Concept explainers

a.

Compute the total product cost and average cost per unit.

a.

Explanation of Solution

Product cost:

It is the cost incurred by the company during the process of manufacturing the product.

Given information:

- • The raw material is $26,000.

- • The wages for production workers are $21,000.

- • Manufacturing equipment is $49,000, its salvage value is $4,000, and an expected life is 6 years.

- • The completed production of Company I is 8,000 units.

Calculation of total product cost for the year 2014 is as follows:

| Particulars | Amount $ |

| Direct materials | $26,000 |

| Direct labor | 21,000 |

| Manufacturing overhead (1) | 9,000 |

| Total product cost | 56,000 |

Table (1)

Hence, the total cost of the product for the year 2014 is $56,000.

Calculation of average cost per unit for the year 2014 is as follows:

Hence, the average cost per unit for the year 2014 is $7.00.

Working note (1):

Calculate the manufacturing

Hence, the manufacturing overheads are $9,000.

b.

Compute the cost of goods sold that appears in 2014 income statement.

b.

Explanation of Solution

Cost of goods sold

The cost of goods sold is the accumulation of all the direct costs incurred in the process of producing a product. It excludes the indirect expenses.

Given information:

- • The total number of units sold by Company I is 7,200 units.

The calculation of total cost of goods sold for the year 2014 is as follows:

Hence, the total cost of goods sold is $50,400.

c.

Compute the cost of ending inventory that appears on 31st December 2014 balance sheet.

c.

Explanation of Solution

Inventory:

It is the term for products that are ready for sale and raw materials that are used in the making of the final product.

Given information:

- • The total number of units sold by Company I is 7,200 units.

- • The completed production of Company I is 8,000 units.

The calculation of ending inventory for the year 2014 is as follows:

Hence, the ending inventory for the year 2014 is $5,600.

d.

Compute the total amount of net income for the year 2014.

d.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from business operations and the result of those operations as the net income or net loss for a particular time period is referred to as an income statement.

The calculation of net income of Company I for the year 2014 is as follows:

Table (2)

Hence, the net income of the Company for the year 2014 is $42,600.

Working note (2):

The calculation of

Working note (3):

The calculation of depreciation value for manufacturing equipment’s:

Working note (4):

The calculation of total units sold at the rate of $9 per unit.

Working note (5):

The calculation of total inventory at the average cost per unit.

e.

Compute the total amount of

e.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from the business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

The calculation of retained earnings of the Company I for the year 2014 is as follows:

Table (3)

Hence, the retained earnings of the Company for the year 2014 are $42,600.

f.

Compute the total assets that appear on the balance sheet.

f.

Explanation of Solution

Financial statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

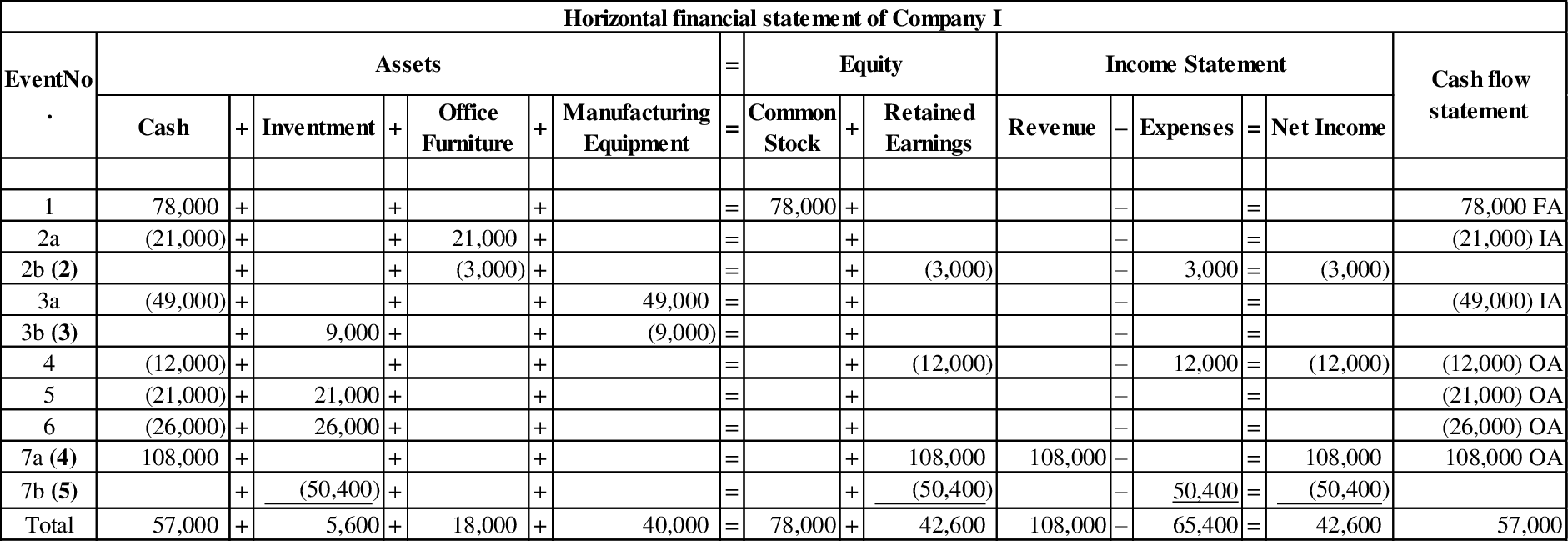

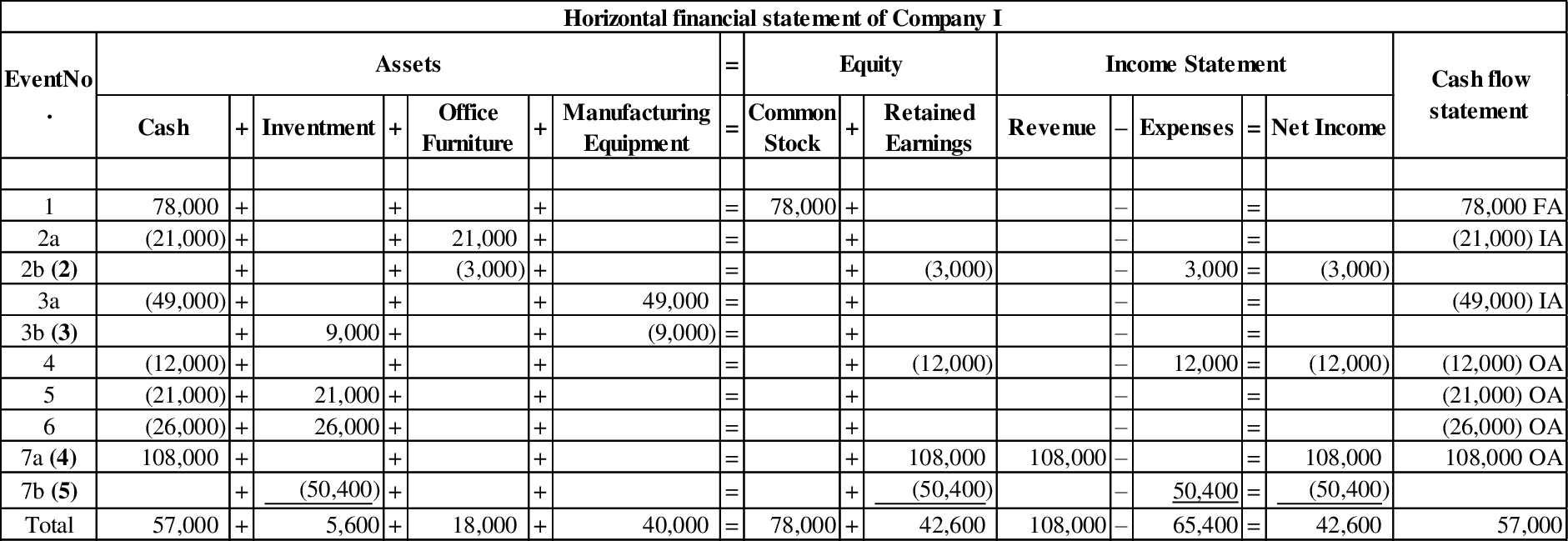

The table showing calculation of assets:

| Event No. | Assets | ||||||

| Cash | + | Investment | + | Office Furniture | + | Manufacturing Equipment | |

| 1 | 78,000 | + | + | + | |||

| 2a | (21,000) | + | + | 21,000 | + | ||

| 2b (2) | + | + | (3,000) | + | |||

| 3a | (49,000) | + | + | + | 49,000 | ||

| 3b (3) | + | 9,000 | + | + | (9,000) | ||

| 4 | (12,000) | + | + | + | |||

| 5 | (21,000) | + | 21,000 | + | + | ||

| 6 | (26,000) | + | 26,000 | + | + | ||

| 7a (4) | 108,000 | + | + | + | |||

| 7b (5) | + | (50,400) | + | + | |||

| Total | 57,000 | + | 5,600 | + | 18,000 | + | 40,000 |

Table (4)

The calculation of total assets is as follows:

Hence, the total amount of assets of the Company for the year 2014 is $120,600.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education