Financial Accounting: Tools for Business Decision Making, 8th Edition

8th Edition

ISBN: 9781118953808

Author: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Question

Chapter 12, Problem 12.1E

To determine

Introduction:

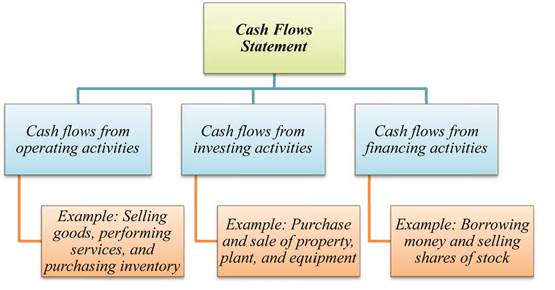

Statement of cash flows

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Type of activities reported in statement of cash flows:

Figure (1)

To Classify: Transactions by type of activity in statement of cash flows.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Kiley corporation had these transactions during 2022. Indicate whether each transactions is an operating activity, investing activity, financing activity, or noncash investing and financing activity (a) purchased a machine for $30000, giving a long term note in exchange (b) issued $50,par value common stock for cash(c) issued $200000 par value common stock upon conversion of bonds having face value of $20000 (d) declared and paid a cash dividend of $13000 (e) sold a long term with a cost of $15000 for $15000 cash (f) collected $16000 from sale of good (g) paid $18000 to suppliers

Kiley Corporation had these transactions during 2022.Analyze the transactions and indicate whether each transaction is an operating activity, investing activity, financing activity, or noncash investing and financing activity.

(a)

Purchased a machine for $30,000, giving a long-term note in exchange.

select an option

(b)

Issued $50,000 par value common stock for cash.

select an option

(c)

Issued $200,000 par value common stock upon conversion of bonds having a face value of $200,000.

select an option

(d)

Declared and paid a cash dividend of $13,000.

select an option

(e)

Sold a long-term investment with a cost of $15,000 for $15,000 cash.

select an option…

Tabares Corporation had these transactions during 2020.Indicate whether each transaction is an operating activity, investing activity, financing activity, or noncash investing and financing activity.

(a)

Issued $50,000 par value common stock for cash.

select a type of activity: Operating Activity, Financing Activity, Noncash Investing and Financing Activity, or Investing Activity

(b)

Purchased a machine for $30,000, giving a long-term note in exchange.

select a type of activity: Operating Activity, Financing Activity, Noncash Investing and Financing Activity, or Investing Activity

(c)

Issued $200,000 par value common stock upon conversion of bonds having a face value of $200,000.

select a type of activity: Operating Activity, Financing Activity, Noncash Investing and Financing Activity, or Investing Activity

(d)

Declared and paid a cash dividend…

Chapter 12 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

Ch. 12 - Prob. 1QCh. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - Prob. 6QCh. 12 - Why is it necessary to use comparative balance...Ch. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10Q

Ch. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - Prob. 13QCh. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 16QCh. 12 - Prob. 17QCh. 12 - Prob. 18QCh. 12 - Prob. 19QCh. 12 - Prob. 20QCh. 12 - Prob. 21QCh. 12 - Prob. 22QCh. 12 - Prob. 12.1BECh. 12 - Prob. 12.2BECh. 12 - Prob. 12.3BECh. 12 - Prob. 12.4BECh. 12 - Prob. 12.5BECh. 12 - Prob. 12.7BECh. 12 - Prob. 12.8BECh. 12 - Prob. 12.9BECh. 12 - Prob. 12.10BECh. 12 - Prob. 12.11BECh. 12 - The management of Uhuru Inc. is trying to decide...Ch. 12 - Prob. 12.13BECh. 12 - Prob. 12.14BECh. 12 - Prob. 12.15BECh. 12 - Prob. 12.1DIECh. 12 - Prob. 12.2ADIECh. 12 - Prob. 12.2BDIECh. 12 - Prob. 12.3DIECh. 12 - Prob. 12.1ECh. 12 - Prob. 12.2ECh. 12 - Prob. 12.3ECh. 12 - Prob. 12.4ECh. 12 - Prob. 12.5ECh. 12 - Prob. 12.6ECh. 12 - Prob. 12.7ECh. 12 - Prob. 12.8ECh. 12 - Prob. 12.9ECh. 12 - Prob. 12.10ECh. 12 - Prob. 12.11ECh. 12 - Prob. 12.12ECh. 12 - Prob. 12.13ECh. 12 - Prob. 12.14ECh. 12 - Prob. 12.15ECh. 12 - Prob. 12.1APCh. 12 - Prob. 12.2APCh. 12 - Prob. 12.3APCh. 12 - Prob. 12.4APCh. 12 - Prob. 12.5APCh. 12 - Prob. 12.6APCh. 12 - Prob. 12.7APCh. 12 - Prob. 12.8APCh. 12 - Prob. 12.9APCh. 12 - Prob. 12.10APCh. 12 - Prob. 12.11APCh. 12 - Prob. 12.12APCh. 12 - Prob. 12.1EYCTCh. 12 - Prob. 12.2EYCTCh. 12 - Prob. 12.3EYCTCh. 12 - Prob. 12.7EYCTCh. 12 - Prob. 12.8EYCTCh. 12 - Prob. 12.9EYCTCh. 12 - Prob. 12.1IFRSCh. 12 - Prob. 12.2IFRSCh. 12 - Prob. 12.3IFRS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dunn Company recognized a 5,000 unrealized holding gain on investment in Starbuckss long-term bonds during 2019. The company classified its investment as an available-for-sale security. How would this information be reported on a statement of cash flows prepared using the indirect method?arrow_forwardAnna Maria Island Co. provided the following information on selected transactions during 2017: Purchase of land by issuing bonds $1,550,000 Proceeds from sale of land 925,000 Proceeds from issuing bonds 1,900,000 Purchases of inventory 2,975,000 Purchases of treasury stock 190,000 Loans made to affiliated corporations 525,000 Dividends paid to preferred stockholders 120,000 Proceeds from issuing preferred stock 325,000 Proceeds from sale of equipment 650,000 The net cash provided by financing activities during 2017 is $1,725,000. $2,465,000. $2,040,000. $1,915,000.arrow_forwardIn 2012, ABC Corporation purchased treasury stock with a cost of $25,000. During the year, the company paid dividends of $15,000 and issued bonds payable for $750,000. Cash flows from financing activities for 2012 are _____.arrow_forward

- Locker Company’s income statement and comparative balance sheets follow. During 2017, the company sold for $34,000 cash old equipment that had cost $72,000 and had $38,000 accumulated depreciation. Also in 2017, new equipment worth $120,000 was acquired in exchange for $120,000 of bonds payable, and bonds payable of $240,000 were retired for cash at a loss. A $52,000 cash dividend was declared and paid in 2017. Any stock issuances were for cash.Calculate Locker’s net cash flow from financing activities for 2017.a. ($250,000)b. ($254,000)c. $ 48,000d. ($ 52,000)arrow_forwardThe Donahoo Western Furnishings Company was formed onDecember 31, 2014, with $1,000,000 in equity plus $500,000in long-term debt. On January 1, 2015, all of the firm’s capitalwas held in cash. The following transactions occurred duringJanuary 2015:• January 2: Donahoo purchased $1,000,000 worth of furniturefor resale. It paid $500,000 in cash and financed the balanceusing trade credit that required payment in 60 days.• January 3: Donahoo sold $250,000 worth of furniture that ithad paid $200,000 to acquire. The entire sale was on creditterms of net 90 days.• January 15: Donahoo purchased more furniture for $200,000.This time, it used trade credit for the entire amount of thepurchase, with credit terms of net 60 days.• January 31: Donahoo sold $500,000 worth of furniture,for which it had paid $400,000. The furniture was soldfor 10 percent cash down, with the remainder payablein 90 days. In addition, the firm paid a cash dividend of$100,000 to its stockholders and paid off $250,000 of…arrow_forwardOriole Company purchased treasury stock with a cost of $68200 during 2022. During the year, the company paid dividends of $24800 and issued bonds payable for proceeds of $1086200. Cash flows from financing activities for 2022 total $93000 net cash outflow. $993200 net cash inflow. $1129600 net cash inflow. $1061400 net cash inflow.arrow_forward

- Tabares Corporation had these transactions during 2020.Indicate whether each transaction is an operating activity, investing activity, financing activity, or noncash investing and financing activity. (a) Issued $50,000 par value common stock for cash. Investing ActivitiesNoncash Investing and/or Financing ActivitiesOperating ActivitiesFinancing Activities (b) Purchased a machine for $30,000, giving a long-term note in exchange. Investing ActivitiesOperating ActivitiesNoncash Investing and/or Financing ActivitiesFinancing Activities (c) Issued $200,000 par value common stock upon conversion of bonds having a face value of $200,000. Operating ActivitiesNoncash Investing and/or Financing ActivitiesFinancing ActivitiesInvesting Activities (d) Declared and paid a cash dividend of $18,000. Operating ActivitiesFinancing ActivitiesNoncash Investing and/or Financing ActivitiesInvesting Activities (e)…arrow_forwardIn preparation for developing its statement of cash flows for the year ended December 31, 2016, Rapid Pac, Inc., collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 65 Payment for the early extinguishment of long-term bonds (book value: $97 million) 102 Proceeds from the sale of treasury stock (cost: $17 million) 22 Gain on sale of land 4 Proceeds from sale of land 12 Purchase of Microsoft common stock 160 Declaration of cash dividends 44 Distribution of cash dividends declared in 2015 40 Required: 1. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2016? 2. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2016?arrow_forwardEnvoi was formed on January 1 , 2016 , when Envoi issued common shares for $ 500,000 . Early in January 2016 , Envoi made the following cash payments : a 250,000 for equipment b . 200,000 for inventory ( four cars at $ 50,000 each ) c 10,000 for 2016 rent on a store building In February 2016 , Envoi purchased six cars for inventory on account . Cost of this inventory was $ 260,000 ( $ . Before year - end , Envoi paid $ 208,000 of this debt . Envoi uses the FIFO method to account for inventory . During 2016 , Envoi sold eight vintage autos for a total of $ 600,000 . Before year - end , Envoi collected 80 % of this amount . The business employs three people . The combined annual payroll is of which Envoi owes $ 4,000 at year end . At the end of the year , Envoi paid income tax of $ 10,000 . Late in 2016 , Envoi declared and paid cash dividends of $ 11,000 . For equipment , Envoi uses the straight - line depreciation method over five years with zero residual value . Requirements 1.…arrow_forward

- Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 29, 2018): Borrowed $21,304 from banks due in two years. Purchased additional investments for $21,500 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment; paid $9,610 in cash and signed a short-term note for $1,448. Issued additional shares of common stock for $1,507 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,045 for $19,045 cash. Declared $11,163 in dividends to be paid at the beginning of the next fiscal year. Use the drop-downs below to select the accounts that should be properly included on the balance sheet. MANGO, INC. Balance Sheet At September 29, 2018 (in millions) Assets Current assets: Total current assets 0 Total assets $0 Liabilities…arrow_forwardAssume that the following transactions (in millions) occurred during the next fiscal year (ending on September 29, 2018): Borrowed $21,304 from banks due in two years. Purchased additional investments for $21,500 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment; paid $9,610 in cash and signed a short-term note for $1,448. Issued additional shares of common stock for $1,507 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,045 for $19,045 cash. Declared $11,163 in dividends to be paid at the beginning of the next fiscal year. QUESTION: Compute Mango's current ratio for the year ending on September 29, 2018. (Round your answer to 2 decimal places.) Current Ratio:arrow_forwardThe 2017 balance sheet of Kerber’s Tennis Shop, Incorporated, showed $2.4 million in long-term debt, $720,000 in the common stock account, and $6.05 million in the additional paid-in surplus account. The 2018 balance sheet showed $4.1 million, $895,000, and $8.3 million in the same three accounts, respectively. The 2018 income statement showed an interest expense of $190,000. The company paid out $600,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $860,000, and the firm reduced its net working capital investment by $115,000, what was the firm's 2018 operating cash flow, or OCF?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License