Loose Leaf for McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

10th Edition

ISBN: 9781260189728

Author: Brian C. Spilker Professor, Benjamin C. Ayers, John Robinson Professor, Edmund Outslay Professor, Ronald G. Worsham Associate Professor, John A. Barrick Assistant Professor, Connie Weaver

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 46P

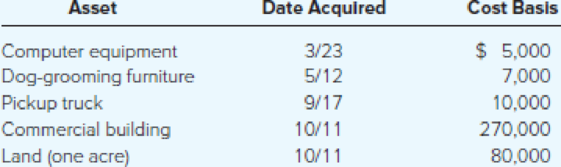

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff’s Palace. Poplock bought and placed in service the following assets during the year:

Assuming Poplock does not elect §179 expensing and elects not to use bonus

- a) What is Poplock’s year 1 depreciation deduction for each asset?

- b) What is Poplock’s year 2 depreciation deduction for each asset?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Line following information applies to the questions displayed below.

At the beginning of the current year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock

bought and placed in service the following assets during the year:

Asset

Computer equipment

Dog-grooming furniture

Pickup truck

Commercial building

Land (one acre)

Asset

Computer equipment

Dog-grooming furniture

Pickup truck

Date Acquired Cost Basis

3/23

5/12

9/17

10/11

10/11

Assuming Poplock does not elect 5179 expensing and elects not to use bonus depreciation, answer the following.

questions: (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.)

Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no

answer blank. Enter zero if applicable.

Commercial building

Land (one acre)

Total

What is Poplock's year 1 depreciation deduction for each asset?

$

$9,000

11,000

10,000

310,000

120,000

Depreciation

Deduction

At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Computers

Office desks Machinery Office building Asset Asset Assuming Anna does not elect §179 expensing and elects not to use bonus

depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate

calculations. Round your final answers to the nearest whole dollar amount. a. What is Anna's year 1 cost recovery for each asset? Year 1

Cost Recovery Computers Office desks Date Acquired 1/30 2/15 7/25 8/13 $ $ $ $ $ 56,000 X 4,573 10,718 Machinery Office building

Total 75,131 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. Cost

Basis $28,000 $ 32,000 $75,000 $ 400,000 3,840 x

At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the

year:

Computers

Office desks…

At the beginning of the current year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock

bought and placed in service the following assets during the year:

Asset

Computer equipment

Dog-grooming furniture

Pickup truck

Commercial building

Land (one acre)

Problem 10-46 Part a (Algo)

Assuming Poplock does not elect §179 expensing and elects not to use bonus depreciation, answer the following

questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.)

Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no

answer blank. Enter zero if applicable.

a. What is Poplock's year 1 depreciation deduction for each asset?

Answer is complete but not entirely correct.

Depreciation

Deduction

Asset

Computer equipment

Dog-grooming fumiture

Pickup truck

Commercial building

Land (one acre)

Total

Date Acquired Cost Basis

3/23

$9,800

5/12

11,800

9/17

10/11

10/11

$

$

$

$

$

$

10,000

318,000

128,000

3,136

2,247…

Chapter 10 Solutions

Loose Leaf for McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company X incurred the following transactions in the current year. For each transaction, explain whether each transaction is tax deductible under the ITAA. Depreciation on the buildings The company incurred legal expenses opposing an application by its competitor to extend its patent on a brand of mower. If the patent was not extended, then Company X could produce a similar mower. The company borrowed money to cover the purchase of a new plant. The loan is repayable in 10 years. Because of a shortage of working capital, the company was forced to sell off some land. The land had originally been bought in October 1995 The company also purchased a new car for the managing directorarrow_forwardOn May 15, 2020, Aldean Company, a calendar year taxpayer, purchased and placed into service a nonresidential building. The company paid $140,000 total and allocated $40,000 of the cost to the land and $100,000 of the cost to the building based on fair market values. Compute Aldean’s maximum first-year depreciation on the realty.arrow_forwardAt the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Date Cost Asset Acquired Basis Computers 1/30 $ 55,000 Office desks 2/15 $ 59,000 Machinery 7/25 $ 102,000 Office building 8/13 $ 436,000 Assuming Anna does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Anna’s year 1 cost recovery for each asset? b. What is Anna’s year 2 cost recovery for each asset?arrow_forward

- Convers Corporation (calendar year-end) acquired the following assets during the current tax year. (ignore $179 expense and bonus depreciation for this problem): (Use MACRS Table 1. Table 2 and Table 5.) Asset Machinery Computer equipment Delivery truck Furniture Total Date Placed in Service October 25 February 3 MACRS depreciation March 17 April 22 Original Basis *The delivery truck is not a luxury automobile. In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of $600,000. $ $ 100,000 40,000 Problem 2-54 Part a (Algo) a. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect $179 expense and elects out of bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. 64,978 53,000 180,000 $ 373,000 5arrow_forwardAt the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Asset Computers Office desks Machinery Office building Date Acquired 1/30 2/15 Asset 7/25 8/13 Assuming Anna does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2. Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. a. What is Anna's year 1 cost recovery for each asset? Year 1 Cost Recovery Computers Office desks Machinery Office building Total Cost Basis $ 28,000 $ 32,000 $ 75,000 $ 400,000arrow_forwardII. MACRS COMPUTATIONS. Compute the allowable MACRS deduction under each of the following independent situations. Show computations for partial credit. In 2021, Early Company made its only purchase of equipment on October 18. The equipment was used property, costing $1,000,000. Assuming the equipment is in the 5-year recovery class, answer the following 1. questions. a. Can Early Co. elect to use bonus depreciation for the equipment? b. If Early cannot or does not wish to use bonus depreciation for the equipment, what depreciation conventic (table) does Early use for the equipment?arrow_forward

- A company purchased a drill press priced at $170,000 in year 0. The company additionally incurred $30,000 for site preparation and labor to install the machine. The drill press was classified as a seven-year MACRS class property. The company is considering selling the drill press for $70,000 at the end of year 4. Compute the book value at the end of year 4 that should be used in calculating the taxable gains.(a) $62,480(b)$53,108(c) $63,725(d)$74,970arrow_forwardAt the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Asset Date Acquired Cost Basis Computers 1/30 $ 28,000 Office desks 2/15 $ 32,000 Machinery 7/25 $ 75,000 Office building 8/13 $ 400,000 Assuming Anna does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: What is Anna's year 1 cost recovery for each asset?arrow_forwardAlfredo's Pizza Cafe acquires an oven on January 1 of Year 1 for $10,000. Alfredo's capitalizes this asset and depreciates it using the straight-line method with a 10-year useful life and salvage value of $2,000. On January 1 of year 4, the company learns that the asset's fair value is $6,000, and records an impairment loss to reduce the oven's net book value to $6,000. The estimated salvage value is still $2,000, and company does not alter its annual depreciation schedule as a result of the impairment. January 1 of Year 6, Alfredo's Pizza Cafe sells the oven for $7,000. What is the gain or loss on the asset sale? Enter a positive number for a gain and a negative number for a loss.arrow_forward

- Material handling equipment used in the manufacture of sugar is purchased and installed for $250,000. It is placed in service in the middle of the tax year and removed from service 5.5 years later. Determine the MACRSGDS depreciation deduction during each of the tax years involved assuming: a. What is the MACRS-GDS property class? b. The equipment is removed 1 day before the end of the tax year. c. The equipment is removed 1 day after the end of the tax year.arrow_forwardKwan acquired a warehouse for business purposes on August 30, 2002. The building cost $550,000. Kwan took $291,500 of depreciation on the building, and then sold it for $680,000 on July 1, 2022. Required: What is the adjusted basis for the warehouse? What amount of the gain or loss is realized on the sale of the warehouse? What amount of the gain or loss is unrecaptured? At what rate is the unrecaptured gain or loss taxed? What amount of the gain or loss qualifies as a § 1231 gain or loss?arrow_forwardAnne LLC purchased computer equipment (five-year property) on August 29 for $36,000 and used the half-year convention to depreciate it. Anne LLC did not take §179 or bonus depreciation in the year it acquired the computer equipment. During the current year, which is the fourth year Anne LLC owned the property, the property was disposed of on January 15. Calculate the maximum depreciation expense. (Use MACRS Table 1.) (Round final answer to the nearest whole number.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License