Pearson eText Foundations of Finance -- Instant Access (Pearson+)

10th Edition

ISBN: 9780135639382

Author: Arthur Keown, John Martin

Publisher: PEARSON+

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 10SP

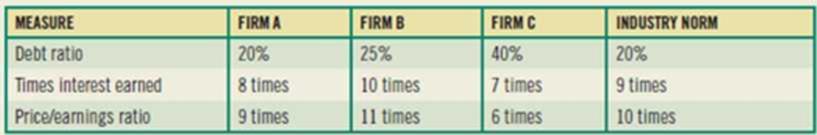

(Assessing leverage use) Financial data for three corporations are displayed here.

- a. Which firm appears to be excessively leveraged?

- b. Which firm appears to be employing financial leverage to the most appropriate degree?

- c. What explanation can you provide for the higher price/earnings ratio enjoyed by firm B as compared with firm A?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following is true regarding the debt to equity ratio?

a.

The debt to equity ratio is a stringent measure of liquidity.

b.

The debt to equity ratio measures the productivity and desirability of the equity investment.

c.

The debt to equity ratio measures management’s ability to productively employ all its resources.

d.

The debt to equity ratio measures the capital structure of the entity.

would D be the correct answer?

The cost of equity is ________.

Group of answer choices

A. the interest associated with debt

B. the rate of return required by investors to incentivize them to invest in a company

C. the weighted average cost of capital

D. equal to the amount of asset turnover

See Image for Information

Compute the following performance indices for both companies:

Profit margin

Asset turnover

Return on Capital Employed (ROCE)

Current ratio

Debt equity ratio

Compare and analyse the performance of the two companies computed in (1) above and explain what the board of Box Limited needs to do to achieve their objective .

c. Which other non-financial measures can influence the decision of the board of Box Limited?

Chapter 12 Solutions

Pearson eText Foundations of Finance -- Instant Access (Pearson+)

Ch. 12 - Prob. 1RQCh. 12 - Prob. 3RQCh. 12 - Prob. 4RQCh. 12 - Prob. 5RQCh. 12 - Prob. 1SPCh. 12 - Prob. 2SPCh. 12 - Prob. 3SPCh. 12 - Prob. 4SPCh. 12 - Prob. 5SPCh. 12 - (Capital structure theory) Match each of the...

Ch. 12 - (Capital structure theory) Which of the following...Ch. 12 - Prob. 8SPCh. 12 - Prob. 9SPCh. 12 - (Assessing leverage use) Financial data for three...Ch. 12 - Prob. 1.1MCCh. 12 - Prob. 1.2MCCh. 12 - Prob. 1.3MCCh. 12 - Prob. 1.4MCCh. 12 - Prob. 2.1MCCh. 12 - Prob. 2.2MCCh. 12 - Prob. 2.3MCCh. 12 - Prob. 3.1MCCh. 12 - Prob. 3.2MCCh. 12 - Prob. 3.3MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is NOT a measure of a company's profitability? a) Return on Investment (ROI) b) Earnings Before Interest and Taxes (EBIT) c) Gross Profit Margin d) Debt -to-Equity Ratioarrow_forwardA)Calculate the following ratios: • Return on Capital Employed (ROCE) • Current Ratio • Gearing Ratio • Price/Earnings (P/E) Ratio B) Based on the above ratios explain, which company George H. and James W. should invest in and discuss the limitations of your analysis.arrow_forwardThe cost of equity is ________. a.equal to the amount of asset turnover b.the interest associated with debt c.the weighted average cost of capital d.the rate of return required by investors to incentivize them to invest in a companyarrow_forward

- Which of the following statements is most accurate? A. Financial leverage is directly related to operating leverage. B. Increasing the corporate tax rate will not affect capital structure decisions. C. A firm with low operating leverage has a small proportion of its total costs in fixed costs. D. Total costs can be calculated as net income minus total revenue.arrow_forwardIn the Du Pont method of analysis the two key drivers of return on equity are: a) Profit margin and return on assets b) Return on assets and the financing plan c) Profit margin and the financing plan In trying to measure a company's effectiveness in earning an adequate return on sales we would use which groups of ratios? a) Profitability ratios b) Asset utilization ratios c) Liquidity ratiosarrow_forwardWhich of the following statements is false? a. A firm’s return on equity exceeds its return on investment under conditions of favorable leverage. b. A common-size balance sheet states each asset, liability and shareholder’s equity account as a percentage of total assets. c. Common-size statements are used to evaluate trends and to make industry comparisons. d. Creditors tend to favor a firm with high financial leverage.arrow_forward

- Indicate whether the following statement is true or false. Provide the relevant explanations. The higher the proportion of equity in a company’s overall capital structure, the higher return required by its debtholders. (Explain your reasoning – in your explanation, provide a numerical example supporting your answer.)arrow_forwardWhich of the following statements are true about the interest-burden ratio? Check all that apply: If the company has no financial leverage, the interest-burden ratio will be equal to 1. A company with higher financial leverage will have a lower interest-burden ratio. if the company has no financial leverage, the interest-burden ratio will be equal to 0. It can be expressed as Net profits/Pretax profits. It can be expressed as EBIT/Interest Expense.arrow_forwardWhich of the following statements are true about the interest-burden ratio? Check all that apply: It can be expressed as EBIT/Interest Expense. If the company has no financial leverage, the interest-burden ratio will be equal to 0. A company with higher financial leverage will have a lower interest-burden ratio. If the company has no financial leverage, the interest-burden ratio will be equal to 1. It can be expressed as Net profits/Pretax profits.arrow_forward

- See image attached 1.Compare and analyse the performance of the two companies based on their profit margin, asset turnover, ROCE, and debt equity ratio and explain what the board of Box Limited needs to do to achieve their objective . 2. Which other non-financial measures can influence the decision of the board of Box Limited?arrow_forwardThe business risk of a company is most accurately measured by the company's: a. Debt-to-equity ratio B. Efficiency in using assets to generate sales c. Operating leverage and level of uncertainty about demand, output prices and competitionarrow_forwardWhich one of the following is minimized when the value of the firm is maximized? A- WACC B- Return on equity C-Debt D-Taxes E- Bankruptcy costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial leverage explained; Author: The Finance story teller;https://www.youtube.com/watch?v=GESzfA9odgE;License: Standard YouTube License, CC-BY