(a)

Enterprise Value:

The enterprise value is the measurement of total value of a firm’s equity or theoretical value in order to take over its operations by paying all its debts and cash. It is calculated by subtracting total cash and cash equivalents in the summation of market value of equity and debt.

Stock Price:

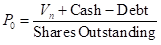

Stock price is the highest amount an investor is willing to pay for a saleable stock of a firm. It can be calculated by the formula given below:

In the given formula,  is enterprise value or present value of expected free cash flows and

is enterprise value or present value of expected free cash flows and  is price of the share.

is price of the share.

To determine:

The stock price of C Incorporation.

(b)

To determine:

The stock price of C Incorporation at the beginning of the second year.

(c)

To determine:

The expected return from C Incorporation at the end of the second year.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Fundamentals of Corporate Finance, Student Value Edition

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education