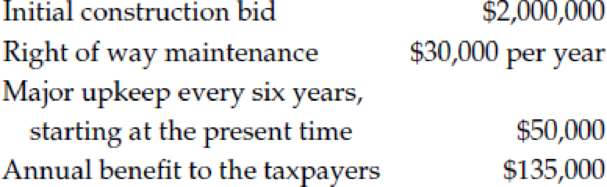

The Adams Construction Company is bidding on a project to install a large flood drainage culvert from Dandridge to a distant lake. If they bid $2,000,000 for the job, what is the benefit-cost ratio in view of the following data? The MARR is 6% per year, and the project’s life is 30 years.

Calculate the benefit cost ratio.

Explanation of Solution

Time period is denoted by n and interest rate (MARR) is denoted by i. Benefit cost ratio (BC) can be calculated as follows.

Benefit cost ratio is 0.72. Since the benefit cost ratio is less than 1, it is not acceptable 1. To make the acceptable project, the bid price need to decrease. The new maximum bid amount to accept the project (B) can be calculated as follows.

Maximum amount bid is $1,306,198.

Want to see more full solutions like this?

Chapter 10 Solutions

Engineering Economy (16th Edition) - Standalone book

- Given the data for two alternatives, choose the better alternative using the B/C ratio analysis. MARR = 8%arrow_forwardThe city of Oak Ridge is considering the construction of a three kilometer (km) greenway walking trail. It will cost $1,000 per km to build the trail and $320 per km per year to maintain it over its 23-year life. If the city's MARR is 10% per year, what is the equivalent uniform annual cost of this project? Assume the trail has no residual value at the end of 23 years.arrow_forwardTwo remediation options are being considered for a contaminated land area formerly used for industrial operations. Option 1 involves removing all of the contaminated soil over a two-year period at a cost of 2.2 million per year. Option 2 is to leave the soil in place but treat it with a bioremediation agent at a cost of 960,000/year over a three-year period. Subsequently, the soil would be sampled each for the next five years to ensure the effectiveness of the treatment system. The cost of the sampling program would be 250,000 the first year and 100,000/year for the remaining years.Draw a cash flow diagram for each of the two options.Calculate the net present value of each option based on discount rate of 6 percent/year.Which option has the lowest overall cost? What is the difference in the total cost between the two options based on NPV? Give your answer both in dollars and as a percentage difference.arrow_forward

- which projects should be considered as the base alternative and the first-choice alternative.arrow_forwardThe following three mutually exclusive alternative proposals are being considered for flood proofing a factory building that is located in an area subject to occasional flooding by a nearby river. 1. Do nothing: Damage to the building in a moderate flood is $11,000 and in a severe flood it is $24,000. 2. Protect the building with a one-time initial expenditure of $20,000 so that the building can withstand moderate flooding without any damage and withstand severe flooding with only a$12,000 damage. 3. Protect the building with a one-time initial expenditure of $32,000 so that the building can withstand any flooding with no damage at all. In any year, there is a 21% probability of moderate flooding and a 10% probability of severe flooding. Using a MARR of 8% per year and a service life of 12 years, determine which of the three alternatives is the most economical. (a) Calculate EUAC values for each scenario (use negative numbers for costs) The expected EUAC for the "Do…arrow_forwardRecent development near Eugene, Oregon, has identified a need for improved access to Interstate 5 at one location. Civil engineers and public planners are considering three alternative access plans. Benefits are estimated for the public in general; disbenefits primarily affect some local proprietors who will see traffic pattern changes as undesirable. Costs are monetary for construction and upkeep, and savings are a reduction in cost of those operations today that will not be necessary in the future. All figures are relative to the present situation, retention of which is still an alternative, and are annualized over the 20-year planning horizon. Solve, a. What is the B/C ratio for each of these alternatives? b. Using incremental B/C ratio analysis, which alternative should be selected? c. Determine the value of B − C for each alternative.arrow_forward

- Two remediation options are being considered for a contaminated land area formerly used for industrial operations. Option 1 involves removing all of the contaminated soil over a two-year period at a cost of 2.2$ million per year. Option 2 is to leave the soil in place but treat it with a bioremediation agent at a cost of 950,000$/year over a three-year period. Subsequently, the soil would be sampled each year for the next five years to ensure the effectiveness of the treatment system. The cost of the sampling program would be 240,000$ the first year and 120,000 $/year for the remaining four years.a)Calculate the net present value of each option based on a discount rate of 5% . (Hint: draw a cash flow diagram for each of the two options.)arrow_forwardAn investment with a first cost of $265,000 leads to annual benefits of $51,000 over a period of ten years. Determine the benefit cost ratio for this investment assuming an interest rate of 10% per year and no salvage value.arrow_forwardExplain how the viewpoint established before a public sector analysis is started can turn an estimate from being categorized as a disbenefit to a cost, or vice versa.arrow_forward

- DPWH is considering building a new expressway going to Bicol to cut the travel time of consumers going south of Luzon. The expressway will be collecting toll from the users of the expressway. The B–C ratio method must be applied in the evaluation. Investment costs of the structure are estimated to be Php 1,000,000,000, and Php 17,000,000 per year in operating and maintenance costs are anticipated. Revenues generated from the toll are anticipated to be Php 125,000,000 in its first year of operation, with a projected annual rate of increase of 3% per year due to the anticipated annual increase in traffic. Using the problem above, assuming zero market (salvage) value for the expressway at the end of 30 years and a MARR of 10% per year, should the expressway be constructed? Solve using PW.arrow_forwardA bridge is to be constructed now as part of a new road. Engineers have determined that traffic density on the new road will justify a two-lane road and a bridge at the present time. Because of uncertainty regarding future use of the road, the time at which an extra two lanes will be required is currently being studied. The two-lane bridge will cost $220,000 and the four-lane bridge, if built initially, will cost $420,000. The future cost of widening a two-lane bridge to four lanes will be an extra $220,000 plus $26,000 for every year that widening is delayed. The MARR used by the highway department is 18% per year. The following estimates have been made of the times at which the four-lane bridge will be required:arrow_forwardSacramento is considering building a temporary bridge to cut travel time during the three years it will take to build the new permanent “I” Street bridge to West Sacramento. The temporary bridge would be constructed over two years at a cost of $300,000 each year. At the beginning of the fourth year following three years of useful life it would be removed at a cost of $80,000. City cost-benefit analysts predict that the benefits in real dollars would be $200,000 during the first year, $300,000 during the second year, and $400,000 during the third year. Set up the NPV equation for the CBA.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education