Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 11MC

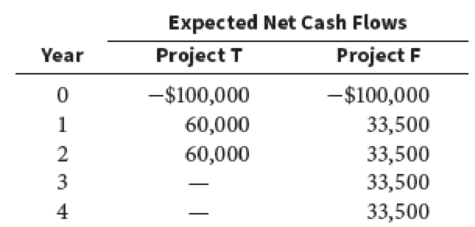

In an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects, Project T (which lasts for 2 years) and Project F (which lasts for 4 years):

The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital.

- (1) What is each project’s initial

NPV without replication? - (2) What is each project’s equivalent annual

annuity ? - (3) Apply the replacement chain approach to determine the projects’ extended NPVs. Which project should be chosen?

- (4) Assume that the cost to replicate Project T in 2 years will increase to $105,000 due to inflation. How should the analysis be handled now, and which project should be chosen?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Financial Management: Theory & Practice

Ch. 10 - Define each of the following terms:

Capital...Ch. 10 - What types of projects require the least detailed...Ch. 10 - Explain why the NPV of a relatively long-term...Ch. 10 - When two mutually exclusive projects are being...Ch. 10 - Suppose a firm is considering two mutually...Ch. 10 - A project has an initial cost of 40,000, expected...Ch. 10 - Refer to Problem 10-1. What is the project’s IRR?

Ch. 10 - Refer to Problem 10-1. What is the projects MIRR?Ch. 10 - Prob. 4PCh. 10 - Prob. 5P

Ch. 10 - Prob. 6PCh. 10 - Your division is considering two investment...Ch. 10 - Edelman Engineering is considering including two...Ch. 10 - Davis Industries must choose between a gas-powered...Ch. 10 - Project S has a cost of 10,000 and is expected to...Ch. 10 - Your company is considering two mutually exclusive...Ch. 10 - Prob. 12PCh. 10 - Cummings Products is considering two mutually...Ch. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Shao Airlines is considering the purchase of two...Ch. 10 - The Perez Company has the opportunity to invest in...Ch. 10 - Filkins Fabric Company is considering the...Ch. 10 - Prob. 19PCh. 10 - The Aubey Coffee Company is evaluating the...Ch. 10 - Your division is considering two investment...Ch. 10 - Prob. 22PCh. 10 - Start with the partial model in the file Ch10 P23...Ch. 10 - What is capital budgeting?Ch. 10 - Prob. 2MCCh. 10 - c. (1) Define the term net present value (NPV)....Ch. 10 - Prob. 4MCCh. 10 - Draw NPV profiles for Franchises L and S. At what...Ch. 10 - What is the underlying cause of ranking conflicts...Ch. 10 - Define the term modified IRR (MIRR). Find the...Ch. 10 - What does the profitability index (PI) measure?...Ch. 10 - (1) What is the payback period? Find the paybacks...Ch. 10 - Prob. 10MCCh. 10 - In an unrelated analysis, you have the opportunity...Ch. 10 - You are also considering another project that has...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forwardProject S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?arrow_forwardMarkoff Products is considering two competing projects, but only one will be selected. Project A requires an initial investment of $42,000 and is expected to generate future cash flows of $6,000 for each of the next 50 years. Project B requires an initial investment of $210,000 and will generate $30,000 for each of the next 10 years. If Markoff requires a payback of 8 years or less, which project should it select based on payback periods?arrow_forward

- Jasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardRoberts Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is 2,293,200. The equipment is expected to last five years and will have no salvage value. The expected cash flows associated with the project are as follows: Required: 1. Compute the projects payback period. 2. Compute the projects accounting rate of return. 3. Compute the projects net present value, assuming a required rate of return of 10 percent. 4. Compute the projects internal rate of return.arrow_forward

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment or $28.000 and is expected to generate the following cash flows: If the discount rate is 5% compute the NPV of each project and make a recommendation of the project to be chosen.arrow_forwardYour division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?arrow_forwardThe Pinkerton Publishing Company is considering two mutually exclusive expansion plans. Plan A calls for the expenditure of 50 million on a large-scale, integrated plant that will provide an expected cash flow stream of 8 million per year for 20 years. Plan B calls for the expenditure of 15 million to build a somewhat less efficient, more labor-intensive plant that has an expected cash flow stream of 3.4 million per year for 20 years. The firms cost of capital is 10%. a. Calculate each projects NPV and IRR. b. Set up a Project by showing the cash flows that will exist if the firm goes with the large plant rather than the smaller plant. What are the NPV and the IRR for this Project ? c. Graph the NPV profiles for Plan A, Plan B, and Project .arrow_forward

- Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: If the discount rate is 12%, compute the NPV of each project.arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License