Managerial Accounting, Binder Ready Version: Tools for Business Decision Making

7th Edition

ISBN: 9781118338421

Author: Weygandt, Jerry J.; Kimmel, Paul D.; Kieso, Donald E.

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.7E

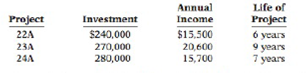

Iggy Company is considering three capital expenditure projects. Relevant data for the projects are as follows.

Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Iggy Company uses the straight-line method of

Instructions

(a) Determine the

(b) If Iggy Company's required rate of return is 10%. which projects are acceptable?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Iggy Company is considering three capital expenditure projects. Relevant data for the projects are as follows.

Annual

Life of

Project

Investment

Income

Project

22A

$243,600

$17,130

6 years

2ЗА

271,500

20,700

9 years

24A

280,600

15,700

7 years

Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Iggy

Company uses the straight-line method of depreciation.

Click here to view PV table.

(a)

Determine the internal rate of return for each project. (Round answers 0 decimal places, e.g. 13%. For calculation purposes, use 5

decimal places as displayed in the factor table provided.)

Internal Rate of

Project

Return

22A

%

23А

%

24A

%

(b)

If Iggy Company's required rate of return is 11%, which projects are acceptable?

Oriole Company is considering three capital expenditure projects. Relevant data for the projects are as follows.

Annual

Project Investment Income

22A

$242,100 $17,560

271,300

283,800

23A

24A

(a)

Annual net income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project.

Oriole Company uses the straight-line method of depreciation.

Click here to view the factor table.

Project

20,630

22A

15,700

Determine the internal rate of return for each project. (Round answers to 0 decimal places, e.g. 13%. For calculation purposes, use 5

decimal places as displayed in the factor table provided.)

23A

24A

Internal Rate of

Return

%

The following project(s) are acceptable

Life of

Project

6 years

9 years

7 years

%

%

(b)

If Oriole Company's required rate of return is 11%, which projects are acceptable?

Sheridan Company is considering three capital expenditure projects. Relevant data for the projects are as follows.

Annual

Project Investment

Income

Life of

Project

22A

$240,900

$17,400

6 years

23A

274,900

20,950

9 years

24A

283,900

15,700

7 years

Annual net income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project.

Sheridan Company uses the straight-line method of depreciation.

Click here to view PV table.

(a)

Determine the internal rate of return for each project. (Round answers O decimal places, eg. 13%. For calculation purposes, use 5 decimal

places as displayed in the factor table provided.)

Project

Internal Rate of

Return

Chapter 12 Solutions

Managerial Accounting, Binder Ready Version: Tools for Business Decision Making

Ch. 12 - Prob. 1QCh. 12 - Prob. 2QCh. 12 - Tom Wells claims the formula for the cash payback...Ch. 12 - Prob. 4QCh. 12 - What is the decision rule under the net present...Ch. 12 - Discuss the factors that determine the appropriate...Ch. 12 - What simplifying assumptions were made in the...Ch. 12 - What are some examples of potential intangible...Ch. 12 - What steps can be taken to incorporate intangible...Ch. 12 - Prob. 10Q

Ch. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - Prob. 13QCh. 12 - What are the strengths of the annual rate of...Ch. 12 - Prob. 15QCh. 12 - Prob. 16QCh. 12 - Prob. 12.1BECh. 12 - Hsung Company accumulates the following data...Ch. 12 - Thunder Corporation, an amusement park, is...Ch. 12 - Caine Bottling Corporation is considering the...Ch. 12 - McKnight Company is considering two different,...Ch. 12 - Prob. 12.6BECh. 12 - Prob. 12.7BECh. 12 - Prob. 12.8BECh. 12 - Prob. 12.9BECh. 12 - Prob. 12.1DICh. 12 - Prob. 12.2DICh. 12 - Prob. 12.3DICh. 12 - Prob. 12.4DICh. 12 - Prob. 12.5DICh. 12 - Prob. 12.1ECh. 12 - Doug's Custom Construction Company is considering...Ch. 12 - Prob. 12.3ECh. 12 - BAK Corp. is considering purchasing one of two new...Ch. 12 - Bruno Corporation is involved in the business of...Ch. 12 - BSU Inc. wants to purchase a new machine for...Ch. 12 - Iggy Company is considering three capital...Ch. 12 - Prob. 12.8ECh. 12 - Legend Service Center just purchased an automobile...Ch. 12 - Vilas Company is considering a capital investment...Ch. 12 - Drake Corporation is reviewing an investment...Ch. 12 - U3 Company is considering three long-term capital...Ch. 12 - Prob. 12.2APCh. 12 - Brooks Clinic is considering investing in new...Ch. 12 - Jane's Auto Care is considering the purchase of a...Ch. 12 - Prob. 12.5APCh. 12 - Prob. 12CDCh. 12 - Luang Company is considering the purchase of a new...Ch. 12 - Prob. 12.2BYPCh. 12 - Tecumseh Products Company has its headquarters in...Ch. 12 - Prob. 12.4BYPCh. 12 - Prob. 12.5BYPCh. 12 - Prob. 12.6BYPCh. 12 - Prob. 12.8BYP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bridgeport Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value A $260,084 $46,590 Project A 7 years $0 Project B Click here to view the factor table. Bridgeport Company uses the straight-line method to depreciate its assets. B $278,237 Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.) $44,540 9 years $0 Internal rate of return % %arrow_forwardDetermine the internal rate of return for each project. (Round answers 0 decimal places, e.g. 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project 22A 23A 24A (b) Internal Rate of Return % % % If Sunland Company's required rate of return is 11%, which projects are acceptable? The following project(s) are acceptablearrow_forwardThe following are the relevant data of two alternative machines are shown in the table below. Determine which is the better machine if T=40%, a CFAT MARR of 10%, and SL as a depreciation method. What is the depreciation per year? Note: Calculate the CFAT thru tabular method. Use AW for solving.arrow_forward

- Windsor Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value A $202,003 $41,080 6 years $0 B $306,910 $49,130 9 years $0 Windsor Company uses the straight-line method to depreciate its assets. Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the facto provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.)arrow_forwardMariam is analyzing a project and has gathered the following data. The firm depreciates its assets using straight-line depreciation to a zero book value over the life of the asset. Required rate of return on this project is 10% Year Cash Flow Net Income 0 -$642,000 n/a 1 170,000 $9,500 2 240,000 79,500 3 $270,000 $85,500 a.What is the payback period for this project? b. What is the discounted payback period? c. What is the projects average accounting rate of return (AAR)? d. What is the NPV for this project? e. What is the profitability index for this project? f. Based on your answers in a) through e), which project will you finally choose?arrow_forwardMariam is analyzing a project and has gathered the following data. The firm depreciates its assets using straight-line depreciation to a zero book value over the life of the asset. Required rate of return on this project is 10% Year Cash Flow Net Income 0 -$642,000 n/a 1 170,000 $9,500 2 240,000 79,500 3 $270,000 $85,500 What is the payback period for this project? What is the discounted payback period? What is the projects average accounting rate of return (AAR)? What is the NPV for this project? What is the profitability index for this project? Based on your answers in a) through e), which project will you finally choose?arrow_forward

- Mariam is analyzing a project and has gathered the following data. The firm depreciates its assets using straight-line depreciation to a zero book value over the life of the asset. Required rate of return on this project is 10% Year Cash Flow Net Income 0 -$642,000 n/a 1 170,000 $9,500 2 240,000 79,500 3 $270,000 $85,500 What is the NPV for this project? What is the profitability index for this project? Based on your answers in a) through e), which project will you finally choose?arrow_forwardA manufacturing company is planning to install an equipment having a first cost of $90Kand a salvage value, after 15 years, of $10,520. The company uses an interest rate of 10%.Find the PW of the depreciation deductions for straight-line, SOYD, double-decliningbalance. Rank the strategies in order of their attractiveness. Identify/determine the bestmethod.arrow_forwardMountain Frost is considering a new project with an initial cost of $180,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $19,500, $20,400, $24,600, and $16,400, respectively. What is the average accounting return?arrow_forward

- Mountain Frost is considering a new project with an initial cost of $205,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $20,000, $20,900, $24,600, and $16,900, respectively. What is the average accounting return? Please make sure its correctarrow_forwardA company is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant mer the project's life. What is the project's NPV? Project cost of capital (r) 10% Net investment in fixed assets (basis) $65,000 Required new working capital $15,000 Straight-line deprec. rate 33.333% Sales revenues, each year $75,000 Operating costs (excl. deprec.), each year $25,000 Tax rate 35.0% a. $26,297 b. $30,950 c. $23,852 d. $23,045 e. $33,993arrow_forwardEdelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows: Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Economic Value Added EVA - ACCA APM Revision Lecture; Author: OpenTuition;https://www.youtube.com/watch?v=_3hpcMFHPIU;License: Standard Youtube License