PRIN.OF CORPORATE FINANCE >BI<

12th Edition

ISBN: 9781260431230

Author: BREALEY

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 19PS

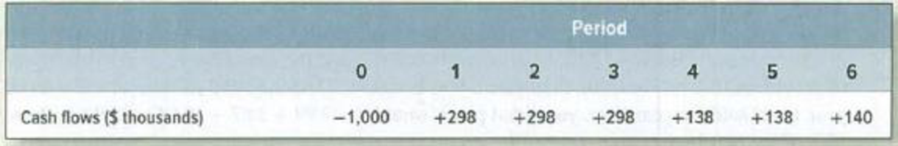

EVA Use the Beyond the Page feature to access the Excel program for calculating the profitability of the Nodhead project. Now suppose that the cash flows from Nodhead’s new supermarket are as follows:

- a. Recalculate economic

depreciation. Is it accelerated or decelerated? - b. Rework Tables 12.2 and 12.3 to show the relationship between (a) the “true”

rate of return and bookROI and (b) true EVA andforecasted EVA in each year of the project’s life.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You have determined the profitability of a planned project by finding the present value of all the cash flows from that project. Which of the following would cause the project to look more appealing in terms of the present value of those cash flows?

A. The discount rate increases.

B. The cash flows are extended over a longer period of time, but the total amount of the cash flows remains the same.

C. The discount rate decreases.

D. Answers B and C above.

E. Answers A and B above.

Please answer the following questions using the information below:

NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected?

PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?

Consider the following cash flows:

Year 0 1 2 3 4 5 6

Cash Flow -$8,000 $3,000 $3,600 $2,700 $2,500 $2,100 $1,600

Payback. The company requires all projects to payback within 3 years. Calculate the payback period. Should it be accepted or rejected?

Discounted Payback. Calculate the discounted payback using a discount rate of 10%. Should it be accepted or rejected?

IRR. Calculate the IRR for this project. The company’s required rate of return is 10%. Should it be accepted or rejected?

NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected?

PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?…

Compute the cash flows for the project. Use the Data Table function to do a two-way sensitivity analysis on the NPV of the project, varying the discount rates from even percentages 0%, 2%, 4%, 6%, 8% ..., 20% vertically and varying the growth rates from 0%, 2%, 4%, ..., 12% horizontally. Please label the discount rate and growth rate in your data table. Use the table below to help.

Chapter 12 Solutions

PRIN.OF CORPORATE FINANCE >BI<

Ch. 12 - Prob. 1PSCh. 12 - Terminology Define the following: a. Agency costs...Ch. 12 - Prob. 3PSCh. 12 - EVA Here are several questions about economic...Ch. 12 - Accounting measures of performance The Modern...Ch. 12 - Economic income Fill in the blanks: A projects...Ch. 12 - Prob. 7PSCh. 12 - Prob. 8PSCh. 12 - Prob. 9PSCh. 12 - Prob. 10PS

Ch. 12 - Management compensation We noted that management...Ch. 12 - Prob. 12PSCh. 12 - Prob. 13PSCh. 12 - Prob. 14PSCh. 12 - EVA Herbal Resources is a small but profitable...Ch. 12 - Prob. 16PSCh. 12 - Economic income Consider the following project:...Ch. 12 - EVA Use the Beyond the Page feature to access the...Ch. 12 - Accounting measures of performance Use the Beyond...Ch. 12 - EVA Ohio Building Products (OBP) is considering...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over the next three years are summarized as follows: Develop and solve an integer programming model for maximizing the net present value. Assume that only one of the warehouse expansion projects can be implemented. Modify your model from part (a). Suppose that if test marketing of the new product is carried out, the advertising campaign also must be conducted. Modify your formulation from part (b) to reflect this new situation.arrow_forwardThe management of Ryland International Is considering Investing in a new facility and the following cash flows are expected to result from the investment: A. What Is the payback period of this uneven cash flow? B. Does your answer change if year 6s cash inflow changes to $920,000?arrow_forwardMartin Weir is evaluating a new project to determine viability for Jonathon's Restaurant's. As part of the new Jonathon's PMO, Marty is responsible for preparing project justifications and he must evaluate the project's cash flows and investment potential. As a first step, Marty developed a table of revenues and investments (see below) that he plans to use in calculating a variety of performance metrics including NPV. Marty understands that a project's discount rate may not be constant throughout the life of the project and he plans to use 0.32 as the initial discount rate, switching to 0.19 beginning in year 4 to more accurately represent the cash costs and imputed risk over time. Assume all cash flows occur at the end of the specified year and calculate all cash flow values and discounted cash flow values to three decimal places. Round discounted values to 3 decimal places before performing subsequent calculations. investment Reveune 13.8 0 14.9 20.3 12.3 27.5 17.6 24.9…arrow_forward

- Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Blue Hamster Manufacturing Inc.: Last Tuesday, Blue Hamster Manufacturing Inc. lost a portion of its planning and financial data when both its main and its backup servers crashed. The company’s CFO remembers that the internal rate of return (IRR) of Project Delta is 11.3%, but he can’t recall how much Blue Hamster originally invested in the project nor the project’s net present value (NPV). However, he found a note that detailed the annual net cash flows expected to be generated by Project Delta. They are: Year Cash Flow Year 1 $1,800,000 Year 2 $3,375,000 Year 3 $3,375,000 Year 4 $3,375,000 The CFO has asked you to compute Project Delta’s initial investment using the information currently available to you. He has offered the…arrow_forward4. In time value of money, we use five categories of information, viz., present value, future value, discount rate, number of compounding periods and interim payments. In particular, the choice of the right discount rates is a challenge as it represents a combination of risk factors, such as business; inflation; environmental; social and political risks. Your company is planning an investment project in commercial forestry. Prepare a briefing note appraising the top management on the potential risks in evaluating a project in commercial forestry and how will this impact the project decisions.arrow_forwardA disadvantage of using the accounting rate of return to evaluate investment alternatives is that Group of answer choices A. It is superior to IRR. B. When net incomes vary from year to year, the ARR will also vary across years, making the project seem desirable in one year and not another. C. It considers the time value of money. D. It is easy to understand and it allows comparison or projects. E. Using ARR has no disadvantages.arrow_forward

- The payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cute Camel Woodcraft Company: Cute Camel Woodcraft Company is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Delta’s expected future cash flows. To answer this question, Cute Camel’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$5,000,000 $2,000,000 $4,250,000…arrow_forwardThe payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cute Camel Woodcraft Company: Cute Camel Woodcraft Company is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Alpha’s expected future cash flows. To answer this question, Cute Camel’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. Round the conventional payback period to two decimal places. For negative values, be sure to include a minus sign in your answer. For full credit, complete the entire table. Year 0 Year 1 Year 2 Year 3 Expected cash flow -4,500,000 $1,800,000 $3,825,000 $1,575,000 Cumulative cash flow year0? year1?…arrow_forwardCashflow patterns and the modified rate of return calculation Locke Manufacturing Inc. is analyzing a project with the following projected cash flows: Year Cash Flow 0 -$1,324,800 1 300,000 2 450,000 3 546,000 4 360,000 This project exhibits_________ (pick one- conventional or unconventional) cash flows. Locke’s desired rate of return is 5.00%. Given the cash flows expected from the company's new project, compute the project’s anticipated modified internal rate of return (MIRR). (Hint: Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) choose the correct choice 6.09% 6.47% 6.85% 7.61% Locke’s managers are generally conservative, and select projects based solely on the project’s modified internal rate of return (MIRR). Should the company’s managers accept this independent project? choose the correct choice. Yes No You’ve just learned that…arrow_forward

- Use the following data to answer questions (a) to (d). Show your working method.A company is considering the purchase of a copier that costs RM 50,000. Assume the required rate of return is 10% and the following is cash flow schedule: Year 1: RM 20,000 Year 2: RM 30,000 Year 3: RM 20,000 (a) What is the project’s payback period?(b) What is the project’s NPV?(c) What is the project’s IRR?(d) What is the project’s profitability index (PI)?arrow_forwardAcme Oscillators is considering an investment project that has the following rather unusual cash flow pattern. Year Cash Flow 0 yr $101 1yr -461 2yr 789 3yr -602.2 4yr 171.6 a. Calculate the project's NPV at each of the following discount rates: 0 %, 5 %, 10 %, 20 %, 30 % , 40 %, 50 %. b. What do the calculations tell you about this project's IRR? The IRR rule tells managers to invest if a project's IRR is greater than the cost of capital. If Acme Oscillators' cost of capital is 8 %, should the company accept or reject this investment? c. Notice that this project's greatest NPVs come at very high discount rates. Can you provide an intuitive explanation for that pattern?arrow_forwardBerdwen, Inc. is analyzing the merits of a potential project. There is great volatility in the marketplace which will impact the project with risky free cash flows. Berdwen, Inc. has a weighted average cost of capital of 15.2%, and forecasts the free cash flows below: Year Expected FCF 0 -$10,000 1 $16,150 2 -$5,500 Use two appropriate capital budgeting techniques to determine if this project should be accepted.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License