1.

Prepare a schedule related to payroll for Company C from the given information.

1.

Explanation of Solution

Payroll: The total payment that a company is required to pay to its employee for the services received is called as payroll.

Payroll withholding deduction: The amounts which the employer withhelds from employees’ gross pay to deduct taxes such as federal income tax, state income tax, social security tax, and Medicare tax are called payroll withholding deduction.

Payroll register: A schedule which is maintained by the company to record the earnings, earnings withholdings, and net pay of each employee is referred to as payroll register.

The purpose of payroll register is used to record the following:

- Earnings of each employee.

- Taxes (Social security tax, Medicare tax, and federal income tax) and other withholdings (health insurance, and other) of each employee.

- Net pay of each employee.

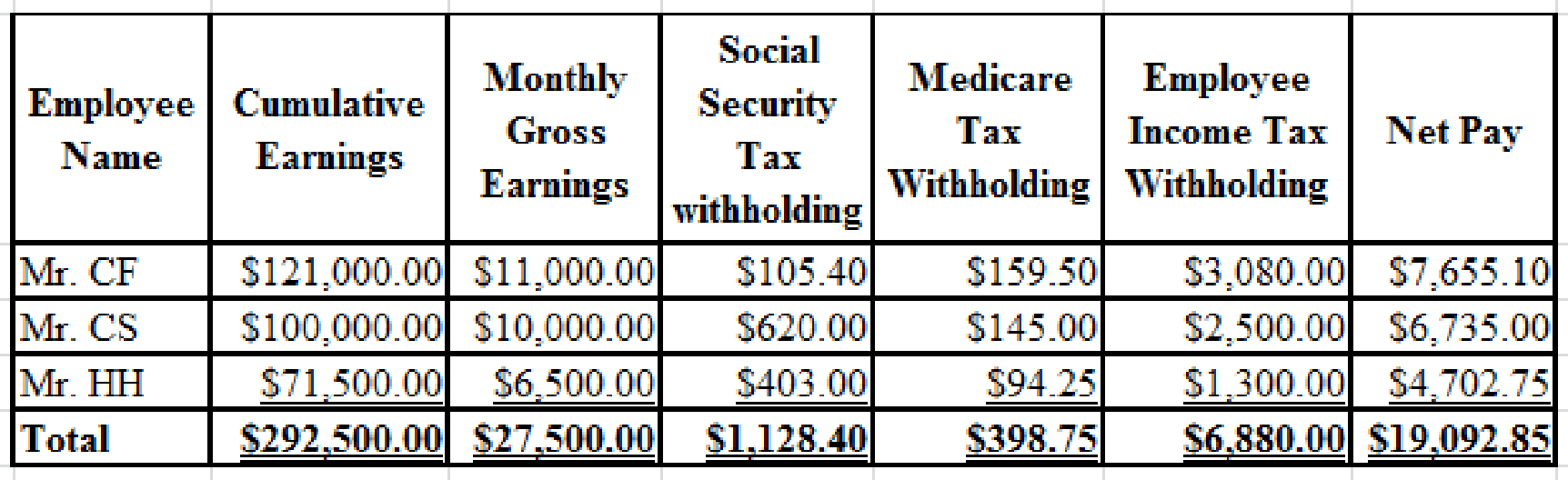

Prepare a schedule related to payroll for Company C as below:

Table (1)

Working notes:

Calculate social security tax withholding for Mr. CF.

The cumulative earnings of Mr. CF are $121,000 and the earnings ceiling of social security tax $122,700. Hence, the taxable salary of social security tax will be $1,700

Calculate social security tax withholding for Mr. CS.

Calculate social security tax withholding for Mr. HH.

Calculate Medicare tax withholding for Mr. CF.

Calculate Medicare tax withholding for Mr. CS.

Calculate Medicare tax withholding for Mr. HH.

Note: Net pay is calculated by using the following formula:

2.

Journalize the entry to record the payroll on December 31, 2019.

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare general journal entry to record the payroll on December 31, 2019.

| General Journal | Page 32 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Salaries Expense | 27,500.00 | |||||

| December | 31 | Social Security Taxes Payable | 1,128.40 | ||||

| Medicare Taxes Payable | 398.75 | ||||||

| Employees Income Taxes Payable | 6,880.00 | ||||||

| Salaries Payable | 19,092.85 | ||||||

| (To record monthly salaries expense and payroll withholdings) | |||||||

Table (2)

- Salaries expense is an expense and it decreases equity value. So, debit it by $27,500.00.

- Social security taxes payable is a liability and it is increased. So, credit it by $1,128.40.

- Medicare taxes payable is a liability and it is increased. So, credit it by $398.75.

- Employee income taxes payable is a liability and it is increased. So, credit it by $6,880.00.

- Salaries payable is a liability and it is increased. So, credit it by $19,092.85.

3.

Journalize the entry to record the payment to employees on December 31, 2019.

3.

Explanation of Solution

Prepare general journal entry to record payment to employees on December 31, 2019.

| General Journal | Page 32 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Salaries Payable | 19,092.85 | |||||

| October | 31 | Cash | 19,092.85 | ||||

| (To record the payment to employees) | |||||||

Table (3)

- Salaries payable is a liability and it is decreased. So, debit it by $19,092.85.

- Cash is an asset and it is decreased. So, credit it by $19,092.85.

Analyze: After all payroll entries posted for the month, the balance of the salaries payable would be zero.

Want to see more full solutions like this?

Chapter 10 Solutions

COLLEGE ACCOUNTING-ACCESS

- Accrued Wages A company employs a part-time staff of 50 employees, each earning $10 per hour and working 30 hours per week. Employees work 5 days per week, Monday through Friday, and are paid weekly on Fridays. The appropriate journal entry was recorded at the end of the accounting period, Tuesday, April 30, 2019. Required: What journal entries are made on Tuesday, April 30, and Friday, May 3, 2019?arrow_forwardDuring the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Diane R. Peters. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forwardDuring the third calendar quarter of 20--, the Beechtree Inn, owned by Dawn Smedley, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage