Concept explainers

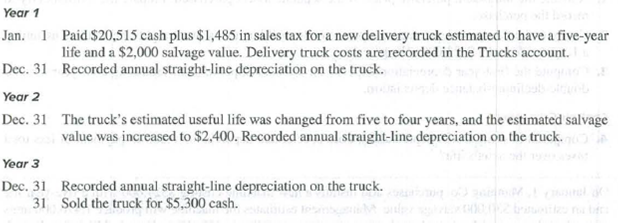

Yoshi Company completed the following transactions and events involving its delivery trucks.

Required

Prepare

Prepare journal entries to record the given transaction and events.

Explanation of Solution

Plant assets:

Plant assets refer to the fixed assets, having a useful life of more than a year that is acquired by a company to be used in its business activities, for generating revenue.

Prepare journal entries to record the given transaction and events as follows:

Year 1:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| January 1, Year 1 | Trucks (1) | 22,000 | ||

| Cash | 22,000 | |||

| (To record the purchase of truck) |

Table (1)

- Truck is an asset account and it increases the value of asset. Therefore, debit the trucks account by $22,000.

- Cash is an asset account and it decreases the value of asset. Therefore, credit Cash account by $22,000.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 1 | Depreciation Expense (2) | 4,000 | ||

| Accumulated Depreciation – Trucks | 4,000 | |||

| (To record the depreciation expense for truck) |

Table (2)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $4,000.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $4,000.

Working Notes:

Compute the acquisition cost of truck:

Compute depreciation expense:

Year 2:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 2 | Depreciation Expense (5) | 5,200 | ||

| Accumulated Depreciation – Trucks | 5,200 | |||

| (To record the depreciation expense for truck) |

Table (3)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $5,200.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $5,200.

Working Notes:

Compute the remaining depreciable amount:

| Computation of Depreciation | |

| Particulars | $ |

| Acquisition cost, January 1, Year 1 | $22,000 |

| Less: Accumulated depreciation for first year | (4,000) |

| Book value | 18,000 |

| Less: Revised salvage value | (2,400) |

| Remaining depreciable amount | $15,600 |

Table (4)

…… (4)

Compute the revised depreciation for year 2

Year 3:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 3 | Depreciation Expense (5) | 5,200 | ||

| Accumulated Depreciation – Trucks | 5,200 | |||

| (To record the annual depreciation expense for truck) |

Table (5)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $5,200.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $5,200.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 3 | Cash | 5,300 | ||

| Accumulated Depreciation – Trucks (6) | 14,400 | |||

| Loss on disposal of trucks (6) | 2,300 | |||

| Trucks | 22,000 | |||

| (To record the sale of truck) |

Table (6)

- Cash is an asset account and it increases the value of asset. Therefore, debit cash account by $5,300.

- Accumulated depreciation is a contra asset, and it increases the value of assets. Therefore, debit the accumulated depreciation by $14,400.

- Loss on sale of truck is an expense account and it decreases the value of stockholder’s equity. Therefore, debit the loss on sale of truck by $2,300.

- Truck is an asset account and it decreases the value of asset. Therefore, credit the trucks account by $22,000.

Working Notes:

Compute the gain or loss on the sale of truck:

| Computation of Gain or Loss on Sale of Truck | ||

| Details | Amount ($) | Amount ($) |

| Cost of the Asset | 22,000 | |

| Less: Accumulated depreciation | ||

| Year 1 (2) | 4,000 | |

| Year 2 (5) | 5,200 | |

| Year 3 (5) | 5,200 | (14,400) |

| Book value of asset | 7,600 | |

| Less: sold value of truck | 5,300 | |

| Loss on sale of Truck | (2,300) | |

Table (7)

...... (6)

Want to see more full solutions like this?

Chapter 10 Solutions

Principles of Financial Accounting.

- The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers: Instructions Journalize the entries to record the transactions of Amsterdam Supply Co.arrow_forwardDecor Services completed the following transactions. Journalize the transactions in general journal form, including brief explanations.arrow_forwardPrepare journal entries for the following transactions from Lumber Wholesale.arrow_forward

- Plumb Line Surveyors provides survey work for construction projects. The office staff use office supplies, while surveying crews use field supplies. Purchases on account completed by Plumb Line Surveyors during May are as follows: Instructions 1. Insert the following balances in the general ledger as of May 1: 2. Insert the following balances in the accounts payable subsidiary ledger as of May 1: 3. Journalize the transactions for May, using a purchases journal (p. 30) similar to the one illustrated in this chapter. Prepare the purchases journal with columns for Accounts Payable, Field Supplies, Office Supplies, and Other Accounts. Post to the creditor accounts in the accounts payable subsidiary ledger immediately after each entry. 4. Post the purchases journal to the accounts in the general ledger. 5. a. What is the sum of the creditor balances in the subsidiary ledger at May 31? b. What is the balance of the accounts payable controlling account at May 31? 6. What type of e-commerce application would be used to plan and coordinate transactions with suppliers?arrow_forwardThe following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to wholesalers and occasionally to retail customers: Instructions Journalize the entries to record the transactions of Green Lawn Supplies Co.arrow_forwardRecord journal entries for the following transactions of Commissary Productions.arrow_forward

- Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identifying letters as transaction codes. Determine the correct ending balance. The ending balance label is provided on the left side of the T account even when the ending balance is a credit. Work in Process b. 56,570 f. 39,200 e. 19,760 Bal. 37,130 ??? Finished Goods e. 39,200 g. 28,810 Bal. 10,390 ??? The T-Accounts are based on these journal entries. a. Materials 33,100 Accounts Payable 33,100 b. Work in Process 56,570 Factory Overhead 5,720 Materials 29,840 Wages Payable 32,450 c. Factory Overhead 6,470 Accounts Payable 6,470 d. Factory Overhead 1,790 Accumulated Depreciation 1,790 e. Work in Process 19,760 Factory Overhead…arrow_forwardA trial balance represents the: Multiple Choice Chronological record of all transactions affecting the company. Process of transferring debit and credit information from the journal to the accounts in the general ledger. List of all accounts and their balances at a particular date to ensure that debits equal credits. Source documents used to determine the effects of transactions on the company's accounts.arrow_forwardThe purchases and disbursements cycle usually begins when Group of answer choices A user department requests for acquisition of goods or services and submits purchase requisition to the purchasing department. A check is issued to the vendor or supplier. The warehouse received the goods from the vendor or supplier. The accounting posts the purchase transaction in the accounts payable ledger.arrow_forward

- Using the following revenue journal for Bowman Cleaners Inc., identify each of the postingreferences, indicated by a letter, as representing (1) posting to general ledger accounts or(2) posting to subsidiary ledger accounts:arrow_forwardPrepare general journal entries for the following transactions of Valdez Services.arrow_forwardTYPES OF FILES For each of the following records, indicate the appropriate related file structure: master file, transaction file, reference file, or archive file. a. customer ledgers b. purchase orders c. list of authorized vendors d. records related to prior pay periods e. vendor ledgers f. hours each employee has worked during the current pay period g. tax tables h. sales orders that have been processed and recordedarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning