Concept explainers

Great Adventures

(This is a continuation of the Great Adventures problem from earlier chapters.)

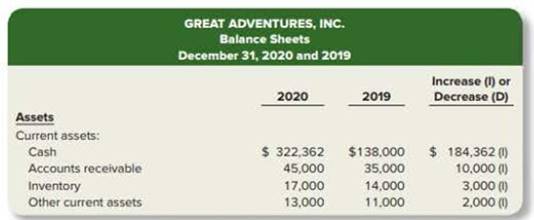

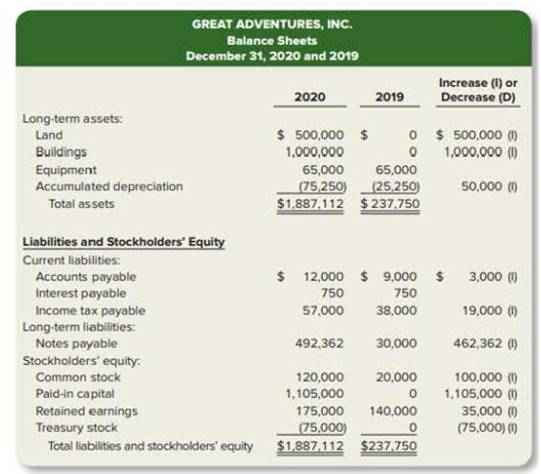

The income statement, balance sheets, and additional information for Great Adventures, Inc., are provided below.

| GREAT ADVENTURES, INC. Income Statement For the year ended December 31, 2020 |

||

| Revenues: | ||

| Service revenue (clinic, racing. TEAM) | $543,000 | |

| Sales revenue (MU watches) | 118,000 | |

| Total revenues | $661,000 | |

| Expenses: | ||

| Cost of goods sold (watches) | 70,000 | |

| Operating expenses | 304,276 | |

| 50,000 | ||

| Interest expense | 29,724 | |

| Income tax expense | 57,000 | |

| Total expenses | 511,000 | |

| Net income | $150,000 | |

Additional Information for 2020:

1. Borrowed $500,000 in January 2020. Made 12 monthly payments during the year, reducing the balance of the loan by $37,638.

2. Issued common stock for $1,200,000.

3. Purchased 10,000 shares of

4. Reissued 5,000 shares of treasury stock at $16 per share.

5. Declared and paid a cash dividend of $115,000.

Required:

Prepare the statement of

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Financial Accounting - Access

- Flip or Flop is a retail shop selling a wide variety of sandals and beach footwear. In 2019, they had gross revenue from sales totaling $93,200. Their operating expenses for this same period were $34,000. If their Cost of Goods Sold (COGS) was 21% of gross revenue, what was their net operating income for the year?arrow_forwardQuality Service Inc. has the following accounts balances in their charts of accounts balances as at June 1, 2020: Cash $138,000; Accounts receivable $0; Land $ 30,000; Building $0; Supplies $0; Accounts payable $0; Notes payable $0; Quality-capital $70,000; Service revenue $98,000; Utilities, salary expense $0. The company also presented the following transactions for the month: June 1. Purchased supplies for $1000 on account June 4. Purchased a building for, $62,100 cash June 6. Performed service for a client on account, $12,000 June 10. Borrowed $7,000 cash, signing a note payable June 13. Paid the liability from June 1 June 17. Sold for $15,000 land that had cost this same amount June 21. Received $8000 cash from June 10 transaction June 30. Paid utilities expense of $600 and salary expense $2,500 Requirements: State the effect each transaction from June 1st -30th will have on the…arrow_forwardQuality Service Inc.has the following accounts balances in their charts of accounts balances as at June 1, 2020: Cash $138,000; Accounts receivable $0; Land $ 30,000; Building $0;Supplies $0; Accounts payable $0; Notes payable $0; Quality-capital $70,000; Service revenue $98,000; Utilities, salary expense $0. The company also presented the following transactions for the month: June 1. Purchased supplies for $1000 on account June 4. Purchased a building for, $62,100 cash June 6. Performed service for a client on account, $12,000 June 10. Borrowed $7,000 cash, signing a note payable June 13. Paid the liability from June 1 June 17. Sold for $15,000 landthat had cost this same amount June 21. Received $8000 cash from June 6 transaction June 30. Paid utilities expense of $600 and salary expense $2,500 Requirements: State the effect each transaction from June 1st -30th will have on the accounting…arrow_forward

- Quality Service Inc. has the following accounts balances in their charts of accounts balances as at June 1, 2020: Cash $138,000; Accounts receivable $0; Land $ 30,000; Building $0; Supplies $0; Accounts payable $0; Notes payable $0; Quality-capital $70,000; Service revenue $98,000; Utilities, salary expense $0. The company also presented the following transactions for the month: June 1. Purchased supplies for $1000 on account June 4. Purchased a building for, $62,100 cash June 6. Performed service for a client on account, $12,000 June 10. Borrowed $7,000 cash, signing a note payable June 13. Paid the liability from June 1 June 17. Sold for $15,000 land that had cost this same amount June 21. Received $8000 cash from June 10 transaction June 30. Paid utilities expense of $600 and salary expense $2,500 Requirements: State the effect each transaction from June 1st -30th will have on the…arrow_forwardThe following information of ABC Merchandise Business for the year ended 31st December 2020 Account Amount (OMR) Sales Discounts 2200 Sales returns 22,000 Sales 257,000 Interest revenue 1000 Gain on Sale of land 2000 Interest expense 7,000 Salesman Salaries 38,000 Office rent 1400 Cost of Goods sold 160,000 Electricity expense – Office 300 Rent expense - office 100 Salesman commission 12500 Advertising expense 3500 Marketing expense 2500 Other non-operating expense 1000 What will be the Income from operation assumes that the business follows Multi step income statement? a. OMR 19,500 b. OMR 9,500 c. OMR 14,500 d. OMR 10,000arrow_forward3. Canine Couture is a specialty dog clothing boutique that sells clothing and clothing accessories for dogs. In 2019, they had gross revenue from sales totaling $86,500. Their operating expenses for this same period were $27,500. If their Cost of Goods Sold (COGS) was 24% of gross revenue, what was their net operating income for the year? Use this information to construct an income statement for the year 2019. Operating Income Cash Retained Earnings Gross Profit Cost of Goods Sold Service Revenue Cost of Services Operating Expenses Sales Revenue PLEASE NOTE: You must enter the account names exactly as written above and all whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Canine Couture Income Statement for Year Ended 2019arrow_forward

- The Following are the accounts of Regina Merchandising for December 31,2019: Sales ₱2,500,000 Salaries Expense 50,000 Supplies Expenses 75,000 Depreciation Expense 60,000 Utilities Expense 40,000 Insurance Expense 20,000 Rent Expense 90,000 Beginning Inventory 50,000 Purhases 1,500,000 Ending Inventory 100,000 Sales Discount 5,000 You were employed by the entity as its bookkeeper in its first year of operations. You are now to prepare the necessary financial statements for the current year. Accordingly, 15% of rent, depreciation and utility expenses pertain to the sales office while the rest pertains to the corporate office. Instructions: 1. How much is the net sales for the year? 2. How much is the cost of sales for the year? 3. How much is the gross…arrow_forwardThe Following are the accounts of Regina Merchandising for December 31,2019: Sales ₱2,500,000 Salaries Expense 50,000 Supplies Expenses 75,000 Depreciation Expense 60,000 Utilities Expense 40,000 Insurance Expense 20,000 Rent Expense 90,000 Beginning Inventory 50,000 Purhases 1,500,000 Ending Inventory 100,000 Sales Discount 5,000 You were employed by the entity as its bookkeeper in its first year of operations. You are now to prepare the necessary financial statements for the current year. Accordingly, 15% of rent, depreciation and utility expenses pertain to the sales office while the rest pertains to the corporate office. Instructions: 1. How much is the net sales for the year? 2. How much is the cost of sales for the year? 3. How much is the gross profit of the year? The Following are the accounts of Regina Merchandising for December 31,2019: Sales ₱2,500,000 Salaries Expense 50,000 Supplies Expenses 75,000 Depreciation Expense 60,000 Utilities Expense 40,000 Insurance Expense…arrow_forwardXYZ Holdings is a company that purchases widgets from Company ABC. This is their first year of operations. The accounts for the financial year ending 30 June 2021 are as follows: Sales 100,000 Accounts receivable 80,000 Drawings 20,000 Building 20,000 Bank loan, due 30 June 2030 100,000 Cost of sales 50,000 Accumulated depreciation - Building 10,000 Cash 60,000 Wages 15,000 Opening retained profit 0 Electricity 500 Capital 50,000 Property, plant and equipment 20,000 Depreciation 12,000 Accounts payable 30,000 Accumulated depreciation - Property, plant and equipment 2,000 Accrued expenses 500 Interest expense 5,000 Insurance expense 10,000 Closing retained profit ??? Required: Prepare an income statement in the Excel template in the 'Income Statement' tab on the LMS, upload your worksheet. Ignore GST and taxes.arrow_forward

- XYZ Holdings is a company that purchases widgets from Company ABC. This is their first year of operations. The accounts for the financial year ending 30 June 2021 are as follows: Sales 100,000 Accounts receivable 80,000 Drawings 20,000 Building 20,000 Bank loan, due 30 June 2030 100,000 Cost of sales 50,000 Accumulated depreciation - Building 10,000 Cash 60,000 Wages 15,000 Opening retained profit 0 Electricity 500 Capital 50,000 Property, plant and equipment 20,000 Depreciation 12,000 Accounts payable 30,000 Accumulated depreciation - Property, plant and equipment 2,000 Accrued expenses 500 Interest expense 5,000 Insurance expense 10,000 Closing retained profit ??? Required: Prepare a balance sheet in the Excel template in the 'Balance Sheet' tab on the LMS, upload your worksheet. Ignore GST and taxes.arrow_forwardThe accountant for Polo's Pet Shop prepared the following list of account balances from the entity's records for the financial year ended June 30, 2021: Sales Revenue $196,000 Cash $25,000 Accounts Receivable 14,500 Cost of Goods Sold 45,000 Equipment 56,000 Polo, Capital-1 July 2020 22,000 Accounts Payable 17,000 Notes Payable 15,000 General & Admin Expense 32,000 Inventory 1,500 Selling Expense 6,000 Accumulated Depreciation 12,000 Mortgage Payable 5,000 Land 66,000 Interest Expense 21,000 What will be Polo's capital at the end of financial year 30 June 2021 if there was no withdrawal from Polo, but he contributed $10,000 more capital to the business? a. $135,000 b. $124,000 c. $132,000 d. $110,000 e. None on these answers are correctarrow_forwardThe accountant for Polo's Pet Shop prepared the following list of account balances from the entity's records for the financial year ended June 30, 2021: Sales Revenue $196,000 Cash $25,000 Accounts Receivable 14,500 Cost of Goods Sold 45,000 Equipment 56,000 Polo, Capital-1 July 2020 22,000 Accounts Payable 17,000 Notes Payable 15,000 General & Admin Expense 32,000 Inventory 1,500 Selling Expense 6,000 Accumulated Depreciation 12,000 Mortgage Payable 5,000 Land 66,000 Interest Expense 21,000 1. What is the amount of Gross profit presented in the income statement? 2. What is the amount of operating income (EBIT) in the income statement? 3. What is the amount of net profit for the financial year 2021? 4. What will be Polo's capital at the end of financial year 30 June 2021 if there was no withdrawal from Polo, but he contributed $10,000 more capital to the…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College