Portfolio:

A portfolio is the total collection of the investments held by an investor, which includes bonds, stocks, options, futures, and other investments like gold or limited

The return of a portfolio is the weighted average of the

The Expected Return of a Portfolio  refers to the weighted average of the expected returns on each individual investment in a particular portfolio. The expected return of a portfolio is hence related to the expected return of the stocks in a portfolio.

refers to the weighted average of the expected returns on each individual investment in a particular portfolio. The expected return of a portfolio is hence related to the expected return of the stocks in a portfolio.

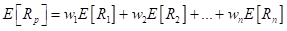

The Expected Return of a Portfolio can be calculated using the formula given below.

Where,

is the expected return of portfolio.

is the expected return of portfolio. is the weight of the investment or stock.

is the weight of the investment or stock. is the expected return of investment or stock.

is the expected return of investment or stock.

To determine:

(a) The expected return (b) The volatility (standard deviation).

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

FUND. OF CORPORATE FINANCE W/ACCESS >I

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education