Financial and Managerial Accounting - CengageNow

15th Edition

ISBN: 9781337911979

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 1MAD

Analyze and compare Amazon.com and Wal-Mart

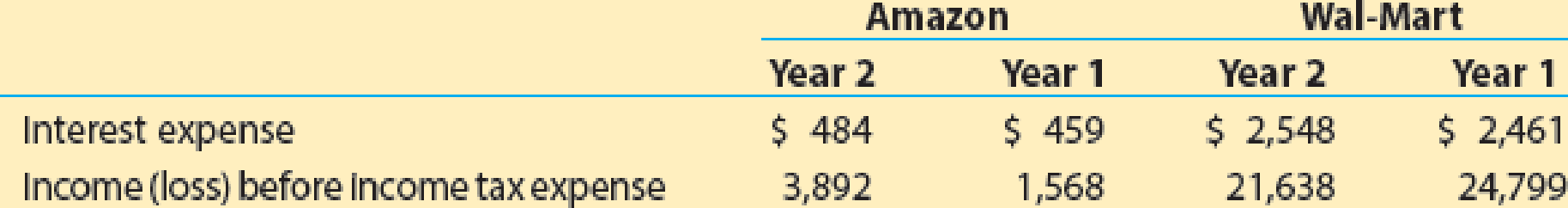

Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Wal-Mart Stores, Inc. (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Interest expense and income before income tax expense from the financial statements of both companies for two recent years follow (in millions):

- a. Compute the times interest earned ratio for both companies for the two years. Round to one decimal place.

- b. Interpret Amazon’s interest coverage from Year 1 to Year 2.

- c. Does a times interest earned ratio less than 1.0 mean that creditors will not get paid interest?

- d. Interpret Wal-Mart’s interest coverage from Year 1 to Year 2.

- e. Which company appears to have the greater protection for creditors?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Preparing an income statement) Prepare an income statement and a common-sized income statement from the following information.

Click on the following icon in order to copy its contents into a spreadsheet.)

Sales

Cost of goods sold

General and administrative expense

Depreciation expense

Interest expense

Income taxes

Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense acc as negative values.)

Income Statement

Gross profits

Total operating expenses

Operating income (EBIT)

Earnings before taxes

Net income

$525,863

199,246

60,236

8,305

11,860

98,486

$

SS

Analyze and compare Amazon.com and Wal-Mart

Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Wal-Mart (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Earnings and common stock outstanding information was obtained from recent financial statements for both companies as follows (in millions):

Amazon

Wal-Mart

Net income

$2,371

$14,694

Average number of common shares outstanding

474

3,207

a. Determine the earnings per share for each company. Neither company had preferred stock outstanding. Round your answers to two decimal places.

Amazon

$

Wal-Mart

$

b. Which company appears more profitable from an earnings-per-share perspective?

c. The market price of Amazon common stock was $750 per share at a time when Wal-Mart’s was $69 per share. How…

Recording sales tax

Consider the following transactions of Sapphire Software:

Journalize the transactions for the company Ignore cost of goods sold.

Chapter 11 Solutions

Financial and Managerial Accounting - CengageNow

Ch. 11 - Describe the two distinct obligations incurred by...Ch. 11 - Explain the meaning of each of the following terms...Ch. 11 - If you asked your broker to purchase for you a 12%...Ch. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Fleeson Company needs additional funds to purchase...Ch. 11 - Prob. 9DQCh. 11 - Issuing bonds at face amount On January 1, the...

Ch. 11 - Issuing bonds at a discount On the first day of...Ch. 11 - Prob. 3BECh. 11 - Prob. 4BECh. 11 - Prob. 5BECh. 11 - Prob. 6BECh. 11 - Times interest earned Averill Products Inc....Ch. 11 - Prob. 1ECh. 11 - Entries for issuing bonds Thomson Co. produces and...Ch. 11 - Prob. 3ECh. 11 - Prob. 4ECh. 11 - Prob. 5ECh. 11 - Entries for issuing and calling bonds; gain Mia...Ch. 11 - Prob. 7ECh. 11 - Present value of amounts due Assume that you are...Ch. 11 - Prob. 9ECh. 11 - Present value of an annuity On January 1, you win...Ch. 11 - Prob. 11ECh. 11 - Prob. 12ECh. 11 - Prob. 13ECh. 11 - Prob. 14ECh. 11 - Appendix 2 Amortize premium by interest method...Ch. 11 - Prob. 16ECh. 11 - Prob. 17ECh. 11 - Bond discount, entries for bonds payable...Ch. 11 - Prob. 2PACh. 11 - Entries for bonds payable, including bond...Ch. 11 - Appendix 1 and Appendix 2 Bond discount, entries...Ch. 11 - Prob. 5PACh. 11 - Bond discount, entries for bonds payable...Ch. 11 - Prob. 2PBCh. 11 - Entries for bonds payable, including bond...Ch. 11 - Prob. 4PBCh. 11 - Prob. 5PBCh. 11 - Analyze and compare Amazon.com and Wal-Mart...Ch. 11 - Analyze and compare Clorox and Procter Gamble The...Ch. 11 - Prob. 3MADCh. 11 - Analyze and compare Hilton and Marriott Hilton...Ch. 11 - Prob. 1TIFCh. 11 - Prob. 3TIFCh. 11 - Prob. 4TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comparing Income Statements and Balance Sheets of CompetitorsFollowing are selected income statement and balance sheet data from two retailers: Abercrombie & Fitch (clothing retailer in the high-end market) and TJX Companies (clothing retailer in the value-priced market). (a) Express each income statement amount as a percentage of sales. Round your answers to one decimal place (ex: 0.2345 = 23.5%). Income Statement ($ millions) ANF TJX Sales $4,680 $21,058 Cost of goods sold 1,599 Answer 16,021 Answer Gross profit 3,081 Answer 5,037 Answer Total expenses 2,435 Answer 4,003 Answer Net income $ 646 Answer $ 1,034 Answer (b) Express each balance sheet amount as a percentage of total assets. Round your answers to one decimal place (ex: 0.2345 = 23.5%). Balance Sheet ($ millions) ANF TJX Current assets $1,010 Answer $3,929 Answer Long-term assets 1,627 Answer 2,608 Answer Total assets…arrow_forwardWhich of the following accounts is credited by the seller when tax is collected on retail sales? A. Payroll Tax B. Unearned Revenue C. Accounts Payable D. Sales Tax Payablearrow_forwardAnalyze and compare Hilton and Marriott Hilton Worldwide Holdings, Inc. (HLT) and Marriott International, Inc. (MAR) are two of the largest hotel operators in the world. Selected financial information from recent income statements for both companies follows (in millions): a. Compute the times interest earned ratio for each company. Round to one decimal place. b. Which company appears to better protect creditor interest? Why?arrow_forward

- When the Sales Tax feature is enabled in QuickBooks Online, where must you record sales tax payments? A. Create Bill B. Sales Tax Center C. Create Check D. Pay Billsarrow_forwardThe Lancaster Corporation's income statement is given below. Sales Cost of goods sold Gross profit Fixed charges (other than interest) Income before interest and taxes LANCASTER CORPORATION Interest Income before taxes Taxes (35%) Income after taxes a. What is the times-interest-earned ratio? Note: Round your answer to 2 decimal places. Times interest earned Fixed charge coverage times b. What would be the fixed-charge-coverage ratio? Note: Round your answer to 2 decimal places. times $ 234,000 175,000 $ 59,000 33,000 $ 26,000 17,300 $ 8,700 3,045 $ 5,655arrow_forwardCompare Martinez and Rosado by converting their income statements to common size. Net sales.... Cost of goods sold. Other expense. Net income.. Which company earns more net income? Which company's net income is a higher percentage of its net sales? Net sales... Cost of goods sold. Other expenses. Net income.. $ $ $ $ Martinez Prepare the common-sized financial analysis: (Round percentages to the nearest tenth percent.) Martinez Amount 10,900 6,660 3,586 654 10,900 $ 6,660 3,586 % 654 $ % $ % % Rosado % $ 16,540 11,909 3,837 794 Rosado Amount 16,540 11,909 3,837 794 % do do % % % %arrow_forward

- accounting When a company makes a sale on credit, what does the account receivable represent on its balance sheet?arrow_forwardIncome statement for Ralph Collins Consignment Sales Companyarrow_forwardCompare Income Statements and Balance Sheets of Competitorsa. Following are selected income statement data from two European grocery chain companies: Tesco PLC (UK) and Ahold (the Netherlands). Prepare a common‑size income statement. To do this, express each income statement amount as a percent of sales.Note: Round percentage to one decimal point (for example, round 18.566% to 18.6%). Income Statements Tesco Carrefour Group For Fiscal Year Ended February 24, 2019 December 31, 2018 (£ millions) (€ millions) Sales £57,520 Answer €70,125 Answer Cost of goods sold 53,790 Answer 54,765 Answer Gross profit 3,730 Answer 15,360 Answer Total expenses 2,542 Answer 15,670 Answer Net income £1,188 Answer €(310) Answer b. Following are selected balance sheet data from two European grocery chain companies: Tesco PLC (UK) and Ahold (the Netherlands). Prepare a common‑size balance sheet. To do this, express each…arrow_forward

- What is the formula for calculating sales tax? A. Amount of Purchase x Sales Tax Rate = Sales Tax B. Cost of Goods Sold x Sales Tax Rate = Sales Tax C. Amount of Revenue x Sales Tax Rate = Sales Taxarrow_forwardTerminology Match each phrase with its definition. A. Sales discount B. Credit period C. Discount period D. FOB destination E. FOB shipping point F. Gross profit G. Merchandise inventory H. Purchases discount 1. 2. 3. 4. 5. 6. 7. 8. Goods a company owns and expects to see to its customers. Time period that can pass before a customer's full payment is due. Seller's description of a cash discount granted to buyers in return for early payment. Ownership of goods is transferred when the seller delivers goods to the carrier. Purchaser's description of a cash discount received from a supplier of goods. Difference between net sales and the cost of goods sold. Time period in which a cash discount is available. Ownership of goods is transferred when delivered to the buyer's place of business. 1arrow_forwardCompute the component percentages for Trixy Magic's Income statement below. (Enter your answers as a percentage rounded to 2 decimal place (i.e. 0.1234 should be entered as 12.34). Enter all answers as positive values.) Net sales Cost of sales Gross margin Expenses Selling, general, and administrative Depreciation Interest-net Total expenses Pre-tax earnings Income tax provision Net earnings TRIXY MAGIC, INC. Consolidated Statements of Earnings (in millions) Fiscal 2018 $ $ 48,236 31,732 16,504 11,093 1,547 294 12,934 3,570 1,328 2,242 % Sales 100.00 % % Fiscal Years Ended on % Sales Fiscal 2017 $ $ 48,284 31,558 16,726 10,534 1,373 201 12,108 4,618 1,719 2,899 100.00 % % Fiscal 2016 % Sales S 46,930 30.741 16,198 ३ 9,746 1,171 156 11,073 5,125 1,910 3.215 100.00 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License