Concept explainers

Requirement a. and c.

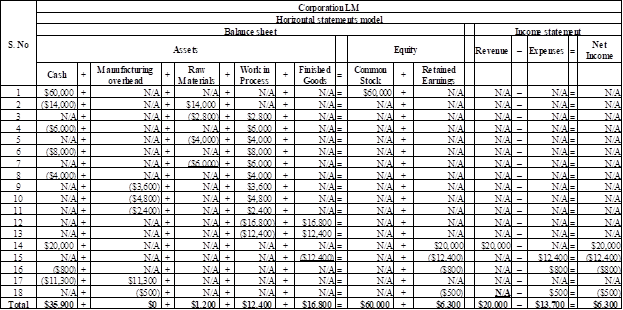

Record the preceding events in a horizontal statements model and record the closing entry for over- or under applied manufacturing overhead.

Requirement a. and c.

Explanation of Solution

Job order costing: Job order costing is one of the methods of cost accounting under which cost is collected and gathered for each job, work order, or project separately. It is a system by which a factory maintains a separate record of each particular quantity of product that passes through the factory. Job order costing is used when the products produced are significantly different from each other.

Manufacturing overhead costs: The costs, which do not relate directly with the manufacturing of products, are referred to as manufacturing overhead costs or indirect costs. Manufacturing overhead cost per unit is the cost of manufacturing overhead incurred to produce one unit of product.

Events:

1. Cash receipts of $60,000 from the issuance of common stocks.

2. Purchased raw materials of $14,000 and worked on three job orders.

3. Direct materials of $2,800 used for Job 1.

4. Cash of $6,000 paid to employees for the completion of Job 1.

5. Direct materials of $4,000 used for Job 2.

6. Cash of $8,000 paid to employees for the completion of Job 2.

7. Direct materials of $6,000 used for Job 3.

8. Cash of $4,000 paid to employees for the completion of Job 3.

9. Manufacturing overhead of $3,600 applied to Job 1.

10. Manufacturing overhead of $4,800 applied to Job 2.

11. Manufacturing overhead of $2,400 applied to Job 3.

12.

13. Cost of Job 3 for $12,400 is transferred from work-in progress inventory to finished goods inventory.

14. Cash proceeds of $20,000 from the sale of Job 3.

15. The cost of goods sold for Job 1 of $12,400 is recognized.

16. Corporation LM paid $800 for selling and administrative expenses.

17. Corporation LM paid cash of $11,300 for actual factory overhead.

18. The under-application of overhead is

Record the preceding events in a horizontal statements model and record the closing entry for over- or under applied manufacturing overhead.

Table (1)

Requirement b.

Reconcile all subsidiary accounts with their respective control accounts.

Requirement b.

Explanation of Solution

Job order costing: Job order costing is one of the methods of cost accounting under which cost is collected and gathered for each job, work order, or project separately. It is a system by which a factory maintains a separate record of each particular quantity of product that passes through the factory. Job order costing is used when the products produced are significantly different from each other.

Reconcile all subsidiary accounts with their respective control accounts.

| Items | Job 1 | Job 2 | Job 3 |

| Direct materials | $2,800 | $4,000 | $6,000 |

| Direct labor (a) | $6,000 | $8,000 | $4,000 |

| Manufacturing overhead | $3,600 | $4,800 | $2,400 |

| Total product cost | $12,400 | $16,800 | $12,400 |

Table (2)

d.

Prepare a schedule of cost of goods manufactured and sold, an income statement, and a classified balance sheet for the year ended 2019.

d.

Explanation of Solution

Schedule of cost of goods manufactured and sold: The schedule which reports all the expenses incurred by a company to sell the goods during the given period.

Prepare the cost of goods manufactured and sold for the year ended 2019:

| Corporation LM | |

| Cost of goods manufactured and sold | |

| For the Year Ending 2019 | |

| Particulars | Amount |

| Beginning raw materials inventory | $0 |

| Add: Purchases | $14,000 |

| Raw materials available | $14,000 |

| Less: Ending raw material inventory | ($1,200) |

| Raw materials used | $12,800 |

| Labour | $18,000 |

| Overhead | $11,300 |

| Total | $42,100 |

| Add: Beginning Work In Process inventory | $0 |

| Total Work In Process inventory | $42,100 |

| Less: Ending Work In Process inventory (Refer Table (2)) | ($12,400) |

| Cost of goods manufactured | $29,700 |

| Add: Beginning finished goods inventory | $0 |

| Goods available | $29,700 |

| Less: Ending finished goods inventory (Refer Table (2)) | ($16,800) |

| Cost of goods sold | $12,900 |

Table (3)

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year ended 2019:

| Corporation LM | |

| Income statement | |

| For the Year Ending December 31, 2019 | |

| Details | Amount |

| Sales Revenue | $20,000 |

| Less: Cost of goods sold (Refer Table (3)) | ($12,900) |

| Gross margin | $7,100 |

| Less: Selling and administrative expenses | ($800) |

| Net Income | $6,300 |

Table (4)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and claims of stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as of 2019:

| Corporation LM | |

| Balance sheet | |

| As of 2019 | |

| Assets | Amount |

| Cash | $35,900 |

| Raw material inventory | $1,200 |

| Work-in-process inventory | $12,400 |

| Finished goods inventory | $16,800 |

| Total assets | $66,300 |

| Equity | |

| Common Stock | $60,000 |

| Retained earnings | $6,300 |

| Total equity | $66,300 |

Table (5)

Want to see more full solutions like this?

Chapter 12 Solutions

FUND.MAN.ACC.CONCEPTS W/CONNECT (LL)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education