Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 18E

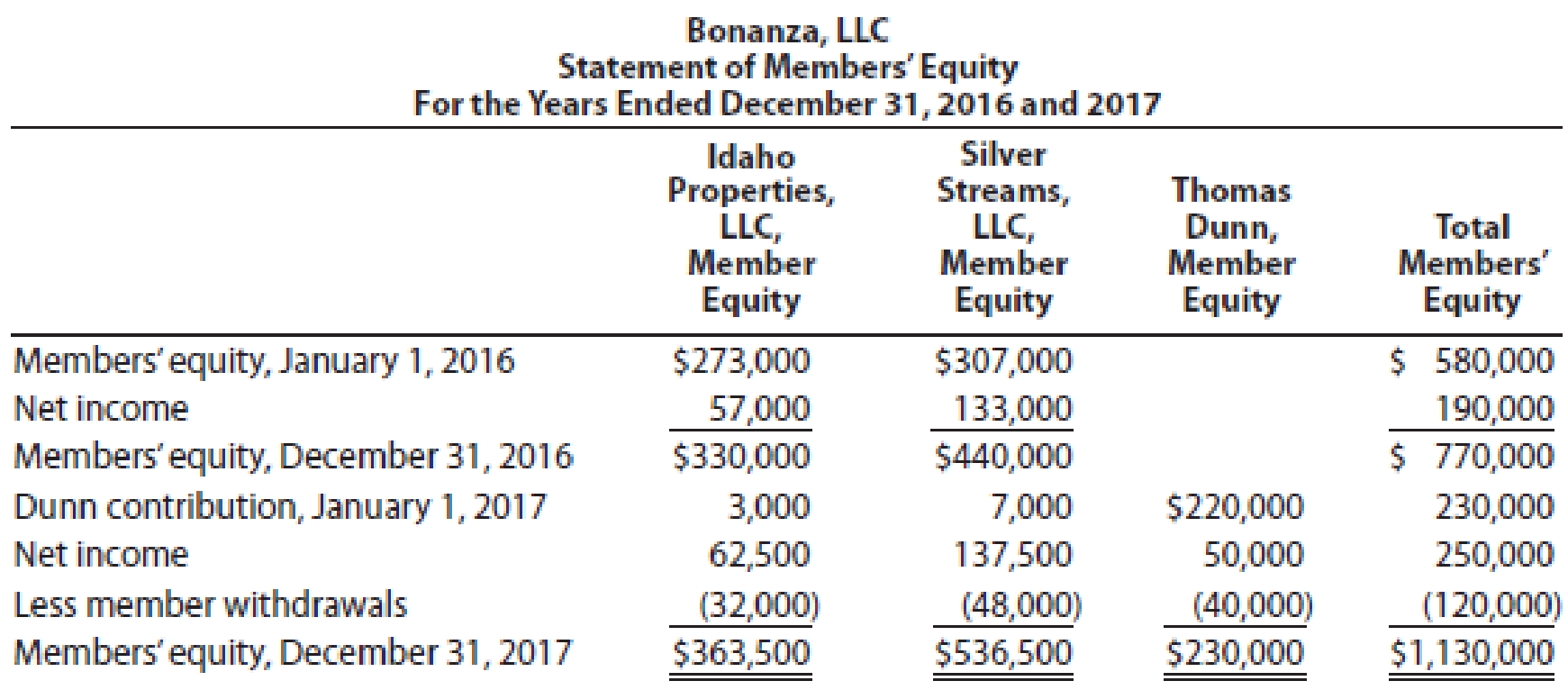

The statement of members’ equity for Bonanza, LLC, follows:

- a. What was the income-sharing ratio in 2016?

- b. What was the income-sharing ratio in 2017?

- c. How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest?

- d. Why do the member equity accounts of Idaho Properties, LLC, and Silver Streams, LLC, have positive entries for Thomas Dunn’s contribution?

- e. What percentage interest of Bonanza did Thomas Dunn acquire?

- f. Why are withdrawals less than net income?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

a) What was the income-sharing ratio in 20Y3? Enter the percentage per member and then select the ratio.

Idaho Properties, LLC

_______%

Silver Streams, LLC

_______ %

b) What was the income-sharing ratio in 20Y4? Enter the percentage per member and then select the ratio.

Idaho Properties, LLC

____________%

Silver Streams, LLC

____________%

Thomas Dunn

____________%

c) How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest? _______

d) What percentage interest of Bonanza did Thomas Dunn acquire?

Consider Southeast Home Care, a for-profit business. In 2015, its net income was $1,500,000 and it distributed $500,000 to ownderws in the form of dividends. Its beginning-of-year equity balance was $12,000,000.

a) Use this information to construct the business's statement of changes in equity.

b) What is the ending 2015 value of the business's equity account?

As of December 31, 2015, Lincolnshire Company had assets of $1,850,000 and liabilities of $570,000. During 2016, the stockholders invested an additional $100,000 and paid dividends of $60,000 from the business.

What is the net income for the company during 2016, assuming that as of December 31, 2016, assets were $1,960,000, and liabilities were $510,000?

Group of answer choices

A) $170,000

B) $130,000

C) $210,000

D) $40.000

Chapter 12 Solutions

Financial Accounting

Ch. 12 - Prob. 1DQCh. 12 - Prob. 2DQCh. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - Prob. 7DQCh. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Prob. 1PEACh. 12 - Prob. 1PEBCh. 12 - Prob. 2PEACh. 12 - Prob. 2PEBCh. 12 - Prob. 3PEACh. 12 - Prob. 3PEBCh. 12 - Prob. 4PEACh. 12 - Prob. 4PEBCh. 12 - Prior to liquidating their partnership, Parker and...Ch. 12 - Liquidating partnerships Prior to liquidating...Ch. 12 - Prob. 6PEACh. 12 - Prob. 6PEBCh. 12 - Prob. 7PEACh. 12 - Eclipse Architects earned 1,800,000 during 2016...Ch. 12 - Prob. 1ECh. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Prob. 4ECh. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - Prob. 7ECh. 12 - Marvel Media, LLC, has three members: WLKT...Ch. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Prob. 17ECh. 12 - The statement of members equity for Bonanza, LLC,...Ch. 12 - Distribution of cash upon liquidation Hewitt and...Ch. 12 - Distribution of cash upon liquidation David Oliver...Ch. 12 - Liquidating partnershipscapital deficiency Lewis,...Ch. 12 - Prob. 22ECh. 12 - Prob. 23ECh. 12 - Statement of partnership liquidation After closing...Ch. 12 - Prob. 25ECh. 12 - Prob. 26ECh. 12 - The accounting firm of Deloitte Touche is the...Ch. 12 - Prob. 28ECh. 12 - Prob. 1PACh. 12 - Prob. 2PACh. 12 - Prob. 3PACh. 12 - Prob. 4PACh. 12 - Statement of partnership liquidation After the...Ch. 12 - Prob. 6PACh. 12 - Prob. 1PBCh. 12 - Prob. 2PBCh. 12 - Prob. 3PBCh. 12 - Prob. 4PBCh. 12 - Statement of partnership liquidation After the...Ch. 12 - On August 3, the firm of Chapelle, Rock, and Pryor...Ch. 12 - Prob. 1CPCh. 12 - Prob. 2CPCh. 12 - Prob. 3CPCh. 12 - Prob. 4CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Respond to the following in a minimum of 175 words: As discussed in the chapter, The Coca-Cola Company reported over $20 billion of investments accounted for under the equity method in 2017, and they reported investment revenue of more than $1 billion in 2017. Explain why Coke accounts for some of its investments by the equity method and what that means? Is the over $1 billion in revenue reported in 2017 cash they can use? Provide an explanation for your response.arrow_forwardCalculate the financial indicators of the firm Merck for the year 2018 and fill in the spaces marked in the table. Company Name: Year 2018 Chemicals and Allied Products Industry Ratios ………….. Solvency or Debt Ratios Merck J&J 2018 Debt ratio …. …. 0.47 Debt-to-equity ratio …. …. 0.38 Interest coverage ratio …. …. -9.43 Liquidity Ratios Current ratio …. …. 3.47 Quick ratio …. …. 2.12 Cash ratio …. …. 2.24 Profitability Ratios Profit margin …. …. -93.4% ROE (Return on equity), after tax …. …. -248.5 ROA (Return on assets) …. …. -146.5 Gross margin …. …. 55.3% Operating margin (Return on sales) …. …. -42.9% Activity or Efficiency Ratios Asset turnover …. …. 1.08 Receivables turnover (days) …. …. 16 Inventory turnover (days)…arrow_forwardCarl and Stefanie each invest $15,000 in a business and are given shares of stock in ThibeauIndustries as evidence of their ownership interests. For this transaction, identify the effect on theaccounting equation.a. Assets increase and liabilities increase.b. Assets increase and stockholders’ equity increases.c. Liabilities increase and stockholders’ equity decreases.d. Liabilities decrease and assets decrease.arrow_forward

- The Corrigan Corporation’s 2015 and 2016 financial statements follow,along with some industry average ratios.a. Assess Corrigan’s liquidity position, and determine how it compares with peers and how the liquidity position has changed over time.b. Assess Corrigan’s asset management position, and determine how it compares with peers and how its asset management efficiency has changed over time.c. Assess Corrigan’s debt management position, and determine how it compares with peers and how its debt management has changed over time.d. Assess Corrigan’s profitability ratios, and determine how they compare with peers and how its profitability position has changed over time.e. Assess Corrigan’s market value ratios, and determine how its valuation compares with peers and how it has changed over time.f. Calculate Corrigan’s ROE as well as the industry average ROE, using the DuPont equation. From this analysis, how does Corrigan’s financial position compare with the industry average numbers?g.…arrow_forwardShown below is information relating to shareholder's equity of R2K Corporation as of December 31,2018 (SEE PICTURE BELOW):What is the amount of total shareholder’s equity that R2K Corporation should report on December 31, 2018?arrow_forwardCalculate the financial indicators of the firms J&J for the year 2018 and fill in the spaces marked in the table. Company Name: Year 2018 Chemicals and Allied Products Industry Ratios ………….. Solvency or Debt Ratios Merck J&J 2018 Debt ratio …. …. 0.47 Debt-to-equity ratio …. …. 0.38 Interest coverage ratio …. …. -9.43 Liquidity Ratios Current ratio …. …. 3.47 Quick ratio …. …. 2.12 Cash ratio …. …. 2.24 Profitability Ratios Profit margin …. …. -93.4% ROE (Return on equity), after tax …. …. -248.5 ROA (Return on assets) …. …. -146.5 Gross margin …. …. 55.3% Operating margin (Return on sales) …. …. -42.9% Activity or Efficiency Ratios Asset turnover …. …. 1.08 Receivables turnover (days) …. …. 16 Inventory turnover (days)…arrow_forward

- Listed are the equity sections of balance sheets for years 2014 and 2015 as reported by Mountain Air Ski Resorts, Inc. The overall value of stockholders' equity has risen from $1,800,000 to $6,600,000. Use the statements to discover how and why this happened. The company paid total dividends of $210,000 during fiscal 2015. a. What was Mountain Air's net income for fiscal 2015? b. How many new shares did the corporation issue and sell during the year? c. At what average price per share did the new stock sold during 2015 sell? d. At what price per share did Mountain Air's original 420,000 shares sell?arrow_forwardAt the end of the year, the owners' equity in Scott Mfg. amounted to $845,000. During 2018, the assets of the business increased by $515,000 and the liabilities increased by $205,000. The owners' equity at the beginning of 2018 was how much?arrow_forwardDuring 2022, Pronghorn Corp entered into the following transactions. 1. Borrowed $62,200 by issuing bonds. 2. Paid $8,890 cash dividend to stockholders. 3. Received $13,900 cash from a previously billed customer for services performed. 4. Purchased supplies on account for $5,000. Using the following tabular analysis, show the effect of each transaction on the accounting equation. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. See Illustration 3-4 for example.) Assets = Liabilities + Stockholders’ Equity Cash + Accounts Receivable + Supplies = Accounts Payable + Bonds Payable + Common Stock + Retained EarningsDividends (1) $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amount…arrow_forward

- CAN SOMEONE HELP ANALYZE THIS EQUITY STATEMENT DATA ? The following information relates to Oriole Co. for the year 2020. Owner’s capital, January 1, 2020 $53,827 Advertising expense $ 2,019 Owner’s drawings during 2020 6,728 Rent expense 11,663 Service revenue 71,321 Utilities expense 3,476 Salaries and wages expense 33,081arrow_forwardGeorge H. and James W. have identified two companies, Riccarton Plc and Edinburgh Plc they would be interested in investing. As they can only invest in one of the companies, they have asked you to provide them with an assessment of the performance of both companies based on the following ratios: Return on Capital Employed (ROCE), Current Ratio, Gearing Ratio and Price/Earnings (P/E) Ratio. The following information from the Statement of Financial Position (Balance Sheet) and the Income Statement (Profit and Loss Account) for both companies is available: (a) Calculate the following ratios: • Return on Capital Employed (ROCE) • Current Ratio • Gearing Ratio • Price/Earnings (P/E) Ratio (b) Based on the above ratios explain, which company George H. and James W. should invest in. You should also briefly discuss the limitations of your analysis.arrow_forwarda. Sales for 2018 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciationand amortization were 11% of net fixed assets, interest was $8,575,000, thecorporate tax rate was 40%, and Laiho pays 40% of its net income as dividends. Giventhis information, construct the firm’s 2018 income statement.b. Construct the statement of stockholders’ equity for the year ending December 31, 2018,and the 2018 statement of cash flows.c. Calculate 2017 and 2018 net operating working capital (NOWC) and 2018 free cashflow (FCF). Assume the firm has no excess cash.d. If Laiho increased its dividend payout ratio, what effect would this have on corporatetaxes paid? What effect would this have on taxes paid by the company’s shareholders?e. Assume that the firm’s after-tax cost of capital is 10.5%. What is the firm’s 2018 EVA?f. Assume that the firm’s stock price is $22 per share and that at year-end 2018 the firmhas 10 million shares outstanding. What is the firm’s MVA at year-end 2018?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License