoice dated July 3. B. On August 3, Serene does not pay the amount due and renegotiates with Kirkland. Kirkland agrees to convert the debt owed into a short-term note, with an 8% annual interest rate, payable in two months from August 3. C. On October 3, Serene Company pays its account in full. Record the journal entries to recognize the initial purchase, the conversion, and the payment.arrow_forwardResin Milling issued a $390,500 note on January 1, 2018 to a customer in exchange for merchandise. The merchandise had a cost to Resin Milling of $170,000. The terms of the note are 24-month maturity date on December 31, 2019 at a 5% annual interest rate. The customer does not pay on its account and dishonors the note. Record the journal entries for Resin Milling for the following transactions. A. Initial sale on January 1, 2018 B. Dishonored note entry on January 1, 2020, assuming interest has not been recognized before note maturityarrow_forwardOn June 1, Phillips Corporation sold, with recourse, a note receivable from a customer to a bank. The note has a face value of 15,000 and a maturity value (principal plus interest) of 15,400. The discount is calculated to be 385, and the accrued interest income is 100. The recourse liability is estimated to be 1,000. Prepare the journal entry of Phillips to record the sale of the note receivable.arrow_forward

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardRogan Companys total sales on account for the year amounted to 327,000. The company, which uses the allowance method, estimated bad debts at 1 percent of its credit sales. Required Journalize the following selected entries: 2017 Dec.31 Record the adjusting entry. 2018 Mar. 2Write off the account of A. M. Billson as uncollectible, 584. June 6Write off the account of W. H. Gilders as uncollectible, 492. Check Figure Adjusting entry amount, 3,270arrow_forwardRain T-Shirts issued a $440,600 note on January 1, 2018 to a customer, Larry Potts, in exchange for merchandise. The merchandise had a cost to Rain T-Shirts of $220,300. The terms of the note are 24-month maturity date on December 31, 2019 at a 4.5% annual interest rate. Larry Potts does not pay on his account and dishonors the note. Record journal entries for Rain T-Shirts for the following transactions. A. Initial sale on January 1, 2018 B. Dishonored note entry on January 1, 2020, assuming interest has not been recognized before note maturityarrow_forward

- On September 30, 2013, the general ledger of Leons Golf Shop, which uses the calendar year as its accounting period, showed the following year-to-date account balances: The merchandise inventory account had a 48,000 balance on January 1, 2013. The historical gross profit percentage is 40%. Leon prepares quarterly financial statements and takes physical inventory once a yearat the end of the accounting period. In order to prepare the financial statements for the third quarter, the store needs to have an estimate of ending inventory. You have been asked to use the gross profit method to estimate the ending inventory. Review the worksheet called GP. Study it carefully because it may have a solution format somewhat different from the one shown in your textbook.arrow_forwardAir Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.arrow_forwardSpath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forward

- Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forwardMillennium Associates records bad debt using the allowance, income statement method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On February 5, Millennium Associates identifies one uncollectible account from Molar Corp in the amount of $1,330. On April 15, Molar Corp unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. February 5, 2018 identification entry C. Entry for payment on April 15, 2018arrow_forwardElement Surfboards issued a $210,800 note on January 1, 2018 to a customer, Leona Marland, in exchange for merchandise. Terms of the note are 9-month maturity date on October 1, 2018 at a 10.2% annual interest rate. Leona Marland does not pay on her account and dishonors the note. On December 2, 2018, Element Surfboards decides to sell the dishonored note to a collection agency for 30% of its value. Record the journal entries for Element Surfboards for the following transactions. A. Initial sale on January 1, 2018 B. Dishonored note entry on October 1, 2018 C. Receivable sale on December 2, 2018arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning