To find: The

Introduction:

The variation between the present value of the cash outflows and the present value of the cash inflows are known as the net present value. In capital budgeting the net present value is utilized to analyze the profitability of a project or investment. The rate of return which equates the initial investment and the present value of net cash inflows are referred to as internal rate of return. This is also called as actual rate of return.

Answer to Problem 32QP

The net present value is $4,725,575.74 and the internal

Explanation of Solution

Given information:

Company A projects the unit sale for the new 7 octave voice emulation implant as follows:

- The year 1 unit sales is 84,000

- The year 2 unit sales is 98,000

- The year 3 unit sales is 113,000

- The year 4 unit sales is 106,000

- The year 5 unit sales is 79,000

The production implant needs $1,500,000 in the net working capital to begin their production activities. The extra net working capital investment for every year is equivalent to the 15% of the sales that is projected has to rise for the following year. The total fixed cost is $3,400,000 for a year, the unit price is $395, and the variable production cost is $265. The installation cost of the equipment is $17,000,000.

The equipment is qualified in the 7 Year MACRS

MACRS depreciation table for year 7:

| MACRS Depreciation table for seven year | |

| Year | Seven year |

| 1 | 14.29% |

| 2 | 24.49% |

| 3 | 17.49% |

| 4 | 12.49% |

| 5 | 8.93% |

| 6 | 8.92% |

| 7 | 8.93% |

| 8 | 4.46% |

Computation of the net present value:

Computation of the

Table showing the cash inflows:

| Year | 1 | 2 | 3 | 4 | 5 |

| Ending book value | $14,570,700 | $10,407,400 | $7,434,100 | $5,310,800 | $3,792,700 |

| Sales | $33,180,000 | $38,710,000 | $44,635,000 | $41,870,000 | $31,205,000 |

| Less: Variable costs | -$22,260,000 | -$25,970,000 | -$29,945,000 | -$28,090,000 | -$20,935,000 |

| Fixed costs | -$3,400,000 | -$3,400,000 | -$3,400,000 | -$3,400,000 | -$3,400,000 |

| Depreciation | -$2,429,300 | -$4,163,300 | -$2,973,300 | -$2,123,300 | -$1,518,100 |

| EBIT | $5,090,700 | $5,176,700 | $8,316,700 | $8,256,700 | $5,351,900 |

| Less: Taxes | -$1,781,745 | -$1,811,845 | -$2,910,845 | -$2,889,845 | -$1,873,165 |

| Net income | $3,308,955 | $3,364,855 | $5,405,855 | $5,366,855 | $3,478,735 |

| Add: Depreciation | $2,429,300 | $4,163,300 | $2,973,300 | $2,123,300 | $1,518,100 |

| Operating cash flow | $5,738,255 | $7,528,155 | $8,379,155 | $7,490,155 | $4,996,835 |

| Net cash inflows: | |||||

| Operating cash flow | $5,738,255 | $7,528,155 | $8,379,155 | $7,490,155 | $4,996,835 |

| Change in net working capital | –829,500 | –888,750 | $414,750 | $1,599,750 | $1,203,750 |

| Capital spending | $0 | $0 | $0 | $0 | $3,537,445 |

| Total cash inflows | $4,908,755 | $6,639,405 | $8,793,905 | $9,089,905 | $9,738,030 |

Computations for the above table:

Formula to calculate the ending book value:

Computation of the ending book value for year 1:

Formula to calculate the sales:

Computation of the sales:

Computation of the depreciation:

The depreciation amount is calculated by using the MACRS depreciation table for seven years.

Formula to calculate depreciation:

Computation of the depreciation:

Formula to calculate the taxes:

Computation of the taxes:

Formula to calculate the net working capital:

Computation of the net working capital:

Computation of the net working capital for the year 5:

Computation of the ending book value:

Formula to calculate the after-tax salvage value:

Computation of the after-tax salvage value:

Formula to calculate the net present value:

Computation of the net present value:

Hence, the net present value is $4,725,575.74.

Computation of the internal rate of return:

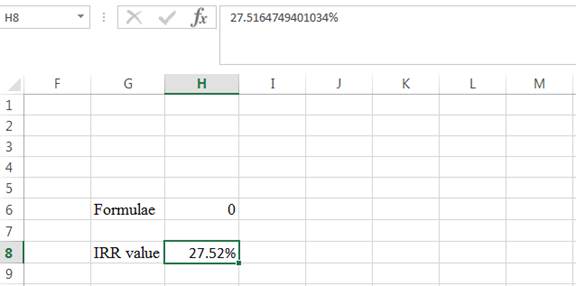

The internal rate of return is calculated by the spreadsheet method.

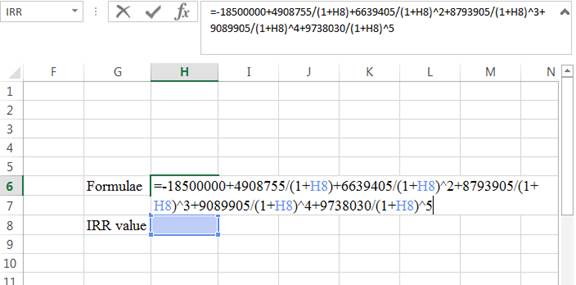

Step 1:

- Type the formulae of the internal rate of return in H6 in the spreadsheet and consider the IRR value as H8

Step 2:

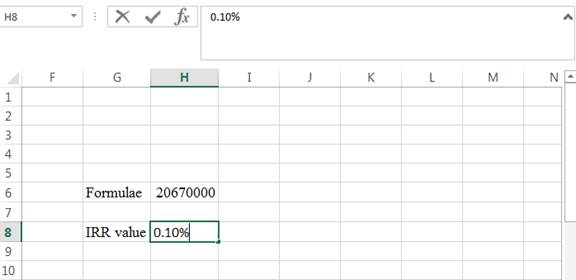

- Assume the IRR value as 0.10%

Step 3:

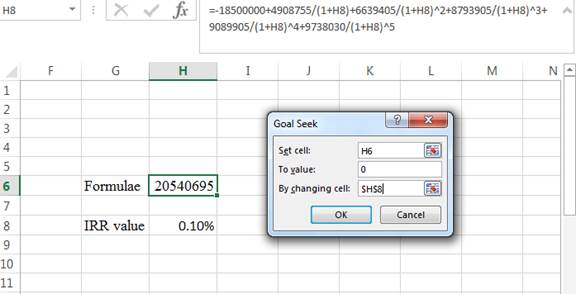

- In the spreadsheet go to data and select the what-if analysis.

- In what-if analysis select goal seek

- In set cell select H6 (the formulae)

- The To value is considered as 0

- The H8 cell is selected for the by changing cell.

Step 4:

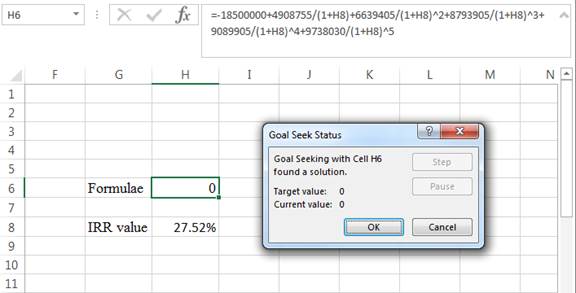

- Following the previous step click OK in the goal seek. The goal seek status appears

Step 5:

- The IRR value appears to be 27.5164749401034%

Hence, the internal rate of return is 27.52%.

Want to see more full solutions like this?

Chapter 10 Solutions

FUND. OF CORPORATE FIN. 18MNTH ACCESS

- A3 8aii You are considering a new product launch. The project will cost $680,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 100 units per year, price per unit will be $19,000, variable cost per unit will be $14,000, and fixed costs will be $150,000 per year. The required return on the project is 15%, and the relevant tax rate is 35%. Ignore the half-year rule for accounting for depreciation. a. Calculate the following six numbers for this project. Round your answers to two decimal places. (ii) Profitability Index (PI)arrow_forwardengineering economy (multiple choice) 3.) Consider a project which involves the investment of P100,000.00 now and P100,000 at the end of one year. Revenues of P150,000 will be generated at the end of years 1 and 2. What is the net present value of this project if the annual interest rate is 10%? a.) P69,421.50 b.) P67,421.50 c.) P68,421.50 d.) P65,421.50arrow_forwardA3 8aiii You are considering a new product launch. The project will cost $680,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 100 units per year, price per unit will be $19,000, variable cost per unit will be $14,000, and fixed costs will be $150,000 per year. The required return on the project is 15%, and the relevant tax rate is 35%. Ignore the half-year rule for accounting for depreciation. a. Calculate the following six numbers for this project. Round your answers to two decimal places. (iii) Payback period (in years)arrow_forward

- A3 8aiv You are considering a new product launch. The project will cost $680,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 100 units per year, price per unit will be $19,000, variable cost per unit will be $14,000, and fixed costs will be $150,000 per year. The required return on the project is 15%, and the relevant tax rate is 35%. Ignore the half-year rule for accounting for depreciation. a. Calculate the following six numbers for this project. Round your answers to two decimal places. (iv) Discounted payback period (in years)arrow_forwarduse excel/show all excel formulas answering the following LO3 20. Sensitivity Analysis We are evaluating a project that costs $1.68 million, has a six-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 90,000 units per year. Price per unit is $37.95, variable cost per unit is $23.20, and fixed costs are $815,000 per year. The tax rate is 21 percent, and we require a return of 11 percent on this project. a. Calculate the base-case cash flow and NPV. What is the sensitivity of NPV to changes in the sales figure? Explain what your answer tells you about a 500-unit decrease in projected sales. b. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. LO3 21. Scenario Analysis In the previous problem, suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to…arrow_forwardA3 8ai You are considering a new product launch. The project will cost $680,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 100 units per year, price per unit will be $19,000, variable cost per unit will be $14,000, and fixed costs will be $150,000 per year. The required return on the project is 15%, and the relevant tax rate is 35%. Ignore the half-year rule for accounting for depreciation. a. Calculate the following six numbers for this project. Round your answers to two decimal places. (i) NPVarrow_forward

- show all excel formulas/ work answering the following: LO2 30. Calculating Required Savings A proposed cost-saving device has an installed cost of $565,000. The device will be used in a five- year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $40,000, the tax rate is 23 percent, and the project discount rate is 12 percent. The device has an estimated Year 5 salvage value of $55,000. What level of pretax cost savings do we require for this project to be profitable?arrow_forwardA3 8avi You are considering a new product launch. The project will cost $680,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 100 units per year, price per unit will be $19,000, variable cost per unit will be $14,000, and fixed costs will be $150,000 per year. The required return on the project is 15%, and the relevant tax rate is 35%. Ignore the half-year rule for accounting for depreciation. a. Calculate the following six numbers for this project. Round your answers to two decimal places. (vi) Average Accounting Return (AAR in %) Hint: Net Income = {[(Price – variable cost)*Quantity Sold] – Fixed Costs – Depreciation} * (1 – Tax rate)arrow_forward16) New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $810,000, and it would cost another $19,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $471,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $16,500. The sprayer would not change revenues, but it is expected to save the firm $314,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? ________$ What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $…arrow_forward

- #11 NPV A proposed nuclear power plant will cost 2.2 to build and then will produce cash flow of 3 million per year for 15 years. After that period (in 15 years) it must be decommissioned at a cost of 900 million. What is the project NPV if the discount rate is 5%? What is the discount rate at 18%?arrow_forwardA company just paid $10 million for a feasibility study. If the company goes ahead with the project, it must immediately spend another $84,052,480 now, and then spend $20 million in one year. In two years it will receive $80 million, and in three years it will receive $90 million. If the cost of capital for the project is 11 percent, what is the project’s NPV 10.6. 1 newarrow_forwardEngineering economy - ENGR 3322 The International Parcel Service has installed a new radio frequency identification system to help reduce the number of packages that are incorrectly delivered. The capital investment in the system is $65,000, and the projected annual savings are tabled below. The system’s market value at the EOY five is negligible, and the MARR is 18% per year. Calculate the annual worth of the project. a. $ 9,750 b. $ 10,750 c. $ 11,750 d. None of the choicesarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education