FUND. OF CORPORATE FINANCE W/ACCESS >I

15th Edition

ISBN: 9781323510728

Author: Berk

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 6P

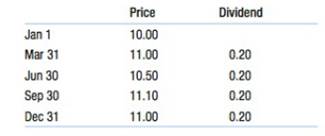

The following table contains prices and dividends for a stock. All prices are after the dividend has been paid. If you bought the stock on January 1 and sold it on December 31, what is your realized return?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using the data from the following table,calculate the return for investing in this stock from January 1 to December 31. Prices are after the dividend has been paid.

Stock Price

Dividend

Jan 1

$50.18

Mar 31

$51.11

$0.58

Jun 30

$49.56

$0.58

Sep 30

$51.93

$0.75

Dec 31

$52.53

$0.75

The return from January 1 to March 31 is

enter your response here.

(Round to five decimal places.)

Part 2

The return from March 31 to June 30 is

enter your response here.

(Round to five decimal places.)

Part 3

The return from June 30 to September 30 is

enter your response here.

(Round to five decimal places.)

Part 4

The return from September 30 to December 31 is

enter your response here.

(Round to five decimal places.)

Part 5

enter your response here%.

(Round to two decimal places.)

At the start of the year, you purchased a single stock for $49.15 and one year later received a dividend of $2.88 and then sold the stock for $54.91. What was your total nominal return?

The table below shows your stock positions at the beginning of the year, the dividends that each stock paid during the year, and the stock prices at the end of the year.

Company

Shares

Beginning of Year Price

Dividend Per Share

End of Year Price

Johnson Controls

750

$

74.91

$

1.57

$

86.92

Medtronic

650

59.57

0.81

55.51

Direct TV

900

26.94

26.39

Qualcomm

600

45.08

0.59

40.92

What is your portfolio dollar return and percentage return? (Round your answers to 2 decimal places.)

Portfolio Return

Dollar return

Percentage return

%

Chapter 11 Solutions

FUND. OF CORPORATE FINANCE W/ACCESS >I

Ch. 11 - Prob. 1CCCh. 11 - Why do investors demand a higher return when...Ch. 11 - For what purpose do we use the average and...Ch. 11 - How does the standard deviation of historical...Ch. 11 - What is the relation between risk and return for...Ch. 11 - Prob. 6CCCh. 11 - Prob. 7CCCh. 11 - Prob. 8CCCh. 11 - Prob. 9CCCh. 11 - Does systematic or unsystematic risk require a...

Ch. 11 - What does the historical relation between...Ch. 11 - What are the components of a stock's realized...Ch. 11 - What is the intuition behind using the average...Ch. 11 - Prob. 4CTCh. 11 - How does the relationship between the average...Ch. 11 - Consider two local banks. Bank A has 100 loans...Ch. 11 - What is meant by diversification and how does it...Ch. 11 - Which of the following risks of a stock are likely...Ch. 11 - Prob. 9CTCh. 11 - Prob. 10CTCh. 11 - If you randomly select 10 stocks for a portfolio...Ch. 11 - Why doesn't the risk premium of a stock depend on...Ch. 11 - Prob. 13CTCh. 11 - DATA CASE Today is April 30, 2016, and you have...Ch. 11 - Convert these prices to monthly returns as the...Ch. 11 - Prob. 3DCCh. 11 - Prob. 4DCCh. 11 - Prob. 5DCCh. 11 - What do you notice about the average of the...Ch. 11 - Prob. 1PCh. 11 - Prob. 2PCh. 11 - Prob. 3PCh. 11 - Your portfolio consists of 100 shares of CSH and...Ch. 11 - You have just purchased a share of stock for $20....Ch. 11 - The following table contains prices and dividends...Ch. 11 - Prob. 7PCh. 11 - Prob. 8PCh. 11 - Use the data in SBUX_GOOG.xlsx on MFL to answer...Ch. 11 - Download the spreadsheet from the book's Web the...Ch. 11 - Prob. 11PCh. 11 - Prob. 12PCh. 11 - Prob. 13PCh. 11 - Consider the following five monthly returns: a....Ch. 11 - Explain the difference between the arithmetic...Ch. 11 - Prob. 16PCh. 11 - Prob. 17PCh. 11 - Prob. 18PCh. 11 - Prob. 19PCh. 11 - Prob. 20PCh. 11 - Prob. 21PCh. 11 - You are a risk-averse investor who is considering...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following table shows your stock positions at the beginning of the year, the dividends that each stock paid during the year, and the stock prices at the end of the year. Company Shares Beginning ofYear Price Dividend Per Share End of Year Price Johnson Controls 550 $73.11 $1.21 $86.02 Medtronic 400 57.77 0.45 53.71 Direct TV 700 25.14 24.59 Qualcomm 100 43.28 0.41 39.12 What is your portfolio dollar return and percentage return? (Round your answers to 2 decimal places.) Portfolio Return Dollar return: ____.__ Percentage return: _____.__%arrow_forwardThe following table shows your stock positions at the beginning of the year, the dividends that each stock paid during the year, and the stock prices at the end of the year. Company Shares Beginning of Year Price Dividend Per Share End of Year Price US Bank 300 $ 44.60 $ 2.17 $ 44.53 PepsiCo 200 60.18 1.38 63.65 JDS Uniphase 500 19.98 17.76 Duke Energy 200 28.00 1.37 33.76 What is your portfolio dollar return and percentage return?arrow_forwardIf you would receive dividends from year 1 to year n before selling the stock, how will you draw the timeline? Please describe, such as how many time points you have on the timeline, what is the cash flow on each time point.arrow_forward

- A stock that sold for $30 per share at the beginning of the year was selling for $78 at the end of the year. If the stock paid a dividend of $3.53 per share, what is the simple interest rate on the investment in this stock? Consider the interest to be the increase in value plus the dividend.arrow_forwardA stock had the following year-end prices and dividends: Year Price Dividend 0 $ 58.75 — 1 68.56 $ 1.14 2 61.78 1.33 3 70.20 1.49 What was the arithmetic average return for the stock?arrow_forwardThe annual rate of return on any given stock can be found as the stock's dividend for the year plus the change in the stock's price during the year, divided by its beginning-of-year price. If you obtain such data on a large portfolio of stocks, like those in the S&P 500, find the rate of return on each stock, and then average those returns, this would give you an idea of stock market returns for the year in question. true/falsearrow_forward

- A stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 64.78 — 2 71.65 $ .69 3 77.45 .74 4 63.72 .80 5 74.01 .89 6 84.25 .96 What are the arithmetic and geometric returns for the stock?arrow_forwardGo to Yahoo.com’s financial website and enter Apple, Inc.’s stock symbol, AAPL. Answer the following questions concerning Apple, Inc. At what price did Apple’s stock last trade? What is the 52-week range of Apple’s stock? When was the last time Apple’s stock hit a 52-week high? What is the annual dividend of Apple’s stock? How many current broker recommendations are strong buy, buy, hold, sell, or strong sell? What is the average of the broker recommendations? What is the price-earnings ratio?arrow_forwardAssume you purchase a share of stock for $50 at time t=0, and another share at $65 at time t= 1, and at the end of year 1 and year 2, the stock paid a $2.00 dividend. Also, at the end of year 2 you sold both shares for $70 each. What is the time-weighted rate of return? Give typing answer with explanation and conclusionarrow_forward

- You bought a stock at the beginning of the year for $986 per share. At the end of the year, the price is $905. At the end of the year, you received a $7.50 dividend per share. What are the dividend yield, capital gains yield, and total percentage return?arrow_forwardAt the beginning of the year, you purchased a stock for $35. Over the year the dividends paid on the stock $2.75 per share. a. Calculate the return if the price of the stock at the end of the year is $30 b. Calculate the return if the price of the stock at the end of the year is $40arrow_forwardA preferred stock from Duquesne Light Company pays $3.55 in annual dividends. If the required return on the preferred stock is percent, whats the 6.7%, what's the value of the stock?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

9 Different Types of Stocks | Investing For Beginners; Author: Kiana Danial - Invest Diva;https://www.youtube.com/watch?v=CdJYcjZfCH0;License: Standard Youtube License