FOUNDATIONS OF FINANCE- MYFINANCELAB

10th Edition

ISBN: 9780135160572

Author: KEOWN

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 20SP

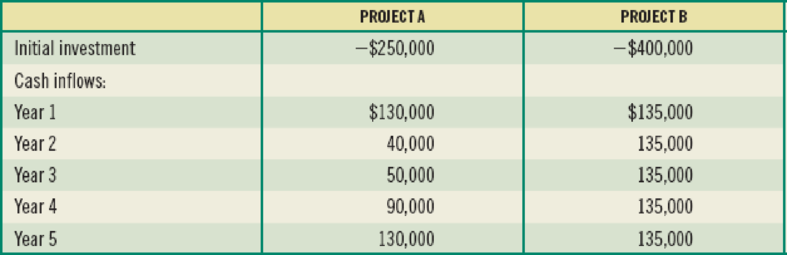

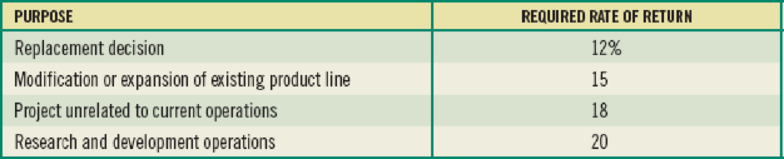

(Risk-adjusted discount rates and risk classes) The G. Wolfe Corporation is examining two capital-budgeting projects with 5-year lives. The first, project A, is a replacement project; the second, project B, is a project unrelated to current operations. The G. Wolfe Corporation uses the risk-adjusted discount rate method and groups projects according to purpose, and then it uses a required rate of return or discount rate that has been preassigned to that purpose or risk class. The expected cash flows for these projects are given here:

The purpose/risk classes and preassigned required rates of return are as follows:

Determine each project’s risk-adjusted

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume the following information for a capital budgeting proposal with a five-year time horizon:

Initial investment:

Cost of equipment (zero salvage value)

Annual revenues and costs:

Sales revenues

Variable expenses

Depreciation expense

Fixed out-of-pocket costs.

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided.

If the company's discount rate is 12%, then the net present value for this investment is closest to:

Multiple Choice

$241,600.

$(141,600).

$ 530,000

$ 300,000

$ 130,000

$ 50,000

$ 40,000

Discuss the four alternative methods for evaluating capital budgeting projects? What is an advantage and disadvantage of each method?

Furthermore, the accrual accounting rate of return (AARR) divides an accrual accounting measure of average annual income from a project by an accrual accounting measure of its investment. What are the strengths and weaknesses of the accrual accounting rate-of-return (AARR) method for evaluating long-term projects?

A company wants to decide which project to undertake out of two projects A and B. For this purpose, it wants to evaluate each project that have the same initial investment (cost) but different cash flows for the next three years. The following table gives information on these two projects. The discount rate to be used is 8 percent, which is the WACC for the company. Use two methods of capital budgeting: The Net Present Value (NPV) Method and the Internal Rate of Return (IRR) Method, to evaluate and compare the two projects. Based on the outcome of calculations, choose the best project A or B and explain your decision for each method. Show all your work for each method step by step.

Initial Investment and Cash Flows of

Projects A and B in AED

Project A

Project B

Initial Investment

- 150,000

- 150,000

Year 1 Cash flow

20,000

50,000

Year 2 Cash flow

90,000

90,000

Year 3 Cash flow

70,000

60,000

Chapter 11 Solutions

FOUNDATIONS OF FINANCE- MYFINANCELAB

Ch. 11.A - Prob. 1MCCh. 11.A - Prob. 2MCCh. 11 - Prob. 1RQCh. 11 - Prob. 2RQCh. 11 - If a project requires an additional investment in...Ch. 11 - Prob. 4RQCh. 11 - Prob. 5RQCh. 11 - Prob. 6RQCh. 11 - Prob. 1SPCh. 11 - (Relevant cash flows) Captins Cereal is...

Ch. 11 - Prob. 3SPCh. 11 - Prob. 4SPCh. 11 - Prob. 5SPCh. 11 - Prob. 6SPCh. 11 - Prob. 7SPCh. 11 - Prob. 9SPCh. 11 - Prob. 10SPCh. 11 - Prob. 11SPCh. 11 - Prob. 12SPCh. 11 - Prob. 15SPCh. 11 - (Real options and capital budgeting) You have come...Ch. 11 - (Real options and capital budgeting) Go-Power...Ch. 11 - (Real options and capital budgeting) McDoogals...Ch. 11 - (Risk-adjusted NPV) The Hokie Corporation is...Ch. 11 - (Risk-adjusted discount rates and risk classes)...Ch. 11 - Prob. 1MCCh. 11 - Prob. 2MCCh. 11 - Prob. 3MCCh. 11 - Prob. 7MCCh. 11 - Prob. 8MCCh. 11 - Prob. 9MCCh. 11 - Should the project be accepted? Why or why not?Ch. 11 - Prob. 11MCCh. 11 - Prob. 12MCCh. 11 - Prob. 13MCCh. 11 - Prob. 14MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are a financial analyst for the Hittle Company. The director of capital budgeting has asked you to analyze six proposed capital investments. Each project has a cost of $1,000, and the required rate of return for each is 12%, determine for each project (a) the payback period, (b) the net present value, (c) the profitability index, and (d) the internal rate of return. Assume under MACRS the asset falls in the three-year property class and that the corporate tax rate is 25 percent. You are limited to a maximum expenditure of $3000 only for this capital budgeting period. Which projects you will accept and why? Justify your suggestions Project A Project B Project C Project D Project E Project F Investment -1000 -1000 -1000 -1000 -1000 -1000 1 150 200 250 800 900 1000 2 350 300 250 350 300 200 3 400 500 600 200 150 100 4 700 650 600 200 150 50 12 Capital Budgeting and Estimating Cash Flows Table 12.2 PROPERTY CLASS RECOVERY YEAR MACRS depreciation percentages 3-YEAR 5-YEAR 7-YEAR 10-YEAR…arrow_forwardMoses Manufacturing is attempting to select the best of three mutually exclusive projects, X, Y, and Z. Although all the projects have 5-year lives, they possess differing degrees of risk. Project X is in class V, the highest-risk class; project Y is in class II, the below-average-risk class; and project Z is in class III, the average-risk class. The basic cash flow data for each project and the risk classes and risk-adjusted discount rates (RADRs) used by the firm are shown in the following tables. Project X Project Y Project Z Initial investment (CF0) $179,000 $235,000 $312,000 Year (t ) Cash inflows (CFt) 1 $80,000 $56,000 $85,000 2 66,000 68,000 85,000 3 62,000 73,000 85,000 4 55,000 84,000 85,000 5 65,000 96,000 85,000 Risk Classes and RADRs Risk Class Description Risk adjusted…arrow_forward1. Alleyne thinks that projects should be selected based on their NPVs. Assume allcash flows occur at the end of the year except for initial investment amounts.Calculate the NPV for each project. Ignore income taxesarrow_forward

- Compare and Contrast the four capital budgeting methods. Show Future Value examples of a) Lump Sum b) annuity. Show Present value of a) Lump Sum and b) annuity Compare Payback Period Method and ARR. What is a valid criticism of the Payback Period Method Rank the four projects in order of preference by the four methods in no. 1 Explain the rankings and which method is best for evaluating all capital investment projectsarrow_forwardScenario: Capital budgeting is utilized to determine if a project is worthwhile. The net present value (NPV), payback period, and internal rate of return (IRR) methods are used to rank and select which project to undertake. The following video outlines the NPV and IRR method of capital budgeting: Explain how to calculate the NPV, IRR, and payback period for each project. Utilizing the capital budgeting calculations, you will need to select the best investment for the company. These calculations will be based on the following scenario: Hunter Shipyard Industries has 3 potential projects to consider, all with an initial cost of $1,250,000. The company prefers to reject any project with a 4-year cut-off period for recapturing initial cash outflow. Given the cost of capital rates and the future cash flow for each project, determine which project the company should accept. Cash Flow Project A Project I Project U Year 1 250,000 450,000 250,000 Year 2 250,000…arrow_forwardthe following information relates to three potential investment projects that are being considered by scrappit pls. due to capital rationing, only one of the three projects can be pursued. a) calculate the payback period, accounting rate of return and net present value of each of the potential project. B) explain which of the three potential investment projects should be undertaken. year explanation should be based on the result of your year calculation in part (a).arrow_forward

- Answer the given question with a proper explanation and step-by-step solution. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 7%. 0 1 2 3 4 Project A -1,000 600 440 210 260 Project B -1,000 200 375 360 710 What is Project A's payback? Do not round intermediate calculations. Round your answer to four decimal places. ____ years What is Project A's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places. ______ years What is Project B's payback? Do not round intermediate…arrow_forwardUse the information provided to answer the questions Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places).Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). Use your answers from previous question to recommend the project that should be chosen. Motivateyour choice.arrow_forwardNeil Corporation has three projects under consideration. The cash flows for each of them are shown in the following table attached. . a.) Calculate each project's payback period. Which project is preferred? b.)Calculate each project's net present value (NPV) assuming a(n) 14%cost of capital. Which project is preferred according to this method? c.) Comment on your findings in parts a and b, and recommend the best project.arrow_forward

- Blue Spruce Inc. is comparing several alternative capital budgeting projects as shown below: Initial investment Present value of net cash flows O C.B.A OA.C.B. OC.A.B. OAB.C. A Save for Later $102000 112000 Using the profitability index, the projects rank as Projects B $142000 $182000 222000 132000 C & Attempts: 0 of 1 used Submit Answer PriScarrow_forwardEdelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows: Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each.arrow_forwardJoliet Company is considering two alternative investments. The company requires an 18% return from its investments. Compute the IRR for both Projects and recommend one of them. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License