(a)

Bonds

Bonds are a kind of interest bearing notes payable, usually issued by companies, universities and governmental organizations. It is a debt instrument used for the purpose of raising fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If selling price of the bond is lesser than the face value, it is known as discount on bond. If selling price of the bond is greater than the face value, it is known as premium on bond.

Redemption of Bonds

The process of repaying the sale amount of bonds to bondholders at the time of maturity or before the maturity period is called as redemption of bonds. It is otherwise called as retirement of bonds.

To prepare: The

(a)

Answer to Problem 10.4AP

Prepare the journal entry to record the issuance of bonds for Corporation K on October 1as shown below:

| Date | Account title and Explanation | Debit | Credit |

| October 1, 2016 | Cash | $700,000 | |

| Bonds payable | $700,000 | ||

| (To record the issuance of 5% bonds payable at face value for Corporation K) |

Table (1)

Explanation of Solution

- Cash is a current asset and increased. Therefore, debit Cash account for $396,000.

- Bonds payable is a long-term liability and increased. Therefore, credit bonds payable account for $700,000.

(b)

To prepare: The

(b)

Answer to Problem 10.4AP

The adjusting entry to record the accrual of interest for Corporation K on December 31, 2017 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| December 31, 2016 | Interest expense (1) | $8,750 | |

| Interest payable | $8,750 | ||

| (To record the accrual interest expense for Corporation K) |

Table (2)

Working note:

Calculation of Interest expense for Corporation K is shown below:

Explanation of Solution

- Interest expense is a component of

stockholders’ equity and decreased it. Therefore, debit interest expense account for $8,750. - Interest payable is a current liability and increased. Therefore, credit interest payable account for $8,750.

(c)

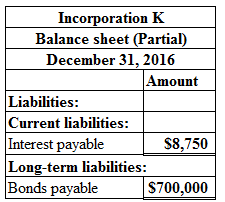

To prepare: The balance sheet presentation of bonds payable and bond interest payable of Incorporation K.

(c)

Answer to Problem 10.4AP

Prepare the balance sheet presentation of bonds payable and bond interest payable of Incorporation K as shown below:

Figure (1)

Explanation of Solution

The balance sheet presentation of interest payable ($8,750) comes under the current liability section and the balance sheet presentation of bonds payable ($700,000) comes under long-term liability section.

(d)

To prepare: The journal entry to record the payment of interest for Corporation K on October 1, 2017.

(d)

Answer to Problem 10.4AP

Prepare the journal entry to record the payment of interest for Corporation K on October 1, 2017 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| October 1, 2017 | Interest expense (1) | $26,250 | |

| Interest payable (3) | $8,750 | ||

| Cash (2) | $35,000 | ||

| (To record the payment of interest expense for Corporation K) |

Table (3)

Working note:

Calculation of interest expense for Corporation K on 1st October 2017 is shown below:

Calculation of cash paid for bonds payable of Corporation K 1st October 2017 is shown below:

Calculation of Interest expense for Corporation K is shown below:

Calculation of Interest payable of Corporation K 1st October 2017 is shown below:

Explanation of Solution

- Interest expense is a stockholders’ equity, and decreased it. Therefore, debit interest expense account for $26,250.

- Interest payable is a current liability and decreased. Therefore, debit interest payable account for $8,750.

- Cash is a current asset account, and decreased. Therefore, cash account for $35,000.

(e)

To prepare: The adjusting entry to record the accrual of interest for Corporation K on December 31, 2017.

(e)

Answer to Problem 10.4AP

The adjusting entry to record the accrual of interest for Corporation K on December 31, 2017 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| December 31, 2017 | Interest expense (1) | $8,750 | |

| Interest payable | $8,750 | ||

| (To record the accrual interest expense for Corporation K) |

Table (4)

Working note:

Calculation of Interest expense for Corporation K is shown below:

Explanation of Solution

- Interest expense is a component of stockholders’ equity and decreased it. Therefore, debit interest expense account for $8,750.

- Interest payable is a current liability and increased. Therefore, credit interest payable account for $8,750.

(f)

To prepare: The journal entry to record the payment of interest for Corporation K on January 1, 2018.

(f)

Answer to Problem 10.4AP

Prepare the journal entry to record the payment of interest for Corporation K on January 1, 2018 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| January 1, 2018 | Interest payable | $8,750 | |

| Cash | $8,750 | ||

| (To record the payment of interest expense for Corporation K) |

Table (5)

Explanation of Solution

Interest payable is a current liability, and decreased. Therefore, interest payable account for $8,750

Cash is a current asset, and decreased. Therefore, cash account for $8,750.

To prepare: The journal entry to record the redemption of bonds for Corporation K on January 1, 2018.

Answer to Problem 10.4AP

Prepare the journal entry to record the redemption of bonds for Corporation K on January 1, 2018 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| January 1, 2018 | Bonds payable | $700,000 | |

| Loss on redemption of bonds (2) | $28,000 | ||

| Cash (1) | $728,000 | ||

| (To record the redemption of bonds before the maturity period for Corporation K) |

Table (6)

Working notes:

Calculation of cash paid for redemption of bonds payable is shown below:

Calculation of loss on redemption of bonds payable is shown below:

Explanation of Solution

Bonds payable is a long-term liability, and decreased. Therefore, debit bonds payable account for $700,000

Loss on redemption of bonds is a component of stockholders’ equity, and decreased. Therefore, debit loss on redemption of bonds for $28,000.

Cash is a current asset, and decreased. Therefore, credit cash account for $728,000

Want to see more full solutions like this?

Chapter 10 Solutions

Financial Acct Print Ll W/ Wp

- Chung Inc. issued $50,000 of 3-year bonds on January 1, 2018, with a stated rate of 4% and a market rate of 4%. The bonds paid interest semi-annually on June 30 and Dec. 31. How much money did the company receive when the bonds were issued? The bonds would be quoted at what rate?arrow_forwardAggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018, and received $540,000. Interest is payable semi-annually. The premium is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of premiumarrow_forwardSaverin, Inc. produces and sells outdoor equipment. On July 1, 2016, Saverin, Inc. issued 62,500,000 of 10-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of 66,747,178. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 2016, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 2017, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for 2016.arrow_forward

- On January 1, 2018, Wawatosa Inc. issued 5-year bonds with a face value of $200,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%. Assuming the bonds were sold at 107.732, what is the selling price of the bonds? Were they issued at a discount or a premium?arrow_forwardOn Jan. 1, Year 1, Foxcroft Inc. issued 100 bonds with a face value of $1,000 for $104,000. The bonds had a stated rate of 6% and paid interest semiannually. What is the journal entry to record the issuance of the bonds?arrow_forwardVolunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $540,000. Interest is payable annually. The premium is amortized using the straightline method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. June 30, 2019: entry to record payment of interest to bondholders C. June 30, 2019: entry to record amortization of premium D. June 30, 2020: entry to record payment of interest to bondholders E. June 30, 2020: entry to record amortization of premiumarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning