FUNDAMENTAL OF CORPORATE FINANCE

4th Edition

ISBN: 9781323942925

Author: Berk

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 20P

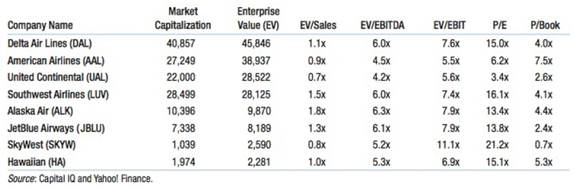

Consider the following data for the airline industry for December 2015 (EV= enterprise value, Book = equity book value). Discuss the potential challenges of using multiples to value an airline.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Give an example of how general economic trends would affect sales forecasting in the airline industry.

Case Study Questions

What was the total postpaid revenue in 2017?

What was the total net profit in 2017?

Identify examples of strategies adopted by MAXIS in that year.

How were the above strategies related to their Customer Relationship Management (CRM) and future sale?

1) Analyze the time-series of each company’s sales growth (i.e., growth in operating revenue). If you average sales growth over the 2015 through 2019 period, which airline is experiencing greater growth pre-COVID19?a) DELTA

b) ALLEGIANT

2) Analyze each company’s gross margin (operating income, or EBIT, divided by operating revenue). Which company has better historical pre-COVID19 gross margins?a) DELTAb) ALLEGIANT

3) Understanding that depreciation expense is largely dependent on management decision making, recalculate gross margin but add depreciation and amortization back to EBIT; in other words, calculate gross margin using EBITDA. Does examining gross margin using EBITDA change your answer to question #2?

a) Yes b) No

4) With respect to leverage, company _______ is more highly levered (i.e., has more debt) than company _______.a) DELTA, ALLEGIANTb) ALLEGIANT, DELTA

5) Compute ROE as NI ÷ (Average Owners’ Equity). Delta’s 2019 ROE is approximately _____ and Allegiant’s 2019 ROE is…

Chapter 10 Solutions

FUNDAMENTAL OF CORPORATE FINANCE

Ch. 10 - Prob. 1CCCh. 10 - Why do we ignore interest payments on the firm's...Ch. 10 - Prob. 3CCCh. 10 - What implicit assumptions do we make when valuing...Ch. 10 - State the efficient markets hypothesis.Ch. 10 - Prob. 6CCCh. 10 - Prob. 7CCCh. 10 - Prob. 8CCCh. 10 - What are the advantages of valuing a stock based...Ch. 10 - Prob. 2CT

Ch. 10 - Prob. 3CTCh. 10 - Prob. 4CTCh. 10 - Prob. 5CTCh. 10 - Prob. 6CTCh. 10 - Prob. 7CTCh. 10 - Prob. 8CTCh. 10 - Prob. 9CTCh. 10 - Prob. 1CQCh. 10 - Compute the IRR and payback period of each...Ch. 10 - Estimate Nanovo's equity cost of capital. Use it...Ch. 10 - Should Nanovo expand the plant? If so, which...Ch. 10 - Prob. 5CQCh. 10 - Suppose Nanovo announces the major expansion and...Ch. 10 - DATA CASE As a new junior analyst for a large...Ch. 10 - Prob. 2DCCh. 10 - Prob. 3DCCh. 10 - Prob. 4DCCh. 10 - Prob. 5DCCh. 10 - To calculate an estimate of JNJ price based on a...Ch. 10 - Compare the stock prices produced by the two...Ch. 10 - Prob. 8DCCh. 10 - Prob. 1PCh. 10 - Prob. 2PCh. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Prob. 6PCh. 10 - Prob. 7PCh. 10 - Prob. 8PCh. 10 - Consider the valuation of Nike given in Example...Ch. 10 - 10. You are evaluating the stock price Of Kroger,...Ch. 10 - Prob. 11PCh. 10 - Prob. 12PCh. 10 - Prob. 13PCh. 10 - Prob. 14PCh. 10 - SLYMN Enterprises has a P/E ratio of 12 and a...Ch. 10 - Prob. 16PCh. 10 - Prob. 17PCh. 10 - Prob. 18PCh. 10 - Prob. 19PCh. 10 - Consider the following data for the airline...Ch. 10 - Prob. 21PCh. 10 - Summit Systems has an equity cost of capital of...Ch. 10 - Assume that Cola Co. has a share price of $43. The...Ch. 10 - Roybus, Inc., a manufacturer of flash memory, just...Ch. 10 - Prob. 25PCh. 10 - 26. You have a $100,000 portfolio made up of 15...Ch. 10 - Prob. 27P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In January 2022, United Airlines had a market capitalization of $14.74 billion, debt of $36.27 billion, and cash of $18.06 billion. United Airlines had revenues of $24.46 billion. Southwest Airlines had a market capitalization of $26.56 billion, debt of 12.49 billion, cash of $15.73 billion, and revenues of $15.42 billion. b. Compare the enterprise value-to-revenue ratio for United Airlines and Southwest Airlines.c. Which of these comparisons is more meaningful?arrow_forwardCompose a financial analysis based on your evaluation of the ratios. Comparison between 2020E ratios and industry averages - (c) Asset utilization ratios; (1) Are the 2020E ratios above, below, or equal to the industryaverages? 2) Is this a good thing or a bad thing for the company? and (3) What can be done to improve the weak ratios or to maintainthe strong ones? (d) Profitability ratios (1) Are the 2020E ratios above, below, or equal to the industryaverages? ( 2) Is this a good thing or a bad thing for the company? and (3) What can be done to improve the weak ratios or to maintainthe strong ones? (e) Market performance ratios. (1) Are the 2020E ratios above, below, or equal to the industryaverages? ( 2) Is this a good thing or a bad thing for the company? and (3) What can be done to improve the weak ratios or to maintainthe strong ones?arrow_forwardComment on Jets Ltd profitability, efficiency, liquidity and solvencyarrow_forward

- The Table also provides financial indicators for the chemical and related products industry (Chemicals and Allied Products) for the year 2018. This will allow you to compare the performance of both firms J & J and Merck with the industry in which they compete for the same year. Do you understand that the performance of firms is superior to the average performance of their competitors in the market? Justify your answer. What adjustments or changes would you recommend to make each of the firms more attractive to shareholders and others interested in them? Justify your answer. Company Name: Year 2018 Chemicals and Allied Products Industry Ratios ………….. Solvency or Debt Ratios Merck J&J 2018 Debt ratio 0.67 0.61 0.47 Debt-to-equity ratio 0.93 0.51 0.38 Interest coverage ratio 12.27 18.91 -9.43 Liquidity Ratios Current ratio 1.17 1.47 3.47 Quick ratio 0.92 1.16 2.12 Cash…arrow_forwarda. As a financial analyst at a leading UK investment company, one of your tasks is to assess drivers of profitability, in order to provide investment recommendations.Required:Based on the current year (2022) conditions, critically discuss three internal and three external factors that would affect the profitability of firms operating in the airline industry. b. The summarised reformulated items (£) for B&M plc for financial years 2020 and 2021 are given below: 2021£ (millions) 2020£ (millions) Operating assets 3322.45 3530.43 Operating liabilities 561.26 611.08 Financial assets…arrow_forwardBased on publicly available data, compare the four mega-carriers across the following characteristics:a. Number of aircraft by type; b. Number of employees; c. Departures; d. Revenue passengers;e. Revenue passenger miles; f. Available seat miles; g. Operating revenue (total); h. Operating revenue per seat mile; i. Operating profit.arrow_forward

- Please explain how to answer these questions, including the formulas I should use, the steps I should follow, and which financial statements to look at if relevant. 1.5 Calculate the sustainable growth rate for Top Harvest using the financial results of 2020/21 and comment on how Top Harvest could improve their sustainable growth rate in the future. 1.7 Calculate the Economic Value Added for Top Harvest (using Total Assets and not Net Assets) and comment on the performance of the business and how they could improve the EVA 1.6 Calculate the Weighted Average Cost of Capital for Top Harvest using the following information:arrow_forwardRiver Valley Production Inc. seeks to increase its market share and improve its results. The company takes as a starting point the current scenario and the results obtained in 2018 and 2019. Like other companies, River Valley uses financial ratios (ratios) as tools for analyzing the results obtained at the end of the period. Consider the data presented in the financial statements below and analyze the company's results based on the financial ratios.1. Use the financial statements to calculate the following financial ratios for the years 2018 and 2019:1.8 Return on Investment (ROI)1.9 Profit Margin1.10 Debt to Equity Ratio1.11 Price/Earning Ratio Balance Sheet 2018 2019 Cash $63,000 $201,000 Accounts Receivable 199,000 305,000 Marketable Securities 81,000 42,000 Inventories 441,000 455,000 Prepaids 5,000 9,000 Total Current Assets 789,000 1,012,000 Property, Plant, and Equipment, net 858,000 858,000…arrow_forward1.How is the company's financial performance based on the data? 2.What do you think are the factors affecting the number of bookings throughout the year? 3. What can you say about the company's revenue for 2020? Regardless if it's good or not, give strategic decisions that can help improve the revenue from its current status 4. What are your analysis and insights on the Financial statement.arrow_forward

- After conducting a CVP analysis, most businesses will then recreate a revised or projected income statement incorporating the results of the CVP analysis. What is the benefit of taking this extra step in the analysis?arrow_forwardAnalyze the financial statements of the company to you in terms of:5) Profitability Ratio2020 Analysis BUT also compare with 2018 - 2019. Please show your solution on computation.arrow_forwardPlease help answer these questions below for the company APPLE with the latest DATA. How would you assess the company's market and industry performance based on its five-year revenues and earnings results? How does the company's five-year performance compare to its industry peers over the same time period? What portfolio recommendations or asset allocation strategies might you consider to improve investment performance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License