Concept explainers

Beasley Ball Bearings paid a

a. Compute the anticipated value of the dividends for the next four years. That is, compute

b. Discount each of these dividends back to present at a discount rate of 15 percent and then sum them.

c. Compute the price of the stock at the end of the fourth year

d. After you have computed

e. Add together the answers in part b and part d to get

f. Use Formula 10-8 to show that it will provide approximately the same answer as part e.

For Formula 10-8, use

g. If current EPS were equal to

h. By what dollar amount is the stock price in part g different from the stock price in part f?

i. In regard to the stock price in part

a.

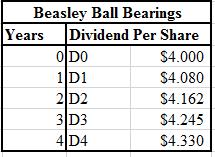

To calculate: The anticipated value of dividends for the next four years to be declared by Beasley Ball Bearings.

Introduction:

Dividends:

It refers to the distribution of profits to the shareholders of the company and can be paid in terms of cash and stock by the company.

Answer to Problem 35P

The calculation for the next four anticipated dividends is shown below:

Explanation of Solution

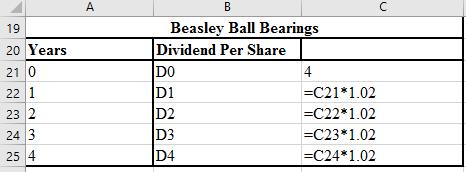

The formulae used for the calculation of the anticipated dividends are shown below:

b.

To calculate: The summation of the present values of the four anticipated dividends discounted at the rate of 15% of Beasley Ball Bearings.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 35P

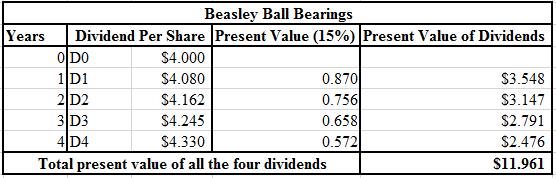

The calculation of the present values of the next four dividends is shown below:

Hence, the sum of the present value of the next four anticipated dividends is $11.961.

Explanation of Solution

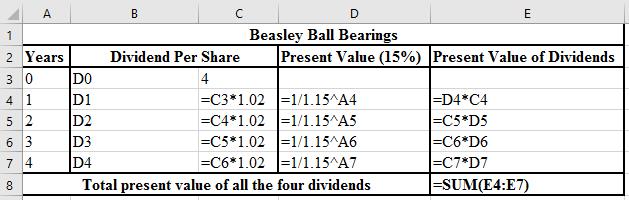

The formula used in the calculation of the present values are shown below:

c.

To calculate: The price of the common stock at fourth year (P4), issued by Beasley Ball Bearings.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock at the end of the fourth year will be $33.977.

Explanation of Solution

Calculation of the stock price:

Working notes:

Calculation of the fifth year expected dividend:

d.

To calculate: The present value of P4 at a discount rate of 15% for Beasley Ball Bearings.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 35P

The present value of P4 at time zero discounted at 15% will be $19.435.

Explanation of Solution

Calculation of the present value of the stock price in part (c):

e.

To calculate: The current value of the stock.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The current value of the stock is $31.401.

Explanation of Solution

Calculation of the current price of the stock:

f.

To calculate: The current value of the stock.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock is $31.385. This price is approximately the same as calculated in the part (e).

Explanation of Solution

Calculation of the stock price by using the formula 10-8:

g.

To calculate: The current value of the stock.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock is $35.86.

Explanation of Solution

Calculation of the price of the stock:

Working Notes:

Calculation of firm’s P/E ratio:

h.

To calculate: The difference between the stock price calculated in part (g) and part (f) for Beasley Ball Bearings.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The dollar amount difference between the stock price in part (g) and part (f) is $4.47.

Explanation of Solution

Calculation of the difference between the stock price in part (g) and part (f):

i.

To calculate: The effect of changing variables on the stock price.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

Answer to Problem 35P

The price of the stock will increase in the 1st and 3rd parts, whereas it will decrease in the 2nd part.

Explanation of Solution

(1) If D1 increases, then the stock price will go up. The stock price and the amount of dividend are positively related to one another.

(2) If the required rate of return increases the stock price will decrease, exhibiting an inverse relationship.

(3) If the growth rate (g) increases, then the price of the stock will also increase. They exhibit a positive relationship.

Want to see more full solutions like this?

Chapter 10 Solutions

Foundations Of Financial Management

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning