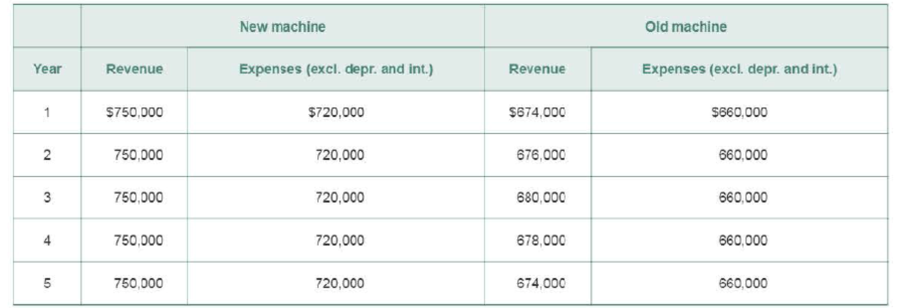

Net cash flows: No terminal value Central Laundry and Cleaners is considering replacing an existing piece of machinery with a more sophisticated machine. The old machine was purchased 3 years ago at a cost of $50,000, and this amount was being

- a. Calculate the initial investment associated with replacement of the old machine by the new one.

- b. Determine the operating cash flows associated with the proposed replacement. (Note: Be sure to consider the deprecation in year 6.)

- c. Depict on a timeline the net cash flows found in parts a and b associated with the proposed replacement decision.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Although the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?arrow_forwardDetermine cash flows Natural Foods Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to generate additional annual sales of 5,000 units at 18 each. The new manufacturing equipment will cost 120,000 and is expected to have a 10-year life and a 17,000 residual value. Selling expenses related to the new product are expected to be 3% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Determine the net cash flows for the first year of the project, Years 29, and for the last year of the project.arrow_forwardGallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forward

- A mini-mart needs a new freezer and the initial Investment will cost $300,000. Incremental revenues, including cost savings, are $200,000, and incremental expenses, including depreciation, are $125,000. There is no salvage value. What is the accounting rate of return (ARR)?arrow_forwardTaos Productions bought a piece of equipment for $79,860 that will last for 5 years. The equipment will generate net operating cash flows of $20,000 per year and will have no salvage value at the end of its life. What is the internal rate of return?arrow_forwardDepreciation Jensen Inc., a graphic arts studio, is considering the purchase of computer equipment and software for a total cost of $18,000. Jensen can pay for the equipment and software over three years at the rate of $6,000 per year. The equipment is expected to last 10 to 20 years, but because of changing technology, Jensen believes it may need to replace the system in as soon as three to five years. A three-year lease of similar equipment and software is available for $6,000 per year. Jensens accountant has asked you to recommend whether the company should purchase or lease the equipment and software and to suggest the length of time over which to depreciate the software and equipment if the company makes the purchase. Required Ignoring the effect of taxes, would you recommend the purchase or the lease? Why or why not? Referring to the definition of depreciation, what appropriate useful life should be used for the equipment and software?arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub