Concept explainers

Cost of plant assets

C1

Kegler Bowling installs automatic scorekeeping equipment with an invoice cost of $190,000. The electrical work required for the installation costs $20,000. Additional costs are $4,000 for delivery and $13,700 for sales tax. During the installation, a component of the equipment is carelessly left on a lane and hit by the automatic lane-cleaning machine. The cost of repairing the component is $1,850.

What is the total recorded cost of the automatic scorekeeping equipment?

Total Recorded Cost:

Total recorded cost refers to the expenses suffered to bring the fixed asset in working state. For example, installation expenses, delivery expenses.

To compute:

Recorded cost of the equipment.

Explanation of Solution

Given,

Cost of equipment is $190,000.

Installation costs are $20,000.

Delivery costs are $4,000.

Sales tax is $13,700.

Repair cost is $ 1,850.

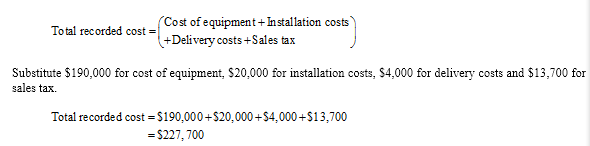

Formula to calculate total recorded cost,

Repair cost is revenue expenditure and therefore the cost of repair will not be included in the total cost of equipment.

Hence, total recorded cost is $227,700.

Want to see more full solutions like this?

Chapter 10 Solutions

FUND.ACCT.PRIN.-CONNECT ACCESS

- A Cost of a Fixed Asset Mist City Car Wash purchased a new brushless car-washing machine for one of its bays. The machine cost $41,700. Mist City borrowed the purchase price from its bank on a 1-year, 8% note payable. Mist City paid $975 to have the machine transported to its place of business and an additional $200 in shipping insurance. Mist City incurred the following costs as a part of the installation: During the testing process, one of the motors became defective when soap and water entered the motor because its cover had not been installed properly by Mist Citys employees. The motor was replaced at a cost of $640. Required: 1. Compute the cost of the car-washing machine. 2. CONCEPTUAL CONNECTION Explain why any costs were excluded from the cost of the machine.arrow_forwardAcquisition Cost Desert State University installed a HD video board with an invoice price of $5,000,000 in its football stadium. Desert State paid an additional $100,000 of delivery and installation costs relating to this board. Because this is one of the largest boards in the world, Desert State also installed ten 5-ton air conditioning units at a total cost of $120,000 to keep the board cool in the desert heat. Required: Determine the cost of the video board.arrow_forwardDEPLETION: CALCULATING AND JOURNALIZING Mining Works Co. acquired a copper mine at a cost of 1,200,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,000,000 tons. (a) During the first year, 400,000 tons are mined and sold. (b) During the second year, 700,000 tons are mined and sold. REQUIRED 1. Calculate the amount of depletion expense for both years. 2. Prepare general journal entries for depletion expense.arrow_forward

- DEPLETION: CALCULATING AND JOURNALIZING Mineral Works Co. acquired a salt mine at a cost of 1,700,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,400,000 tons. (a) During the first year, 200,000 tons are mined and sold. (b) During the second year, 600,000 tons are mined and sold. REQUIRED 1. Calculate the amount of depletion expense for both years. 2. Prepare general journal entries for depletion expense.arrow_forwardBetterment versus Maintenance Expenditures During the year, Graham International made the following expenditures relating to plant, machinery, and equipment: Completed regularly scheduled repairs at a cost of $300,000. Overhauled several stamping machines at a cost of $550,000 to improve production efficiency. Replaced a broken cooling pump on a 100-ton press at a cost of $30,000. Required Identify which expenditures should be expensed as a maintenance expense or capitalized as a betterment outlay. Total amount charged as maintenance expense for the year: $Answer Total amount charged as betterment outlays for the year: $Answerarrow_forwardQUESTION FOUR Richy Limited has plant that cost R345 000 on 01 January 2016. Installation andmodification costs R69 000 (including vat). Transfer costs paid to lawyer amounted toR20 000. Transport costs for bringing the asset to location amounted to R20 000. Theplant was ready for use on 01 January 2016. The machines were cleaned on 01 March2016 at a cost of R10 000. Due to the low order levels in April 2016 the plant stood idle.Depreciation is provided over its useful life of 5 years using the straight-line method to anil residual value. Richy Limited measures plant under the revaluation model. The plant was revalued asfollows: 31 December 2016 R310 00031 December 2017 R300 00031 December 2018 R250 000 Richy Limited transfers the maximum amount from the realised portion of therevaluation surplus to equity. VAT must be calculated at 15%.Required:Disclose the above information in the notes to the financial statements for years ending2016, 2017 and 2018. (Include in you answer the…arrow_forward

- 7. Champion Contractors completed the following transactions involving equipment. Year 1 January 1 Paid $322,000 cash plus $12,880 in sales tax and $1,800 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $32,200 salvage value. Loader costs are recorded in the Equipment account. January 3 Paid $5,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,500. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $4,200 to overhaul the loader’s engine, which increased the loader’s estimated useful life by two years. February 17 Paid $1,050 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required:Prepare journal entries to record these transactions and events.arrow_forwardAEC purchased an equipment for its manufacturing plant that costs PhP 3,750,000 + 10,000(x). It is estimated to have a useful life of 20 years; scrap value of PhP 375,000, production of 12,345,678 + 15,000(x) units and working hours of 100,000 + 1,500(x) hours. The company uses the equipment for 7,884 hours and produced 876,543 units on the first year and 7,883 hours and produced 987,654 units on thesecond year. Solve for the following: x=09 Working Hours Method -Total Depreciation after the 1st year -book value at the end of the 2nd yeararrow_forwardAEC purchased an equipment for its manufacturing plant that costs PHP 3, 750 000 + PHP 10,000 (01). It is estimated to have a useful life of 20 years; scrap value of PHP 375, 000, production of 12,345,678 + 15,000 (01) units and working hours of 100,000 + 1,500 hours. The company uses the equipment for 7,884 hours and produced 876,543 units on the first year and 7,883 hours and produced 987,654 units on the second year. Solve for the following: a. Double Declining Balance Method - Book value at the end of 2nd yearKindly provide a COMPLETE and CLEAR solution.arrow_forward

- AEC purchased an equipment for its manufacturing plant that costs PHP 3, 750 000 + PHP 10,000 (01). It is estimated to have a useful life of 20 years; scrap value of PHP 375, 000, production of 12,345,678 + 15,000 (01) units and working hours of 100,000 + 1,500 hours. The company uses the equipment for 7,884 hours and produced 876,543 units on the first year and 7,883 hours and produced 987,654 units on the second year. Sol ve for the following: a. Straight Line Method - Total Depreciation after the 1st year - Book value at the end of 2nd yearKindly provide a COMPLETE and CLEAR solutions.arrow_forwardAn industrial air conditioner with an expected useful operating life of 30.000 hours costs $45,000. It is known that the salvage value of the air conditioner is $10,000 at the end of its useful life. The total working time of the air conditioner diuring first year is 4,000 hours. Find the depreciation for the first year by using the unit-of-production met hod. A) $5,333.33 B) $4,666.67 C) $6,000.00 D) Answers A, B and C are not correctarrow_forwardFE17 Revson Corporation purchased land adjacent to its plant to improve access for trucks makingdeliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $55,000;broker’s fees, $6,000; title search and other fees, $5,000; demolition of an old building on theproperty, $5,700; grading, $1,200; digging foundation for the road, $3,000; laying and pavingdriveway, $25,000; lighting $7,500; signs, $1,500.List the items and amounts that should be included in the Land accountarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,