Concept explainers

a)

The computation of magnitude of operating leverage utilising contribution margin approach of each firm.

a)

Answer to Problem 27P

the operating leverage of L Company and B Company are 1.5 times and 3 times.

Explanation of Solution

Given information:

The formula to calculate the magnitudes of operating leverage are as follows:

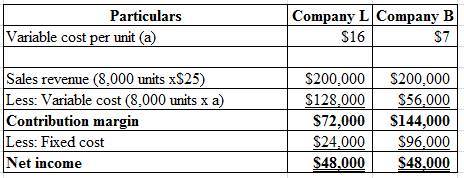

Calculate the magnitude of operating leverage of L Company and B Company:

Hence, the operating leverage of L Company and B Company are 1.5 times and 3 times.

b)

Determine the change in net income in amount and change in percentage of net income

b)

Explanation of Solution

Given information:

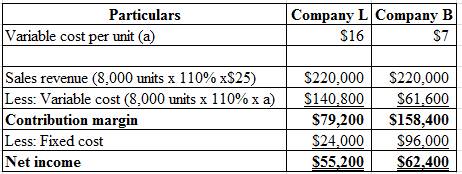

The sales increased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to calculate the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is 15% and 30%

c)

Determine the change in net income in amount and change in percentage of net income.

c)

Explanation of Solution

Given information:

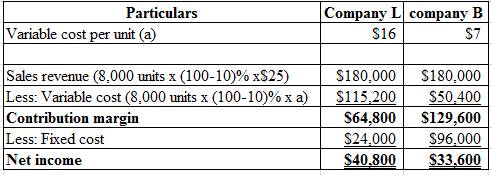

The sales decreased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to compute the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is −15% and −30%

d)

Write a memo regarding the analyses and advice by Person JD.

d)

Explanation of Solution

To,

Person A

From,

Person JD

Subject:

Analysis and recommendation regarding the investment

Date: 11/29/2018

The rewards and risk of both the companies are different even though they have same amount of sales and net income. From the analysis of Person JD the operating leverage is 1.5 for Company L and 3 for Company B.

The analytical data indicates that income of Company B is more volatile than Company L.

Investment in Company B will be the better choice in a economy boom situation. Otherwise, Company L is considering better. An aggressive investor can choice Company B and a conservative investor can go for Company L.

Want to see more full solutions like this?

Chapter 11 Solutions

GEN COMBO LOOSELEAF SURVEY OF ACCOUNTING; CONNECT ACCESS CARD

- Problem 15-1 The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $4.5 million, of which $900,000 of the purchase price would represent land value, and $3.6 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year…arrow_forwardQuestion 3) Textbook Exercise 13-29: Cost-plus operating income/return on investment pricing. 13-29 Cost-plus, target return on investment pricing. Zoom-o-licious makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although Zoom-o-licious makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. Zoom-o-licious has a total capital investment of $15,000,000. It expects to produce and sell 300,000 cases of candy next year. Zoom-o-licious requires a 10% target return on investment. Expected costs for next year are: Variable production costs $4.00 per case Variable marketing and distribution costs $1.00 per case Fixed production costs $300,000 Fixed marketing and distribution costs $400,000 Other fixed costs $200,000 Zoom-o-licious prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital.…arrow_forwardQ1) B. Circle correct answer: 1. The company sales $100,000, Variable cost $70,000, what is Profit Volume Ratio of the company? a. 30% b. 20% c. 25% d. none of the above 2. A company average annual income is $40,000 and Initial investment is $400,000. What is Accounting Rate of Return of the company? a. 5% b. 10% c. 15% d. none of the above 3. What is capital budgeting? a. It is a short term planning b. It is a long term planning c. It is Long term planning for making and financial decisions. d. none of the abovearrow_forward

- QUESTION FOUR (a)Belta manufacturers in China produce car engines. They have been in the business for almost 20 years. They have been profitable enough to employ more staff and increase their production. But with a recent loan taken to facilitate automation, investors want to know how the company is doing. Their total assets are worth K3, 500,000 while they have current assets of K9, 200,000. Their current liabilities stand at K5, 000,000 while retained earnings amount to K800, 000. Earnings before Interest and Tax come to K6, 500,000. Sales total K8, 300,000 while the market value of equity is K7, 000,000.The company has 1,000,000 equity shares outstanding with par value of K5.These shares are now selling at K7 per share. Calculate the Altman z-score for the company and advise. (b)The risk incurred by a bank when the maturities of its assets and liabilities are mismatched is called interest rate risk. (i) Describe two types of interest rate risks (ii) Describe any three methods…arrow_forwardQuestion No. 2 CVP – Basic Analysis Raveen Products sells camping equipment. One of the company’s products, a camp lantern, sells for $90 per unit. Variable expenses are $63 per lantern, and fixed expenses associated with the lantern total $135,000 per month. Required: Compute the company’s break-even point in number of lanterns and in total sales dollars. Compute the company’s Margin of Safety in sales dollar and in percentage. At present, the company is selling 8,000 lanterns per month. The sales manager is convinced that a 10% reduction in the selling price will result in a 25% increase in the number of lanterns sold each month. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. Show both total and per unit data on your statements. Refer to the data in (3) above. How many lanterns would have to be sold at the new selling price to yield a minimum net operating income of $72,000…arrow_forwardQUESTION 27 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 2 Sales $9,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Return on investment 8% 10% 12% 9%arrow_forward

- Question 6 [Estimating Working Capital Requirement Using Operating Cycle Method] X Ltd Co. wants to know working capital by operating cycle methods when : Estimated Sales 20,000 units @ $5 P.U. Production and Sales will remain similar throughout the year. Production costs: M – 2.5 P.U., Labour 1.00 P.U. Overheads $17.500. Customers are given 60 days credit and 50 days credit from suppliers. 40 days supply of raw materials and 15 days supply of finished goods are kept in store. Production cycle is 15 days. All materials are issued at the commencement of each production cycle. 1/4 on an Average of working capital is kept as cash balance for contingenciesarrow_forwardQuestion 17 options: With the following information, answer the following questions using the specified format (For example 40 days). This year, a business bought $10,000,000 worth of products from its suppliers. Its accounts payable balance shown on the balance sheet is $1,000,000. During the following year, the company expects to buy $12,000,000 worth of products from its suppliers and estimate its accounts payable to increase by $300,000. This year's average payment period is ______.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning